Application For Filing Clarification Gst

Description

How to fill out Sample Letter For Request For Payment To Delinquent Account Before Filing Suit?

It’s widely recognized that you cannot instantly transform into a legal authority, nor can you learn to swiftly prepare the Application For Filing Clarification Gst without possessing a distinct set of capabilities.

Drafting legal documents is a labor-intensive task that demands specific education and expertise. Therefore, why not entrust the preparation of the Application For Filing Clarification Gst to the professionals.

With US Legal Forms, which offers one of the most comprehensive libraries of legal documents, you can discover everything from court paperwork to templates for internal business correspondence. We understand how vital it is to comply with federal and state laws and regulations.

You can regain access to your files from the My documents tab at any moment. If you are an existing client, you can simply Log In and find and download the template from the same section.

Regardless of the objective of your documents – whether financial, legal, or personal – our website has you supported. Give US Legal Forms a try now!

- Locate the document you require using the search feature at the top of the site.

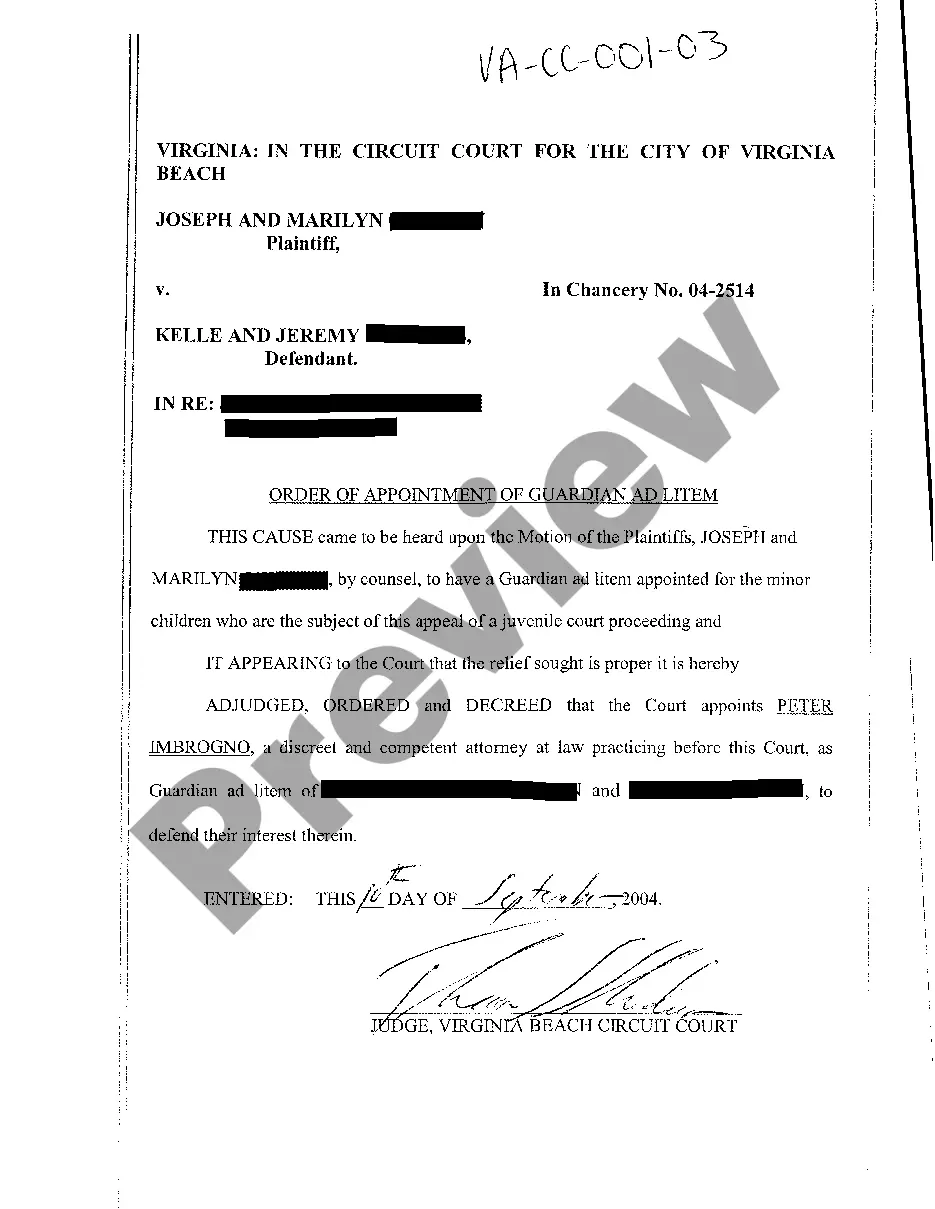

- Preview it (if this option is available) and review the accompanying description to assess if the Application For Filing Clarification Gst meets your needs.

- Restart your search if you require a different template.

- Create a complimentary account and select a subscription plan to acquire the form.

- Click Buy now. Once the payment is successfully processed, you can obtain the Application For Filing Clarification Gst, complete it, print it, and send it by mail to the appropriate individuals or organizations.

Form popularity

FAQ

Your Social Security Statement (Statement) is available to view online by opening a my Social Security account. It is useful for people of all ages who want to learn about their future Social Security benefits and current earnings history.

Form SSA-44 allows you to request a review of your Medicare premium in light of a significant life event that affected your household income. Events can include retirement, work reduction, divorce, or the sale of an income-producing property, among other things.

1-800-325-0778 You can also use our automated telephone services to get recorded information and conduct some business 24 hours a day. If you would like to receive your Social Security Statement by mail please follow these instructions. If you live outside the United States visit Service Around the World.

The flagship welfare programme in the US has rigid and specific rules for how much one's monthly check will be; there are no extra bonuses to receive. There is no such thing as an ?annual bonus? of $16,728? for Social Security.

Earnings Records - If you are seeking a living or deceased individual's earnings records, please follow the instructions to complete Form SSA-7050-F4 available at: and mail it to the address on the form along with the applicable fee and other evidentiary documents, as required.

How to get the $16,728 bonus in retirement? Work as long as you can: the later you retire the higher your benefit will be. Remember that 70 is the maximum age. ... Years worked: If you work less than 35 years you will have a reduction in your SSA check. ... High salary: with a high salary you will have a high retirement.

How can I get a form SSA-1099/1042S, Social Security Benefit Statement? Using your personal my Social Security account, and if you don't already have an account, you can create one online. ... Calling us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, am ? pm.

General information for recording statements on the SSA-795. Use an SSA-795 whenever a signed statement is required or desirable, except when we request some other form or questionnaire or we can readily adapt for the statement. Prepare an SSA-795 using the claimant's own words whenever possible.