Liquidation Of Assets For Medicaid

Description

How to fill out Liquidation Of Assets For Medicaid?

When you are required to submit Liquidation Of Assets For Medicaid that adheres to your local state's standards, there may be numerous options available. There's no requirement to examine every form to ensure it aligns with all the legal requirements if you are a US Legal Forms member.

It is a dependable tool that can assist you in acquiring a reusable and current template on any subject.

US Legal Forms is the most comprehensive online repository with a collection of over 85,000 ready-to-use documents for both business and personal legal matters. All templates are confirmed to conform to each state's regulations. Thus, when downloading Liquidation Of Assets For Medicaid from our platform, you can be assured that you possess a valid and recent document.

Select the most fitting subscription plan, Log In to your account, or create a new one. Pay for a subscription (PayPal and credit card options are available). Download the template in your choice of file format (PDF or DOCX). Print the document or complete it electronically via an online editor. Acquiring professionally drafted official documents becomes effortless with US Legal Forms. Moreover, Premium users can also take advantage of the powerful built-in tools for online PDF editing and signing. Try it today!

- Acquiring the necessary sample from our platform is quite straightforward.

- If you already hold an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- In the future, you can access the My documents tab in your profile and retrieve the Liquidation Of Assets For Medicaid at any time.

- If this is your first encounter with our website, please adhere to the guidelines below.

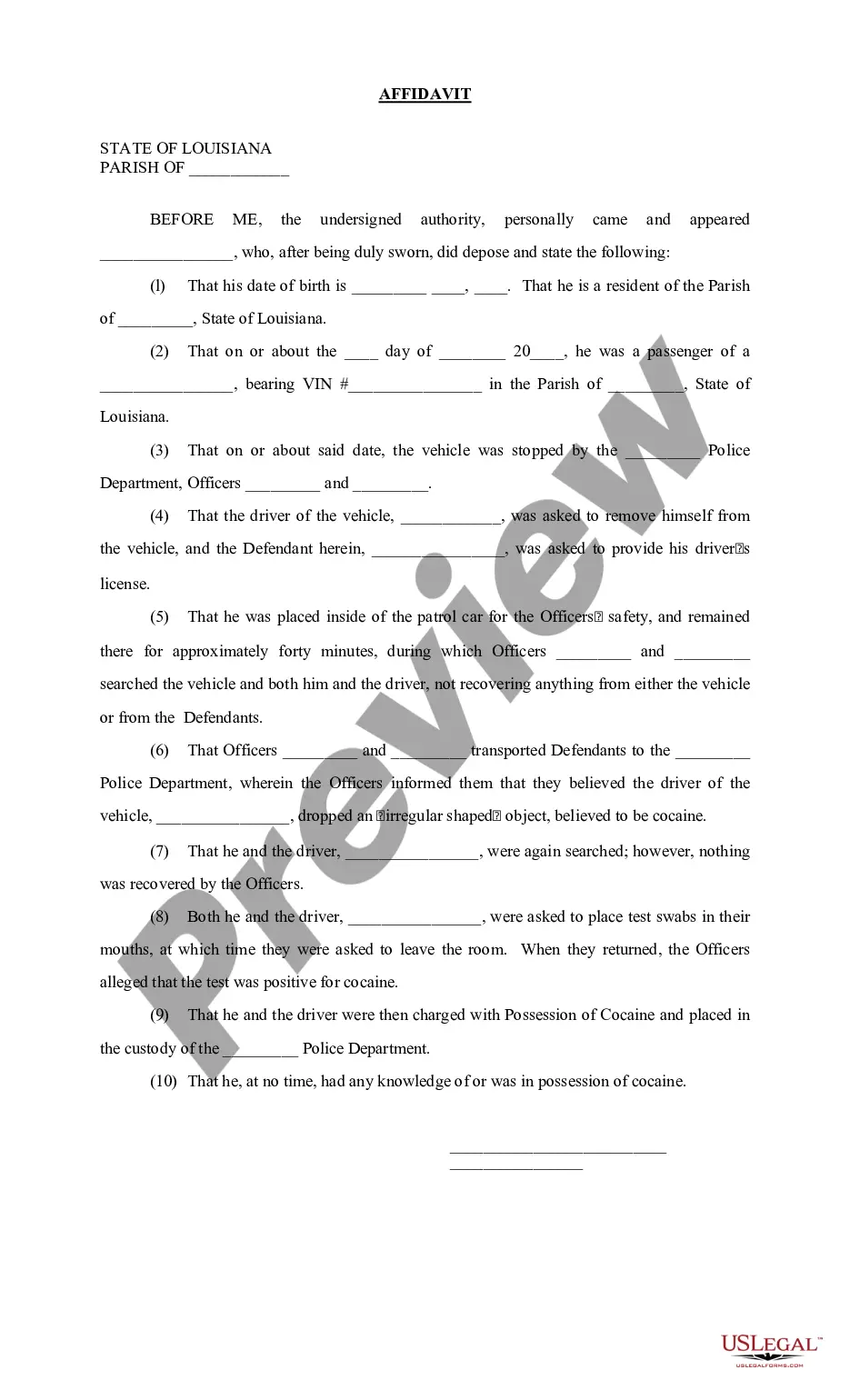

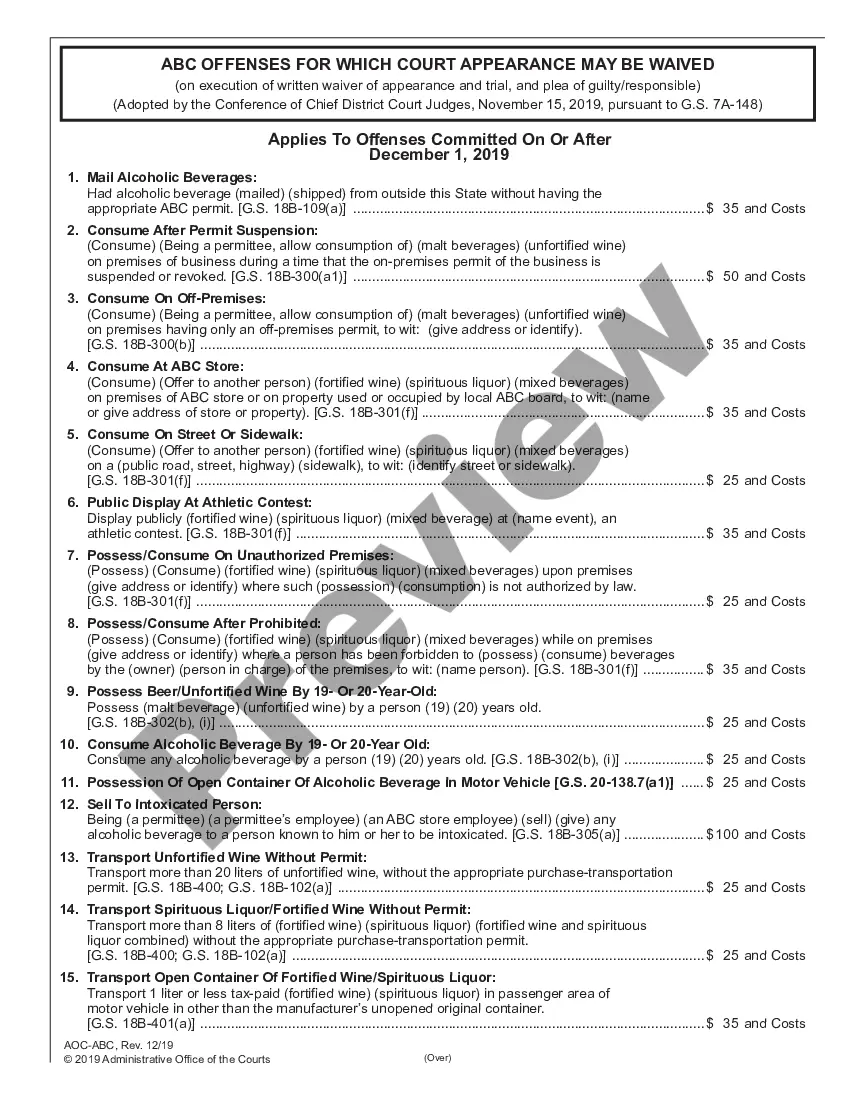

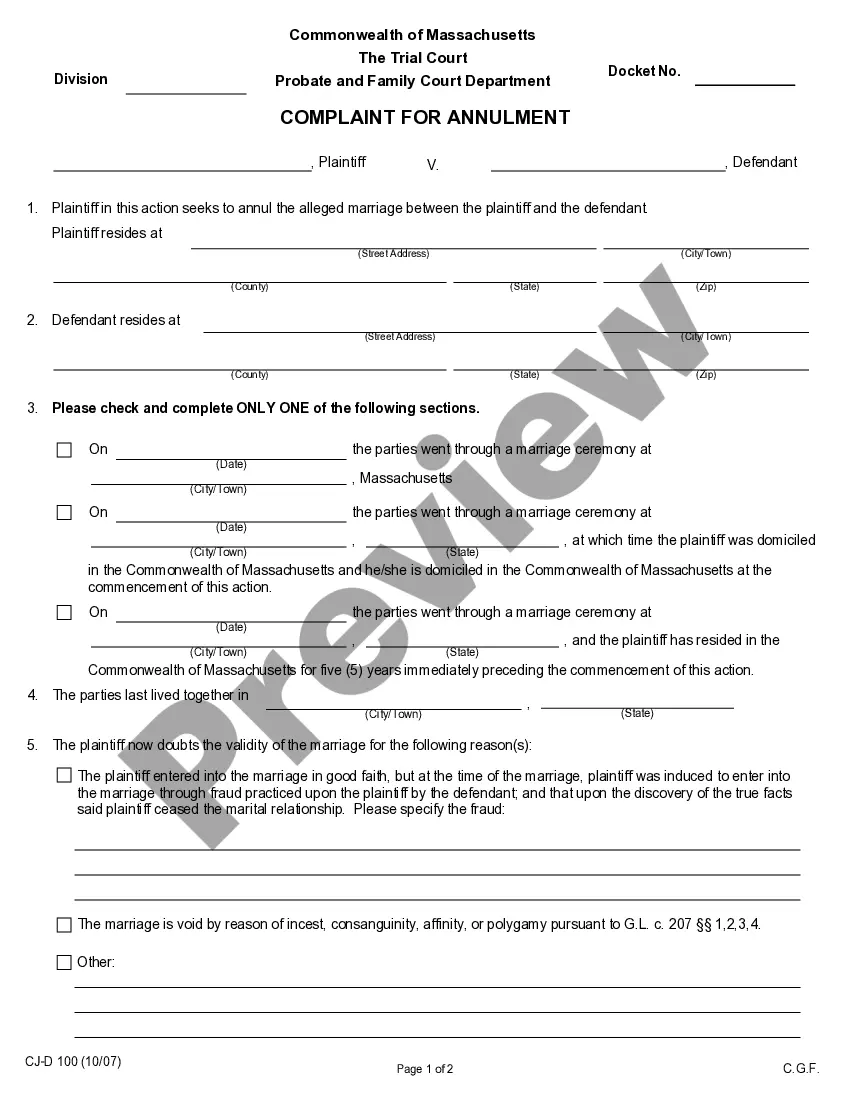

- Review the recommended page and verify it for conformity with your requirements.

- Utilize the Preview mode and examine the form description if it is available.

- Find another sample using the Search bar in the header if necessary.

- Click Buy Now when you identify the appropriate Liquidation Of Assets For Medicaid.

Form popularity

FAQ

To protect your excess assets for Medicaid eligibility, consider consulting with an estate planning attorney. Strategies may include gifting assets, establishing trusts, or spending down assets legally. These methods can offer a pathway to successful management and liquidation of assets for Medicaid.

Medicaid can recover funds from your estate to cover the costs of services provided after you reach the age of 55. The amount varies depending on the state and the specifics of the case. Understanding these factors will prepare you for the potential impacts on the liquidation of assets for Medicaid.

Yes, you can contest a Medicaid lien if you believe it is unfair or incorrect. This process can include gathering evidence and possibly filing an appeal. Engaging with legal experts can strengthen your case while considering the liquidation of assets for Medicaid.

Certain assets like your primary home, personal property, and a vehicle may be exempt from Medicaid recovery. Federal and state laws protect these assets to ensure you have a basic standard of living. Understanding these exemptions can significantly influence the liquidation of assets for Medicaid.

Yes, you can sell a house that has a Medicaid lien, but the proceeds may need to go toward satisfying that lien. Before selling, consult a legal professional to understand how this could affect your assets. Managing a Medicaid lien effectively is essential during the liquidation of assets for Medicaid.

To discover if Medicaid has a lien on your house, you should check public records through your county's recorder or assessor office. Often, a Medicaid lien will appear in property tax records or court documents. This is crucial for understanding your situation before proceeding with the liquidation of assets for Medicaid.

The best way to protect assets from Medicaid usually involves a combination of strategies, such as creating legal trusts and engaging in asset gifting. Planning early is crucial, as Medicaid has strict rules regarding asset eligibility. You can also consider the liquidation of assets for Medicaid; understanding which assets can be preserved while ensuring eligibility is essential. Utilizing the services of US Legal Forms can offer the structured support you need.

Yes, placing your home in an irrevocable trust can protect it from Medicaid claims for long-term care costs, as it removes the asset from your personal estate. However, this strategy requires careful planning and consideration of state laws. The liquidation of assets for Medicaid often necessitates guidance in order to comply with regulations and optimize your benefits. It's wise to consult professionals to navigate these complexities.

To protect inheritance from Medicaid, consider establishing a trust or gifting assets to heirs before applying for Medicaid benefits. This strategy requires careful planning and timing to avoid complications. Liquidation of assets for Medicaid can also play a crucial role; by understanding which assets may affect your eligibility, you can make informed decisions. Consulting with a legal expert can provide tailored strategies for your situation.

Exempt assets usually include your primary home, essential personal items, and some retirement funds. Each state may have different guidelines on exempt assets, so it is beneficial to review local regulations. Knowing what assets you can protect from the liquidation of assets for Medicaid plays a significant role in securing your financial future.