Title: Complete Guide to Writing an Effective Sample Email for Debt Collection Introduction: In debt collection, sending a well-crafted and professional email can significantly improve your chances of recovering overdue payments. This detailed guide will provide you with a range of sample email templates for debt collection, each designed to address different scenarios and maximize your success. 1. Initial Payment Reminder: Subject: Friendly Reminder — Outstanding Payment for [Service/Product] Dear [Debtor's Name], I hope this email finds you well. This is to kindly remind you that your payment of [amount] for [service/product] is past due. The original due date was [date], and as of today, the balance remains unpaid. We understand that oversight or unexpected circumstances can occur, but it is crucial for us to receive payment promptly. Attached to this email, you will find the invoice for your reference. To avoid any late fees or disruptions to our services, we kindly request that you settle the outstanding balance within the next [mention due date or reasonable timeframe]. You can conveniently make the payment through [appropriate payment methods]. We are confident that this was a simple oversight and look forward to promptly resolving this matter. Should you have any questions or concerns, please do not hesitate to reach out to us at [contact details]. Thank you for addressing this matter promptly. Sincerely, [Your Name] [Your Company] 2. Firm Payment Demand: Subject: Final Notice — Urgent Payment Required for [Service/Product] Dear [Debtor's Name], We have not received payment for the outstanding balance of [amount] due for [service/product], even after sending several reminders. Despite our attempts to resolve this matter amicably, it is now imperative that you settle the debt immediately. Please be aware that failure to make the payment or respond to this email within [mention a reasonable timeframe], will leave us with no choice but to explore more serious actions, such as engaging a collection agency or pursuing legal alternatives, which may incur additional costs for you. Attached is the invoice for your reference, detailing the services/products rendered along with the outstanding balance. We urge you to treat this matter with urgency and resolve the payment as soon as possible. Please confirm the payment or provide an update regarding the situation by [mention deadline]. We genuinely hope to resolve this matter without further complications or escalations and continue our relationship on a positive note. Feel free to reach out to us at [contact details] with any questions or concerns. Yours sincerely, [Your Name] [Your Company] 3. Negotiation of Payment Terms: Subject: Payment Resolution — Possibility of Extended Payment Terms Dear [Debtor's Name], We acknowledge that circumstances may sometimes hinder your ability to settle the outstanding balance of [amount] for [service/product] within the previously agreed-upon timeframe. While we remain committed to collecting the debt owed to us, we understand that unexpected challenges can arise. We are willing to explore an alternative solution that suits both parties, such as extending the payment terms or creating a custom payment plan. We invite you to discuss the matter further to identify a mutually beneficial resolution. Your cooperation in promptly contacting us at [contact details] will be highly appreciated, allowing us to navigate this situation together and find a sustainable agreement. We look forward to working out a solution that accommodates your financial circumstances while repaying the outstanding balance. Thank you for your attention to this matter. Best regards, [Your Name] [Your Company] Conclusion: By tailoring your debt collection email to the specific situation, you can adopt a professional approach that increases the likelihood of recovering the overdue payment. These sample email templates cover the initial reminder, firm demands, and potential negotiation scenarios, providing a comprehensive toolkit to handle various debt collection situations effectively. Remember to utilize these templates as a starting point and adapt them to suit your business needs and debtor relationship.

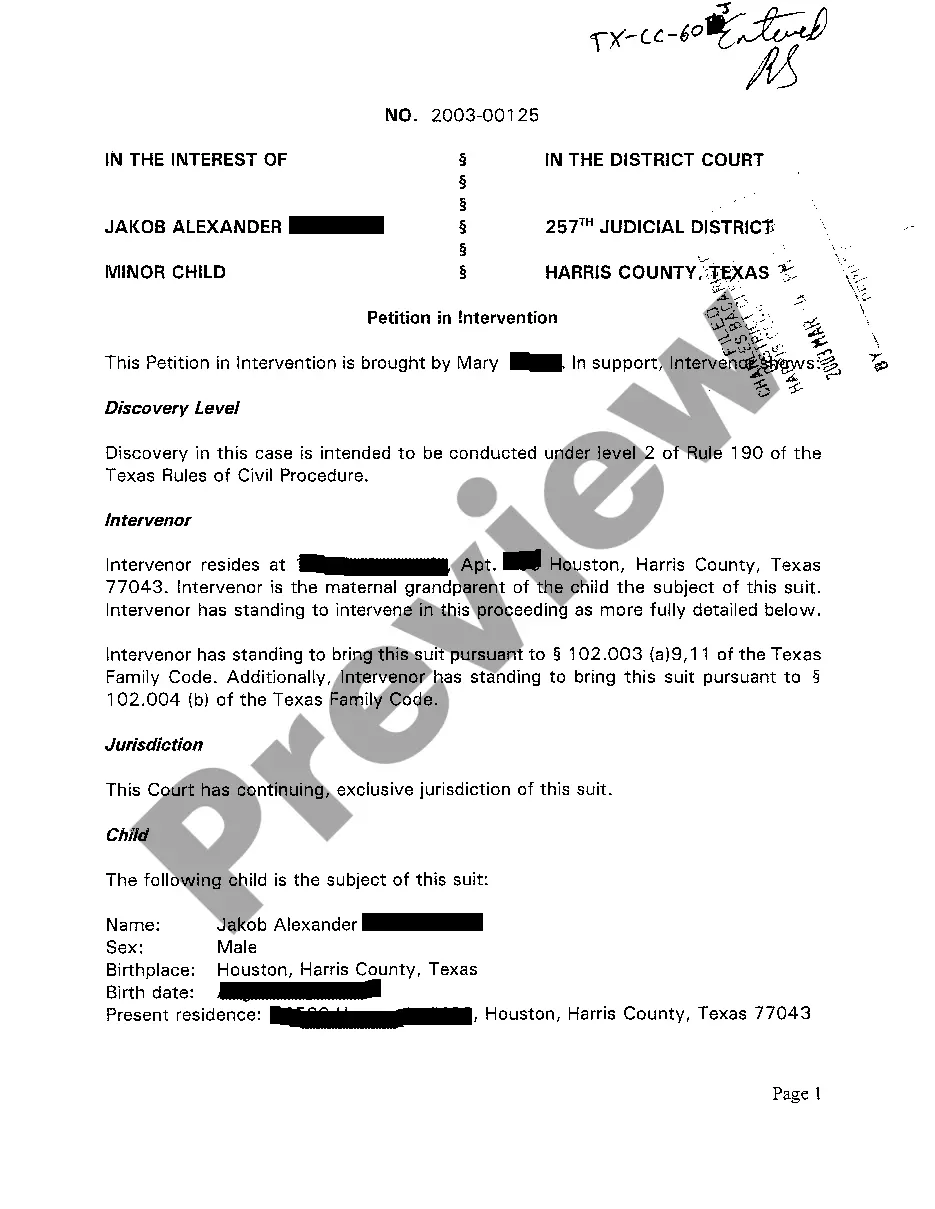

Sample Email For Debt Collection

Description

How to fill out Sample Email For Debt Collection?

Obtaining legal templates that comply with federal and local regulations is a matter of necessity, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the appropriate Sample Email For Debt Collection sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal scenario. They are simple to browse with all documents arranged by state and purpose of use. Our experts keep up with legislative updates, so you can always be sure your paperwork is up to date and compliant when acquiring a Sample Email For Debt Collection from our website.

Obtaining a Sample Email For Debt Collection is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the guidelines below:

- Examine the template utilizing the Preview option or via the text description to ensure it meets your requirements.

- Locate another sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve found the right form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Sample Email For Debt Collection and download it.

All documents you locate through US Legal Forms are reusable. To re-download and fill out previously saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Detail the debt amount: State the dollar amount of debt owed, the original date that this amount was due, and any other fees or interest accrued. If there are multiple amounts, include the total amount due. Provide context: Outline events in chronological order. Provide as much detail and context as possible.

Summary: A "creditor" is not required to inform their clients before passing an account to collections. A debt collection agency is responsible for sending an initial demand letter, also known as a ?validation notice,? to notify your debtor about their account being assigned to the agency.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

Start with a polite reminder or enquiry about the bill, as overdue payment may not be any fault of the customer, and then follow up as necessary. Try one or more of the follow-up tactics below: Personal visit ? a face-to-face encounter can often solve the issue or ensure you get priority treatment.

Dear [Customer Name], I hope this email finds you well. I am reaching out in regards to Invoice [Invoice Number], which has not been paid despite its due date of [Due Date]. I understand that paying outstanding debts can be challenging, and I am writing to offer you multiple payment plan options.