3 Types Of Commercial Leases

Description

How to fill out Sample Basic Commercial Lease Agreement?

Legal document managing may be frustrating, even for experienced specialists. When you are searching for a 3 Types Of Commercial Leases and don’t have the a chance to commit looking for the correct and updated version, the procedures can be demanding. A strong online form library might be a gamechanger for everyone who wants to manage these situations efficiently. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available at any time.

With US Legal Forms, you can:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any requirements you might have, from individual to enterprise documents, in one location.

- Utilize advanced tools to finish and manage your 3 Types Of Commercial Leases

- Gain access to a resource base of articles, tutorials and handbooks and materials relevant to your situation and requirements

Help save effort and time looking for the documents you need, and use US Legal Forms’ advanced search and Preview tool to locate 3 Types Of Commercial Leases and get it. If you have a membership, log in in your US Legal Forms account, look for the form, and get it. Take a look at My Forms tab to view the documents you previously saved and to manage your folders as you can see fit.

If it is your first time with US Legal Forms, create an account and have unlimited use of all benefits of the platform. Here are the steps to consider after downloading the form you want:

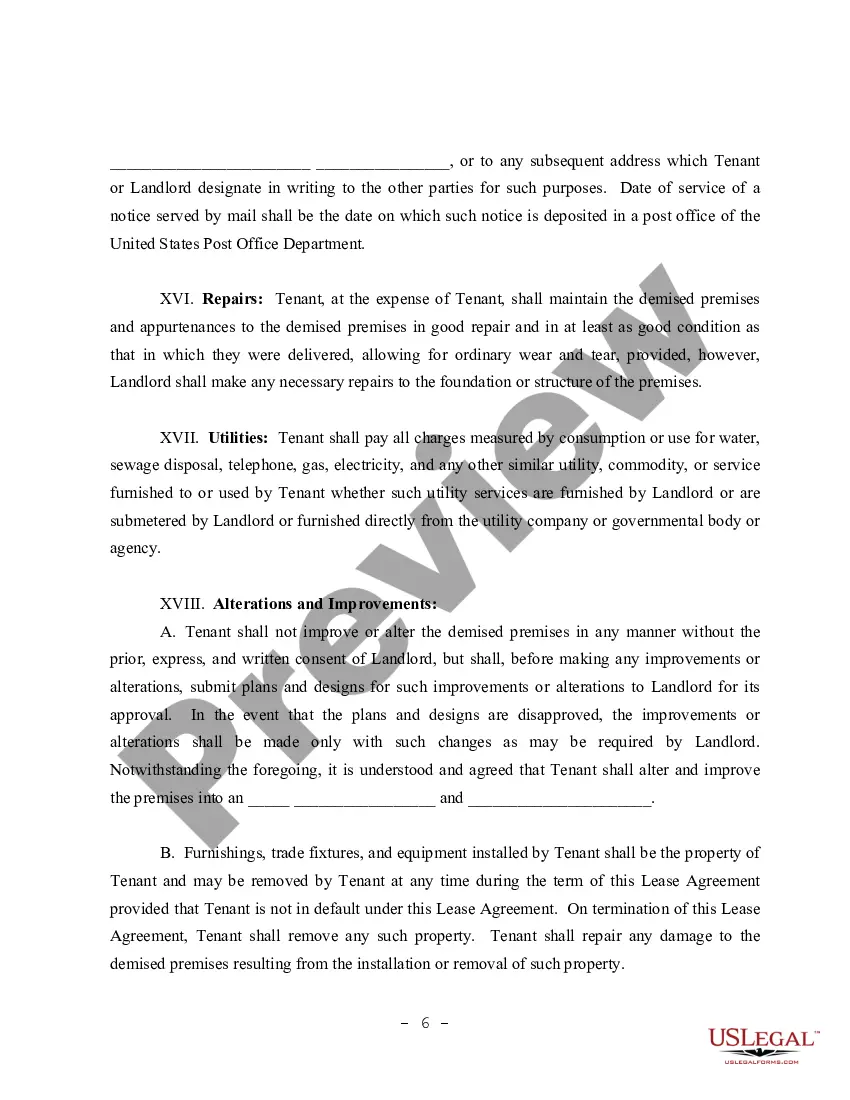

- Confirm this is the right form by previewing it and reading its information.

- Ensure that the sample is recognized in your state or county.

- Pick Buy Now when you are ready.

- Select a subscription plan.

- Find the format you want, and Download, complete, sign, print out and deliver your document.

Take advantage of the US Legal Forms online library, backed with 25 years of experience and stability. Change your daily document administration into a smooth and intuitive process right now.

Form popularity

FAQ

When seeking NNN properties for sale or a commercial retail outlet lease, it is vital to understand how CAM differs from NNN. CAM is an acronym for Common Area Maintenance, while NNN features three nets, including CAM, property tax, and insurance.

Cons of Triple Net Leases Tenants might invest some work and time in property management, from hiring repair companies to comparing and buying insurance and protesting taxes if needed. Some unexpected costs (in maintenance or tax liabilities, for example) may arise during the time of occupancy.

Triple net lease, or NNN lease In a triple net lease, the tenant pays CAM charges and takes on almost all responsibilities. The tenant pays their pro rata share of the property taxes, property insurance, and common area maintenance. Typically, the only responsibility the landlord has is paying for capital expenditures.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

Compare Commercial Lease Agreements Gross leases tend to benefit the tenant, whereas net leases are more landlord friendly. In a gross lease, the tenant has more control over how much is spent on such expenses as janitorial services and utilities.