Indemnification Clause With Cap

Description

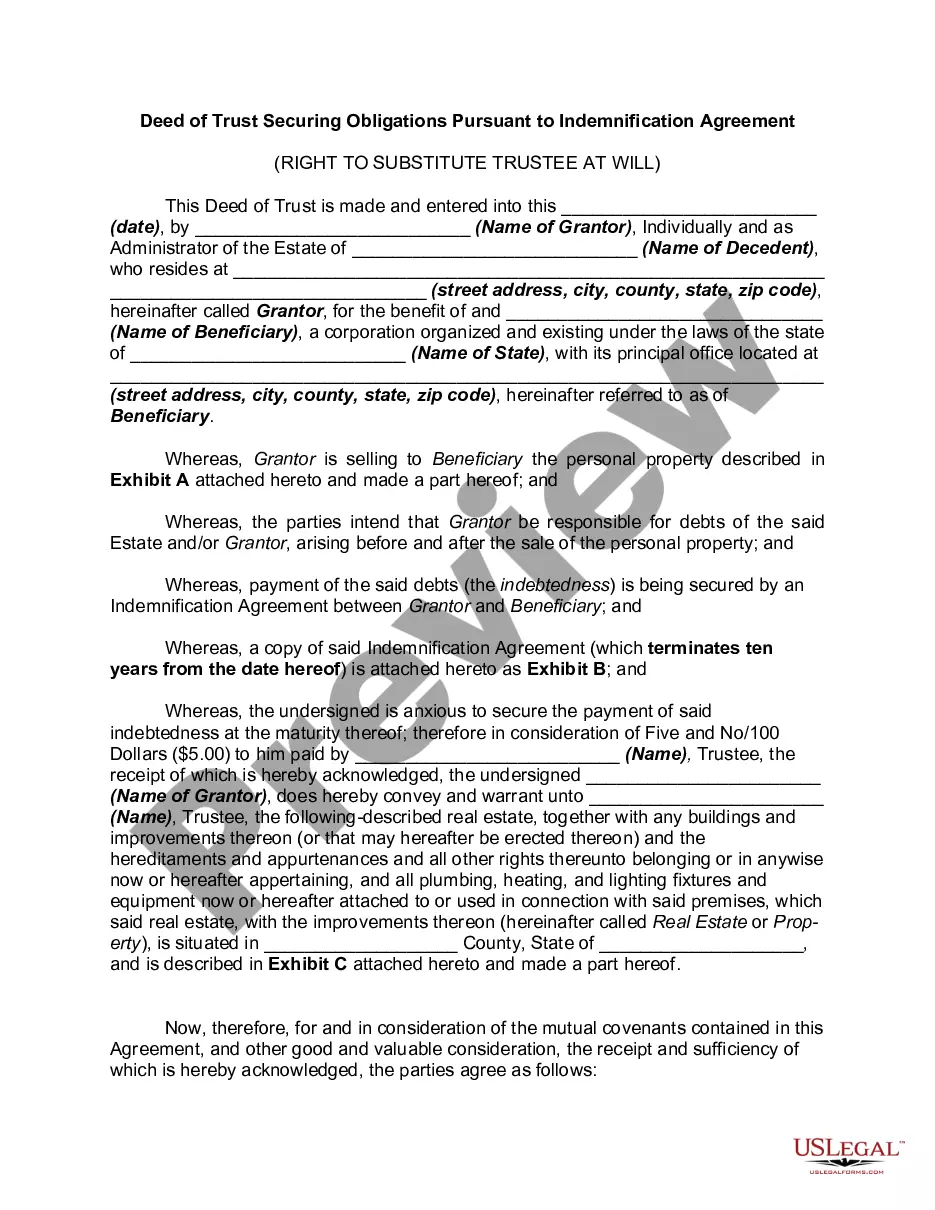

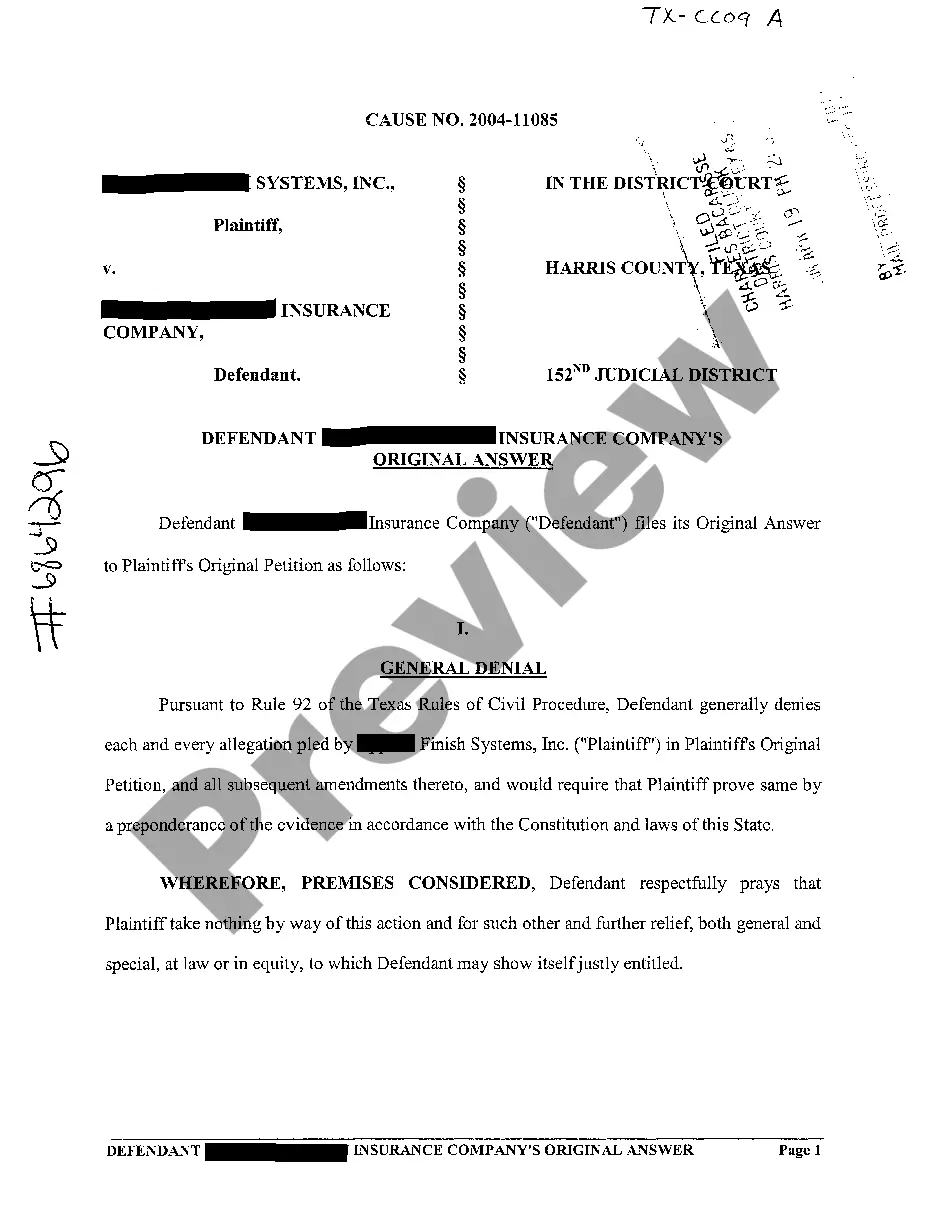

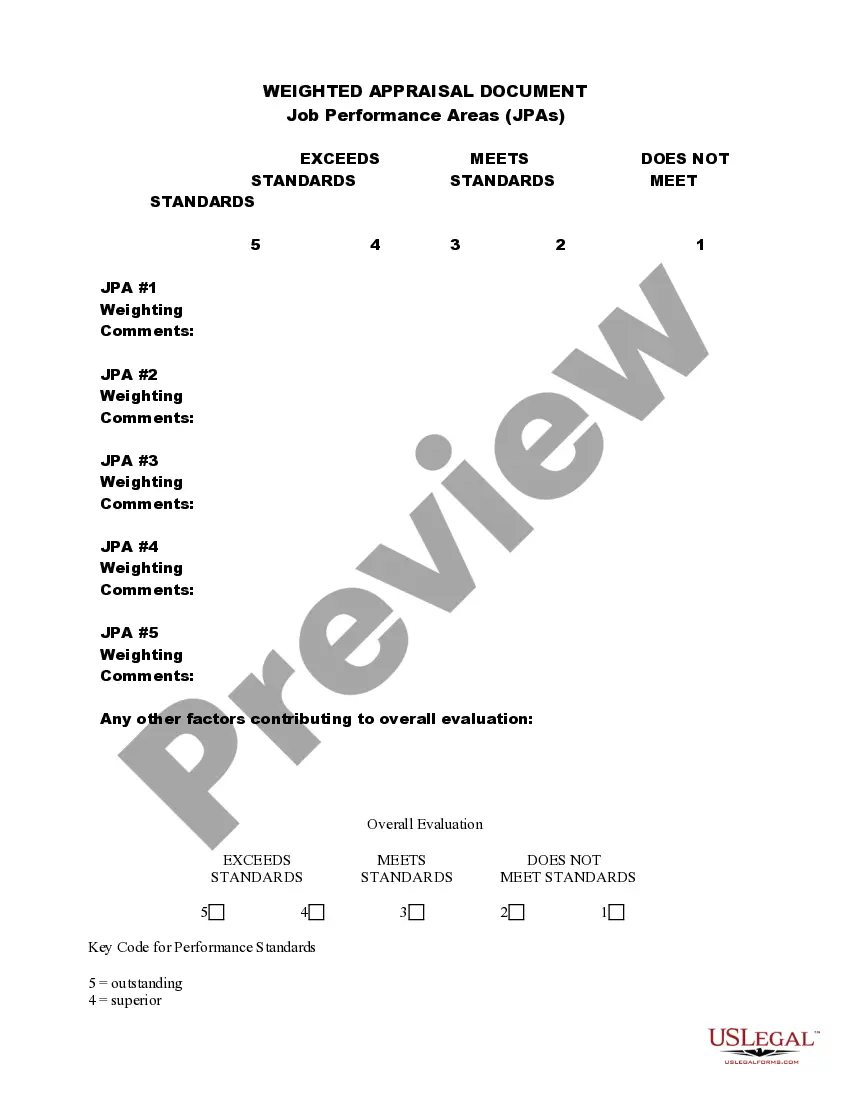

How to fill out Indemnification Agreement For A Trust?

Creating legal documents from the ground up can sometimes be daunting.

Certain situations may require extensive research and significant financial investment.

If you’re looking for a more straightforward and economical method of drafting Indemnification Clause With Cap or any other documents without the hassle, US Legal Forms is always available.

Our online collection of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal affairs.

Examine the document preview and descriptions to ensure you are looking at the document you need. Ensure that the form you choose complies with the laws and regulations of your state and county. Select the appropriate subscription plan to purchase the Indemnification Clause With Cap. Download the form, and then complete, validate, and print it. US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and make form execution an effortless and streamlined process!

- With just a few clicks, you can promptly obtain state- and county-compliant documents meticulously prepared by our legal professionals.

- Use our platform whenever you require trusted and dependable services to easily find and download the Indemnification Clause With Cap.

- If you’re familiar with our website and have previously registered an account with us, simply Log In to your account, find the template and download it or re-download it anytime later in the My documents section.

- Don’t have an account? No worries. It takes just a few minutes to create it and explore the library.

- But before you dive right into downloading Indemnification Clause With Cap, consider these suggestions.

Form popularity

FAQ

The indemnification provision with cap is a contractual clause that limits the amount of indemnity one party can receive from another. This provision balances the need for protection with the desire to limit financial exposure. By defining a cap, parties can negotiate terms that are fair and manageable. Utilizing platforms like US Legal Forms can simplify the drafting of an effective indemnification provision with cap.

If there is no indemnification clause in a contract, parties may face unexpected financial risks without recourse. This omission could lead to disputes and uncertainty regarding liability in case of a loss. Without clear terms, the parties may struggle to resolve issues that arise. Therefore, including an indemnification clause with cap is essential for protecting interests in any contractual arrangement.

The purpose of an indemnification provision is to allocate risk between the parties involved in a contract. It protects one party from financial loss due to the actions or omissions of the other party. By including this provision, businesses can mitigate potential liabilities and foster a more secure business relationship. An indemnification clause with cap helps in defining the extent of this protection.

The average indemnification cap can vary widely depending on the industry and the specific terms of the agreement. Typically, caps range from a percentage of the contract value to a fixed monetary amount. Understanding the average can help you gauge what is reasonable in your negotiations. Utilizing resources like US Legal Forms can aid in determining the appropriate indemnification cap for your contracts.

Yes, you can put a cap on an indemnity, and this practice is quite common in contracts. This cap serves to limit the financial risks associated with indemnification claims. By specifying a cap, parties can ensure that their potential losses are manageable. Thus, an indemnification clause with cap is a valuable tool in contract negotiations.

The indemnification cap amount is the specific limit defined in the indemnification clause. It outlines the maximum financial liability one party has towards another for claims made under the agreement. This cap amount can vary based on the nature of the contract and the risks involved. Businesses often negotiate this amount to align with their risk management strategies.

The cap clause for indemnification sets a maximum limit on the amount one party can claim from another in the event of a loss or damage. This clause is crucial as it provides certainty and predictability in contractual relationships. By including an indemnification clause with cap, parties can manage their financial exposure effectively. This helps to foster trust and cooperation between the parties involved.

A standard indemnification cap refers to a limit placed on the amount one party can recover from another under an indemnification clause with cap. This cap helps to manage risk and ensures that potential liabilities are predictable and manageable. Typically, the cap is expressed as a fixed dollar amount or a percentage of the contract value. Understanding this concept is crucial, as it allows you to better navigate legal agreements and protect your interests.

To limit an indemnification clause, you can set a cap on the total amount of indemnity payable or specify certain types of damages that will not be covered. Clearly defining the scope of indemnity and negotiating terms can also help manage expectations. Using US Legal Forms can aid you in drafting an effective indemnification clause with cap, tailored to your specific needs.

An indemnity cap clause might specify that a party is only liable for indemnification claims up to a certain percentage of the total contract value, such as 50%. This approach provides a balanced way to manage risk while still offering some level of protection. Crafting a precise indemnification clause with cap ensures both parties are aware of their limits and obligations.