Partnership Resolution Form Withholding Tax

Description

How to fill out Partnership Resolution To Sell Property?

Whether for business purposes or for individual matters, everyone has to deal with legal situations at some point in their life. Completing legal papers demands careful attention, beginning from choosing the correct form sample. For instance, when you pick a wrong version of the Partnership Resolution Form Withholding Tax, it will be declined when you send it. It is therefore essential to have a reliable source of legal documents like US Legal Forms.

If you have to get a Partnership Resolution Form Withholding Tax sample, stick to these simple steps:

- Find the template you need by using the search field or catalog navigation.

- Look through the form’s information to make sure it suits your case, state, and county.

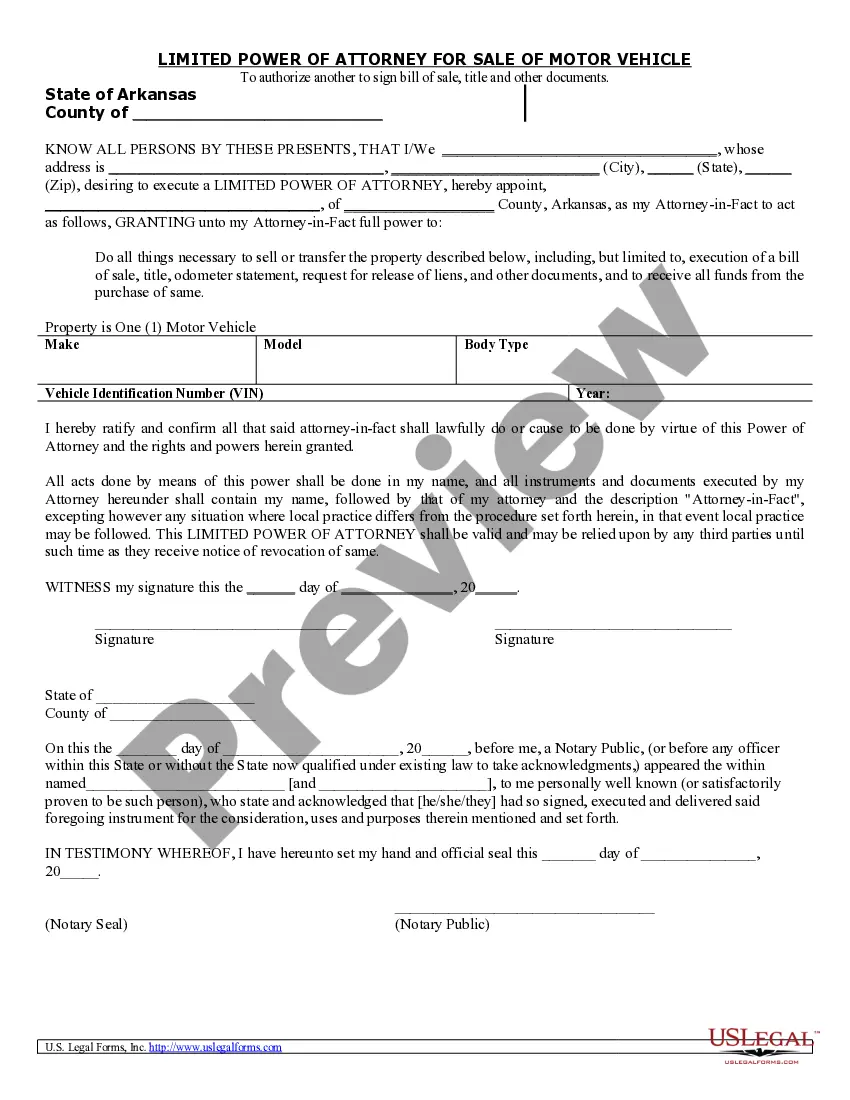

- Click on the form’s preview to view it.

- If it is the incorrect document, get back to the search function to find the Partnership Resolution Form Withholding Tax sample you require.

- Get the file when it meets your requirements.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved templates in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Pick the proper pricing option.

- Complete the account registration form.

- Pick your transaction method: use a bank card or PayPal account.

- Pick the file format you want and download the Partnership Resolution Form Withholding Tax.

- Once it is saved, you can fill out the form by using editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time seeking for the appropriate template across the internet. Utilize the library’s easy navigation to get the right template for any occasion.

Form popularity

FAQ

Generally, NRA withholding describes the withholding regime that requires 30% withholding on a payment of U.S. source income and the filing of Form 1042 and related Form 1042-S. Payments to all foreign persons, including nonresident alien individuals, foreign entities and governments, may be subject to NRA withholding.

A withholding foreign partnership (WP) is any foreign partnership that has entered into a WP withholding agreement with the IRS and is acting in that capacity.

A nonwithholding foreign partnership has three partners: a nonresident alien individual; a foreign corporation, and a U.S. citizen. You make a payment of U.S. source interest to the partnership. Assume that the payment is subject to Chapter 3 withholding but is not a withholdable payment.

Income Tax: Partnership firms are liable to pay income tax at a rate of 30% on their taxable income. Surcharges: If the taxable income of the partnership firm exceeds one crore rupees, a surcharge of 12% is applicable in addition to the income tax.

Under the law passed at the end of 2017, the purchaser of a partnership interest that is being sold by a foreign person is generally required to withhold 10% of the sales price of the partnership interest. This 10% withholding must be remitted to the Internal Revenue Service (IRS) no later than 20 days after closing.