Sample Letter For Derogatory Credit Explanation

Description

How to fill out Sample Letter For Request For Removal Of Derogatory Credit Information?

Legal administration can be overwhelming, even for the most seasoned experts.

When you are seeking a Sample Letter For Derogatory Credit Explanation and lack the time to search for the appropriate and updated version, the process can be daunting.

US Legal Forms encompasses all requirements you may have, from personal to business documentation, all in one location.

Employ cutting-edge tools to complete and manage your Sample Letter For Derogatory Credit Explanation.

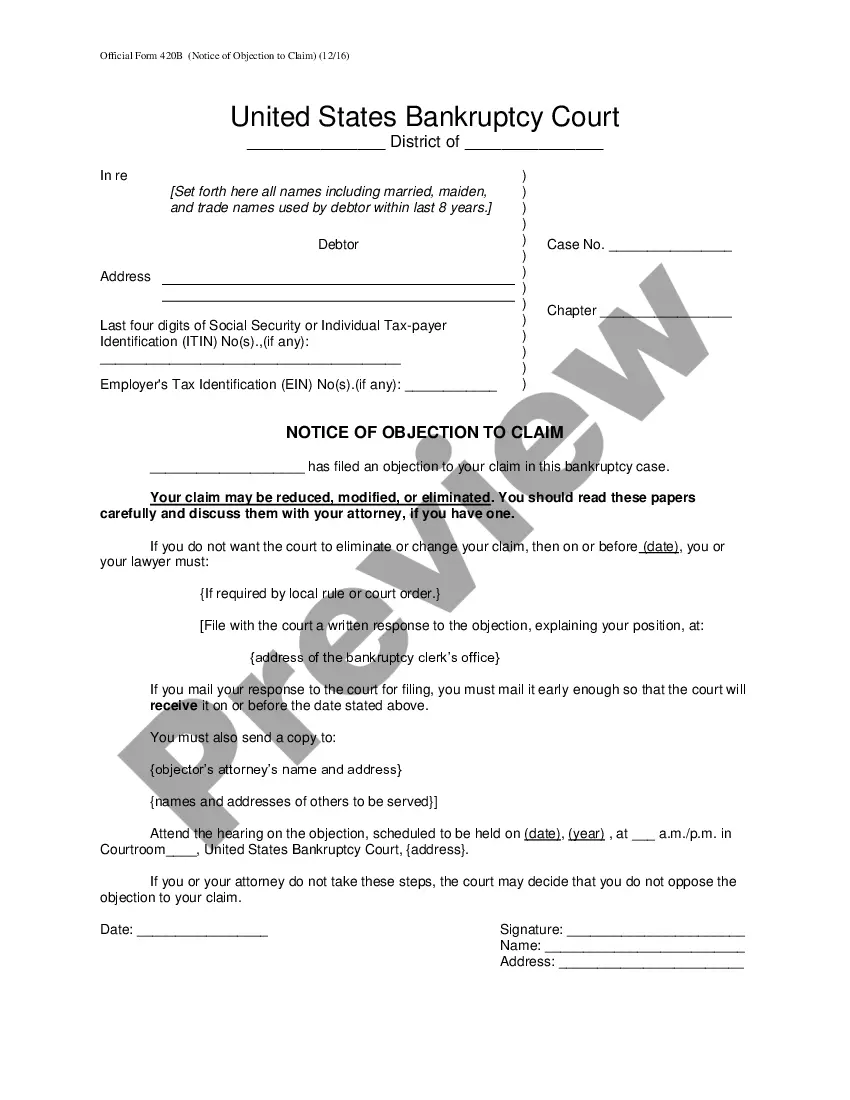

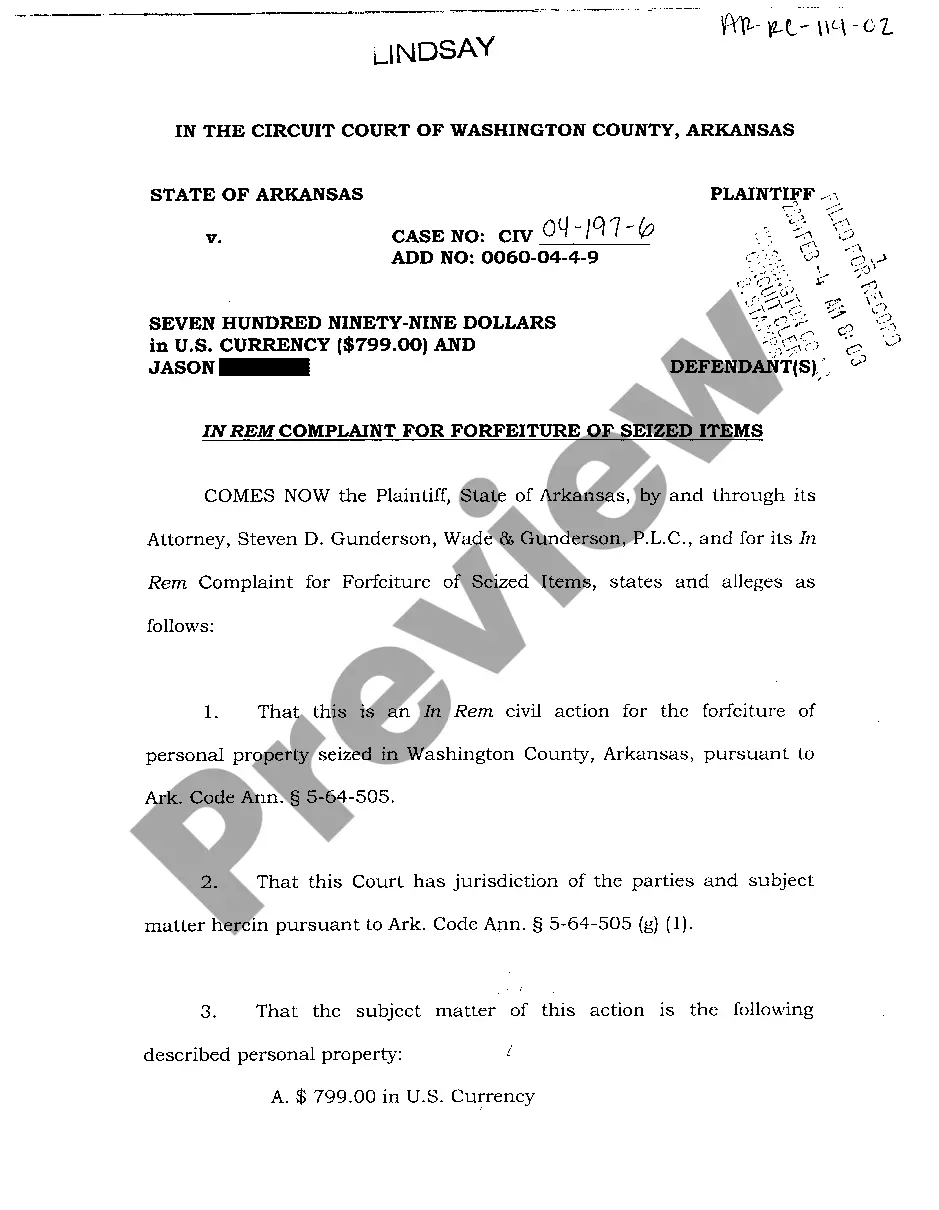

Here are the steps to consider after downloading the desired form: Validate that this is the correct form by previewing it and reviewing its description.

- Access a valuable resource database filled with articles, guides, and materials pertinent to your circumstances and needs.

- Conserve time and effort in searching for the documents you require, using US Legal Forms’ advanced search and Review feature to find and download the Sample Letter For Derogatory Credit Explanation.

- If you possess a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to discover the documents you have previously downloaded and organize your folders as desired.

- If this is your first time with US Legal Forms, create an account and enjoy unlimited access to all benefits of the library.

- Utilize a robust online form repository that could change the game for anyone wishing to manage these issues effectively.

- US Legal Forms is a frontrunner in digital legal forms, boasting over 85,000 state-specific legal templates available at any time.

- Access state- or county-specific legal and business forms.

Form popularity

FAQ

Derogatory items refer to negative entries on your credit report that can harm your credit score. These can include late payments, bankruptcies, and accounts in collections. Understanding these items is crucial for managing your credit health. Utilizing a sample letter for derogatory credit explanation can help you explain these entries when applying for new credit.

If you receive a 1099 form for any work performed in Nevada, or if you are an owner of a business, you need a state business license. DO I QUALIFY FOR AN EXEMPTION? license requirement. Exemptions are listed in Nevada Re- vised Statutes 76.020(2) and Nevada Administrative Code 76.

Who must be licensed as a contractor? All businesses or individuals who construct or alter any building, highway, road, parking facility, railroad, excavation, or other structure in Nevada must be licensed by the Nevada State Contractors Board.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Am I required to have a State Business License? Yes. Unless statutorily exempted, sole proprietors doing business in Nevada must maintain a State Business License. Sole proprietors may submit their State Business License application online at .nvsilverflume.gov, by mail, or in-person.

Under Nevada law, an independent contractor is defined as a self-employed person who agrees with a client to do work for the client, for a certain fee, ing to the means or methods of the self-employed person and not subject to supervision or control of the client exception as to the results of the work.

Nevada nonprofit entities formed pursuant to NRS Chapter 82 and corporations sole formed pursuant to NRS Chapter 84 are specifically exempted from the requirements of the State Business License and are not required to maintain a state business license nor are they required to claim an exemption.

How is Form 1099-NEC completed? Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied.