Signature credit card benefits are exclusive perks and privileges that come with owning a Signature credit card. These benefits are tailored towards high-income individuals who seek enhanced purchasing power and premium services. Signature credit cards are considered an upgrade compared to regular credit cards and offer a range of additional features and rewards. Here are some key benefits of Signature credit cards: 1. Enhanced Rewards Program: Signature credit cards often come with a more lucrative rewards program compared to standard credit cards. Cardholders can enjoy accelerated points or cashback earnings on their purchases, enabling them to accumulate rewards faster. 2. Travel Benefits: Signature credit cards usually offer a suite of travel-related perks that can enhance the overall travel experience. These benefits may include complimentary airport lounge access, priority check-in and boarding, free checked baggage, travel insurance coverage, and exclusive discounts on flights, hotels, and car rentals. 3. Concierge Service: Cardholders gain access to a dedicated concierge service that assists with various lifestyle requests, such as making reservations at top restaurants, booking event tickets, organizing travel itineraries, and obtaining personalized recommendations. 4. Premium Insurance Coverage: Signature credit cards often provide robust insurance coverage, including purchase protection, extended warranty, rental car collision coverage, and emergency medical assistance during travel. 5. Exclusive Events and Experiences: Cardholders may receive invitations to exclusive events, such as concerts, sports events, fashion shows, and art exhibitions. These special experiences provide cardholders with access to VIP areas, backstage passes, meet-and-greet opportunities, and more. 6. Personalized Customer Support: Signature credit cardholders usually receive priority customer support, offering dedicated helplines and faster response times. This ensures a higher level of personalized assistance and quick resolution of any queries or concerns. It's important to note that different financial institutions may offer slightly different variations of Signature credit card benefits. Some may provides additional perks like complimentary hotel stays, access to luxury airport transfer services, expedited security screening, or even access to exclusive golf clubs. It is advisable to carefully review the specific benefits associated with different Signature credit cards before making a choice to ensure they align with your lifestyle and preferences.

Signature Credit Card Benefits

Description

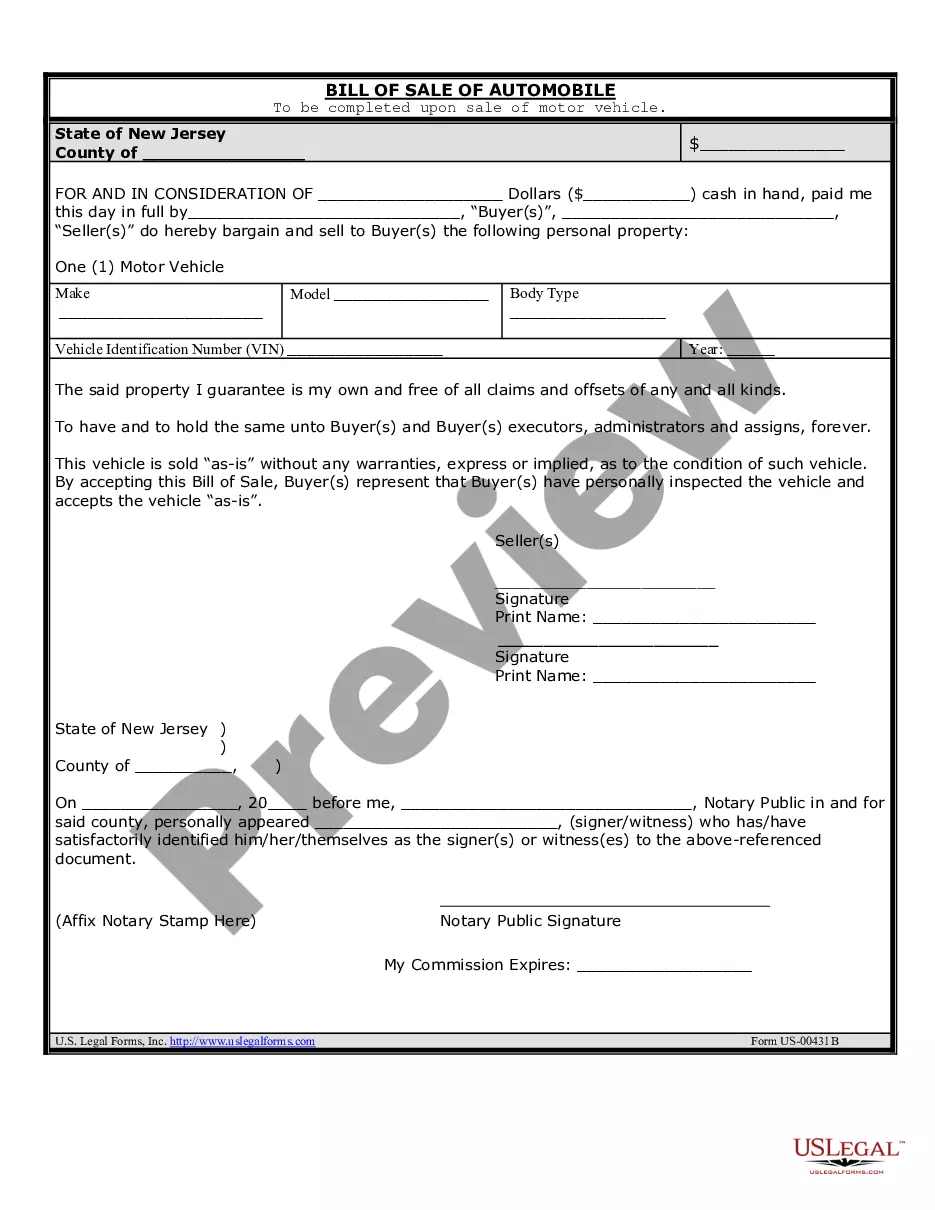

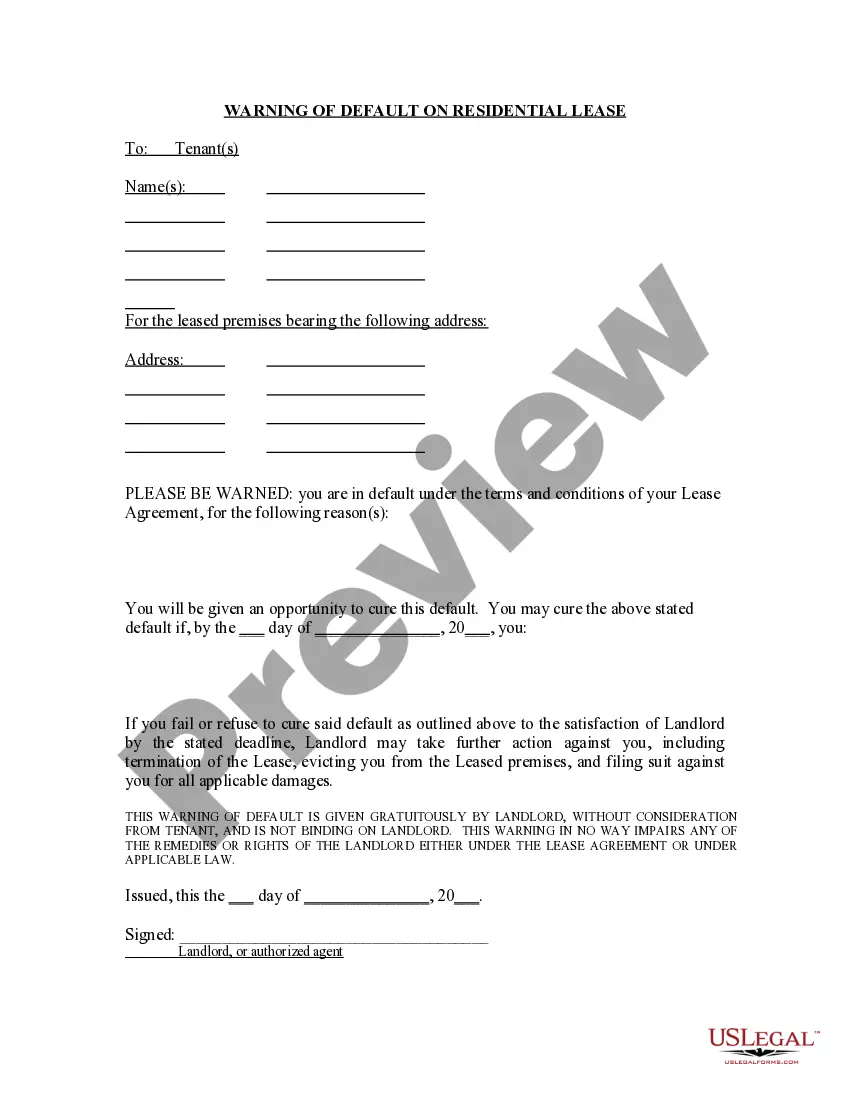

How to fill out Affidavit Regarding Account Access Signature Card?

Finding a go-to place to access the most current and appropriate legal samples is half the struggle of working with bureaucracy. Discovering the right legal documents calls for accuracy and attention to detail, which is the reason it is very important to take samples of Signature Credit Card Benefits only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and view all the information regarding the document’s use and relevance for the circumstances and in your state or region.

Take the following steps to complete your Signature Credit Card Benefits:

- Make use of the catalog navigation or search field to find your sample.

- Open the form’s information to see if it matches the requirements of your state and county.

- Open the form preview, if available, to make sure the form is definitely the one you are looking for.

- Get back to the search and locate the appropriate template if the Signature Credit Card Benefits does not suit your needs.

- If you are positive regarding the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Choose the pricing plan that fits your needs.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by selecting a transaction method (credit card or PayPal).

- Choose the file format for downloading Signature Credit Card Benefits.

- When you have the form on your gadget, you can change it with the editor or print it and finish it manually.

Eliminate the hassle that comes with your legal paperwork. Check out the comprehensive US Legal Forms collection to find legal samples, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

Summary of Visa Signature benefits Extended warranty protection. Travel and emergency assistance. Year-end spending summary. Visa Signature concierge. Roadside assistance (T). Auto rental collision damage waiver (T). Zero fraud liability (T). Lost/stolen card reporting, emergency replacement and emergency cash (T).

Visa Signature cards come with a minimum credit limit of $5,000, so that's one barrier of entry for new cardholders who apply. If you cannot qualify for a credit limit of at least that amount, it's likely you'll receive a traditional Visa card in situations where different tiers of the same card are offered.

The qualifications needed to obtain a Visa Signature card vary depending on the financial institution that issues the card. But per Visa, in some cases you may need good or excellent credit to obtain a Visa Signature card.

5% Cash Back on Gas & Electric Vehicle-charging stations. 3% Cash Back on Grocery Stores, Restaurants, Travel, and AAA purchases. 1% Cash Back on all other purchases. $100 Statement credit when you spend $1,000 within the first 90 days of account opening.

Minimum $5,000 Credit Limit ? Visa Signature cards are issued with a minimum $5,000 credit limit; for this reason, you must have a good to excellent credit score to qualify.