Sample Loan Agreement Form With Notary

Description

How to fill out Sample Letter Regarding Revolving Note And Loan Agreement?

Individuals typically link legal documentation with something complex that only an expert can manage.

In a sense, this is accurate, as composing a Sample Loan Agreement Form With Notary requires extensive understanding of subject standards, including state and county laws.

However, with US Legal Forms, the process has become more straightforward: a collection of ready-to-use legal templates for any personal and business scenario specific to state regulations is gathered in a single online repository and is now accessible to all.

Pick the format for your sample and click Download. Print your document or upload it to an online editor for faster completion. All templates in our collection are reusable: once purchased, they remain saved in your profile. You can access them whenever necessary via the My documents tab. Explore all the advantages of utilizing the US Legal Forms platform. Join today!

- US Legal Forms provides over 85k current documents categorized by state and application area, so locating a Sample Loan Agreement Form With Notary or any other specific template only takes a few minutes.

- Previously registered users with an active membership need to Log In to their account and click Download to access the form.

- New users will first need to establish an account and enroll before they can retrieve any documentation.

- Here’s the step-by-step instructions on how to obtain the Sample Loan Agreement Form With Notary.

- Review the page content carefully to ensure it satisfies your requirements.

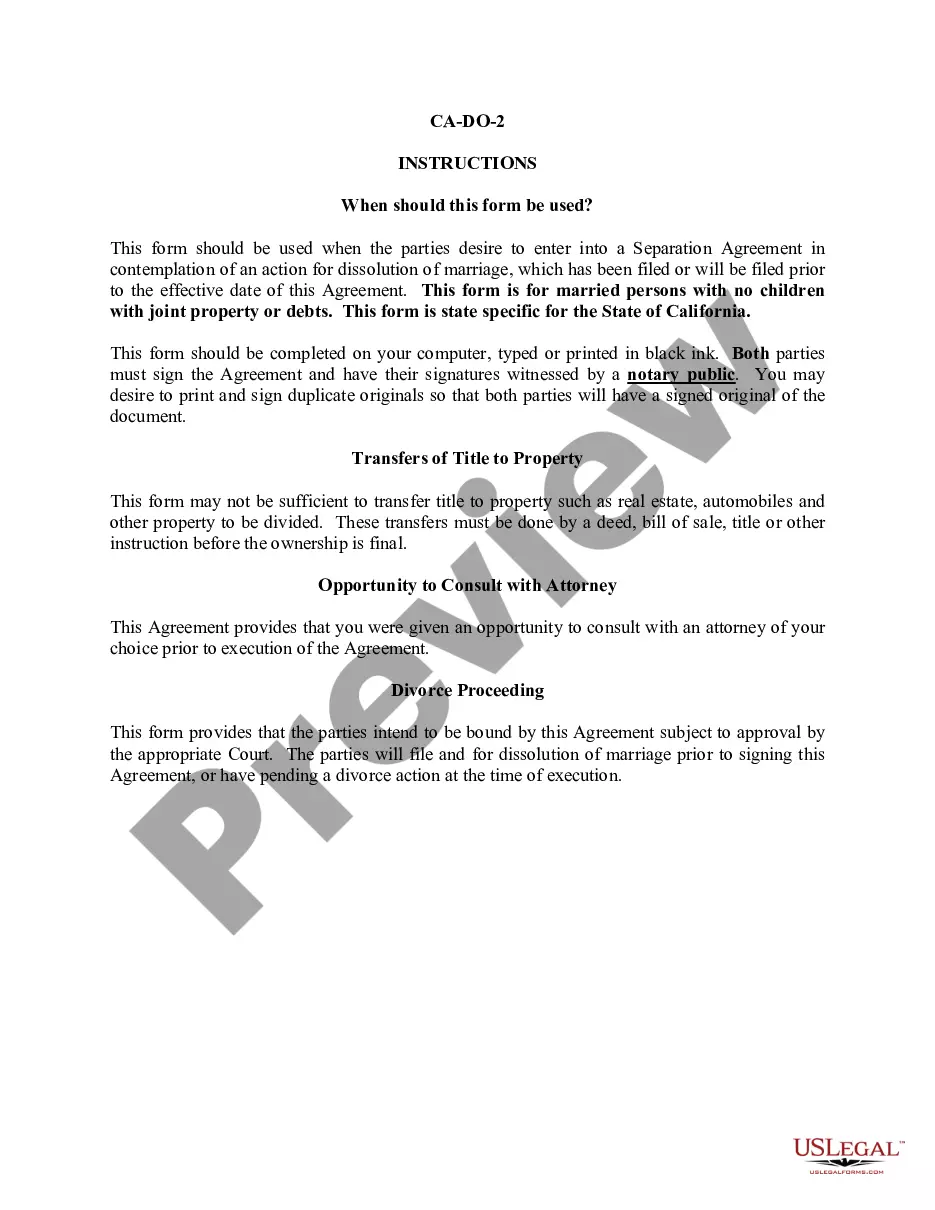

- Read the form description or view it through the Preview feature.

- If the last sample does not fit your needs, look for another example using the Search bar above.

- Once you find the appropriate Sample Loan Agreement Form With Notary, click Buy Now.

- Select a subscription plan that aligns with your preferences and budget.

- Create an account or Log In to proceed to the payment page.

- Complete your payment for the subscription via PayPal or with a credit card.

Form popularity

FAQ

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

How to sign a loan agreement onlineLoad the loan agreement template.Fill in the lender and borrower information.Specify the loan amount and the date of the loan.Specify the loan delivery method.Fill in the details of the loan repayment schedule and regular payment options.More items...

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?