Template Sample Answer To Summons For Credit Card Debt

Description

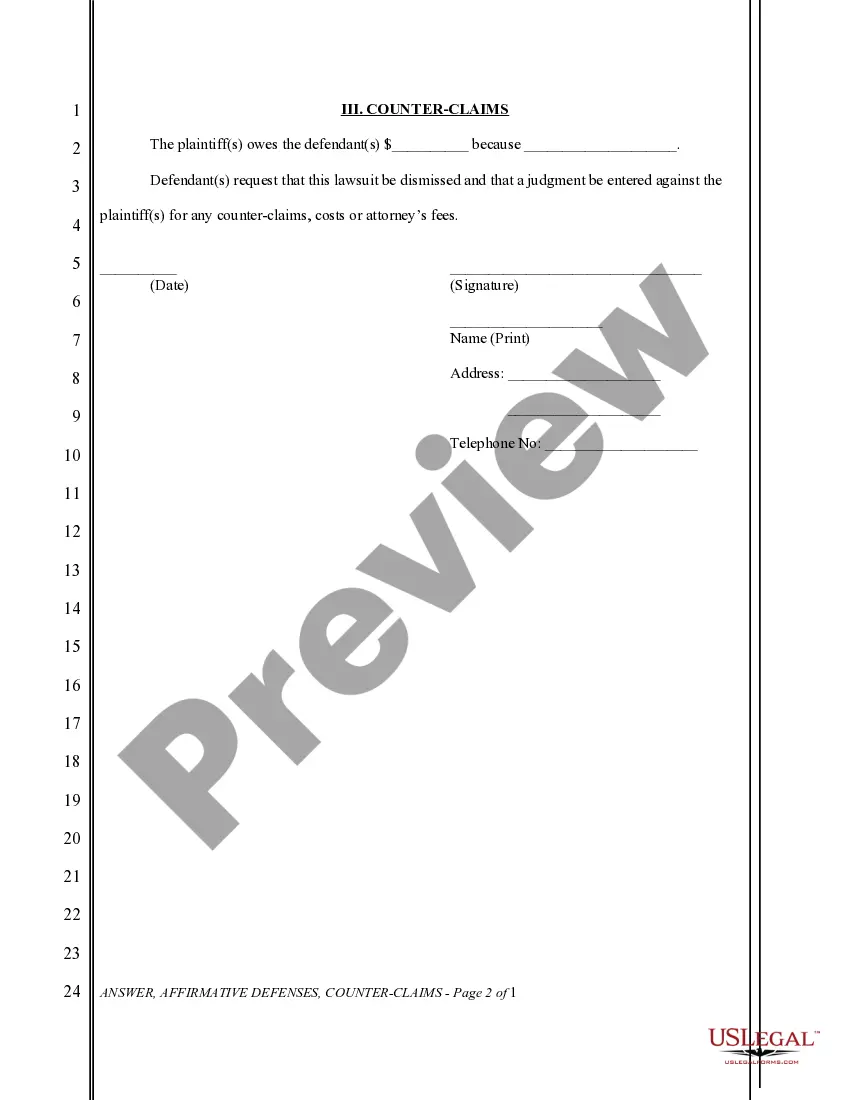

How to fill out General Form Of Civil Answer With Affirmative Defenses And Counterclaim?

It’s well known that you cannot transform into a legal specialist instantly, nor can you comprehend how to swiftly prepare a Template Sample Answer To Summons For Credit Card Debt without a unique set of expertise.

Assembling legal documents is an extensive process that demands specific knowledge and abilities. So, why not entrust the development of the Template Sample Answer To Summons For Credit Card Debt to experts.

With US Legal Forms, one of the broadest libraries of legal templates, you can obtain everything from court papers to templates for office communication.

If you need any additional forms, restart your search.

Establish a free account and choose a subscription plan to purchase the form. Click Buy now. Once the purchase is processed, you can retrieve the Template Sample Answer To Summons For Credit Card Debt, complete it, print it out, and send or deliver it to the appropriate people or organizations.

- Understand how crucial adherence to federal and local regulations is.

- That’s why all templates on our platform are tailored to locations and current.

- To begin using our website and acquire the form you require in just minutes.

- Search for the document you need utilizing the search bar located at the top of the page.

- If available, view it and examine the additional description to see if Template Sample Answer To Summons For Credit Card Debt is suitable for you.

Form popularity

FAQ

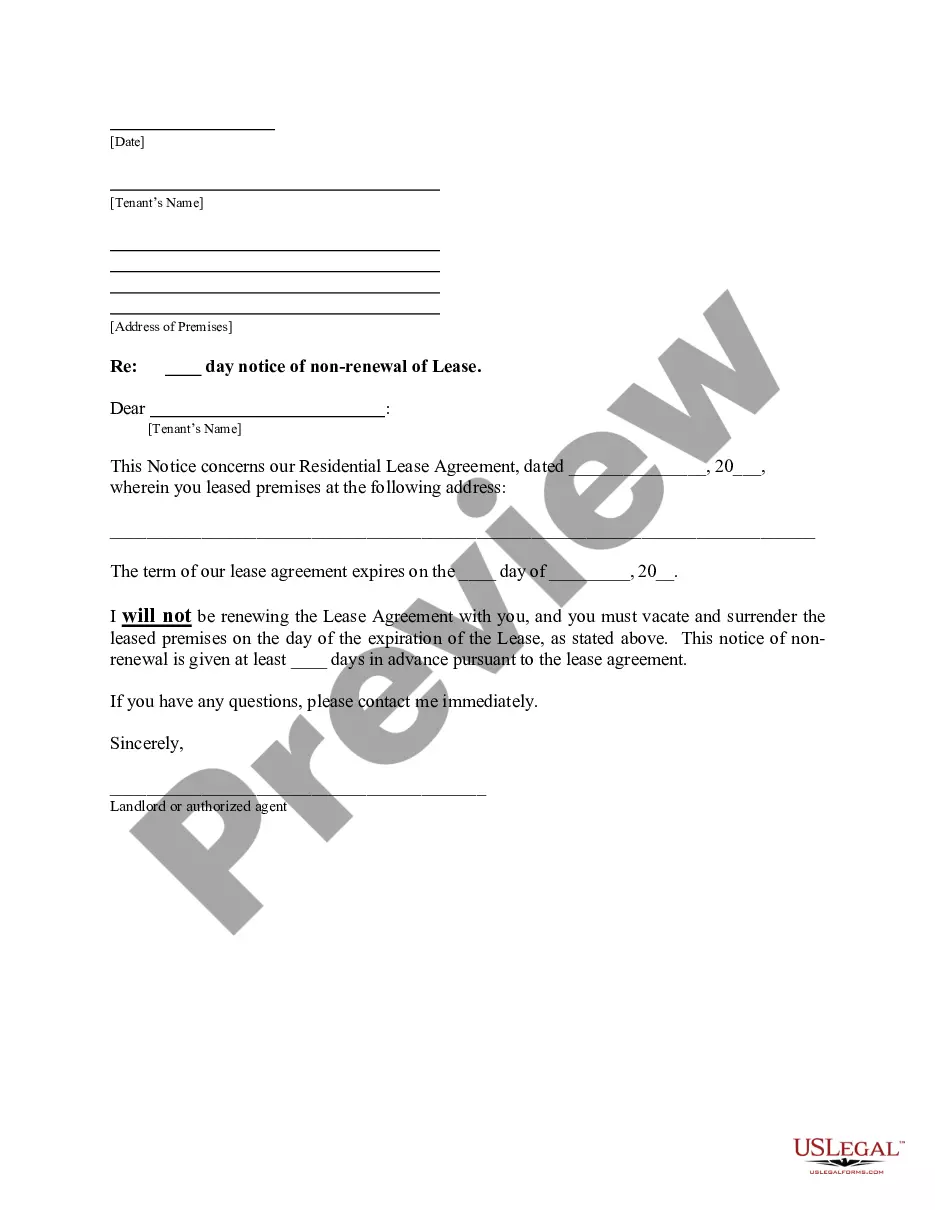

Credit Card Debt: Guide to Responding to Court Summons Review the Complaint and The Summon. You should review the summon and look out for important details including: ... Calculate the Deadline for Filing A Response. ... Draft A Response to The Complaint. ... File the Answer Form. ... Serve Copies to The Plaintiff.

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

I am responding to your contact about collecting a debt. You contacted me by [phone/mail], on [date] and identified the debt as [any information they gave you about the debt]. I do not have any responsibility for the debt you're trying to collect.

Resolving debt before a lawsuit A partial one-time payment is often the least expensive way to pay off a debt. ... You may be able to negotiate payments in monthly installments. ... If you are being harassed by debt collectors, you can ask them to stop. ... When debt expires, you can't be sued for it.

An affirmative defense is a defense that brings up new facts or issues not in the Complaint that, if true, would be a legal reason why the plaintiff should not win, or should win less than they're asking for. It is not a denial that you did what the plaintiff says you did.