Subchapter S Corporation Form

Description

How to fill out Subchapter S Corporation Form?

Bureaucracy necessitates accuracy and exactness.

Unless you manage the completion of documents like Subchapter S Corporation Form on a daily basis, it may result in some misunderstanding.

Choosing the appropriate template from the outset will guarantee that your document submission proceeds smoothly and avoid any issues of resending a file or executing the same task entirely from the beginning.

Obtaining the correct and current templates for your documents is a matter of minutes with an account at US Legal Forms. Eliminate the concerns of bureaucracy and simplify your form management.

- Find the template using the search bar.

- Verify that the Subchapter S Corporation Form you’ve discovered is applicable to your state or locality.

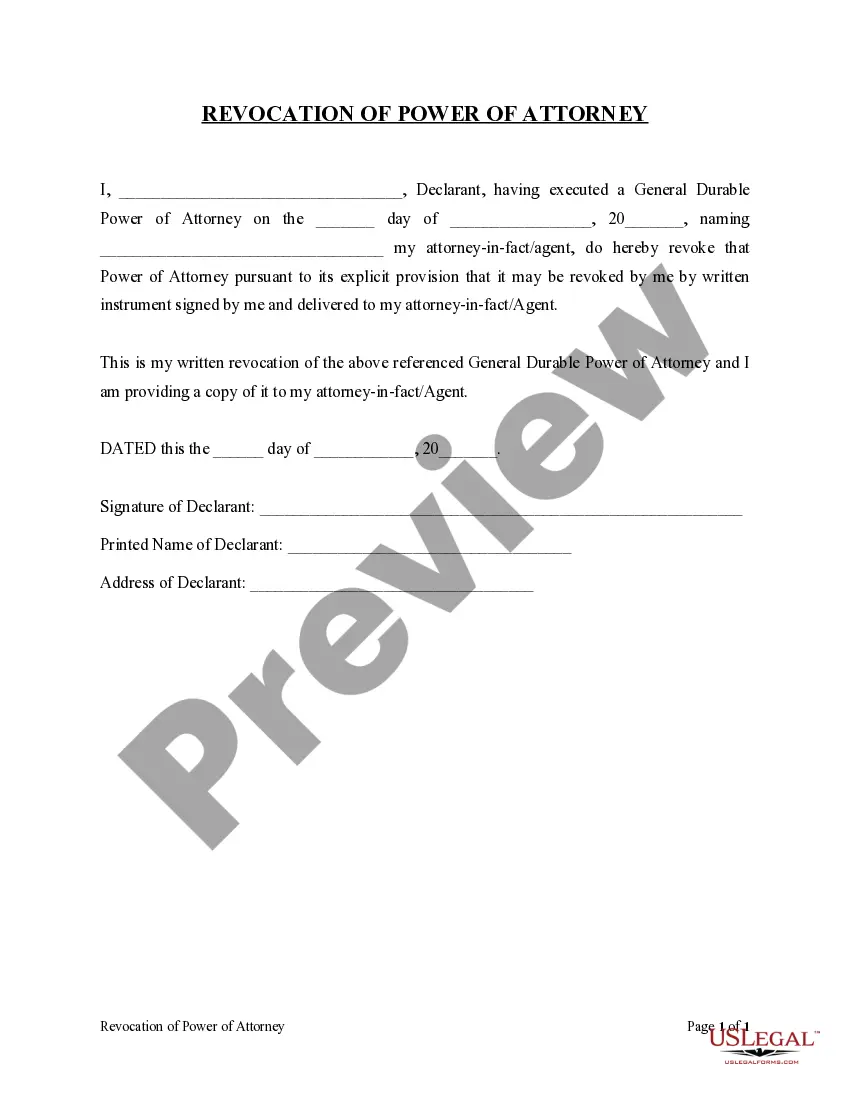

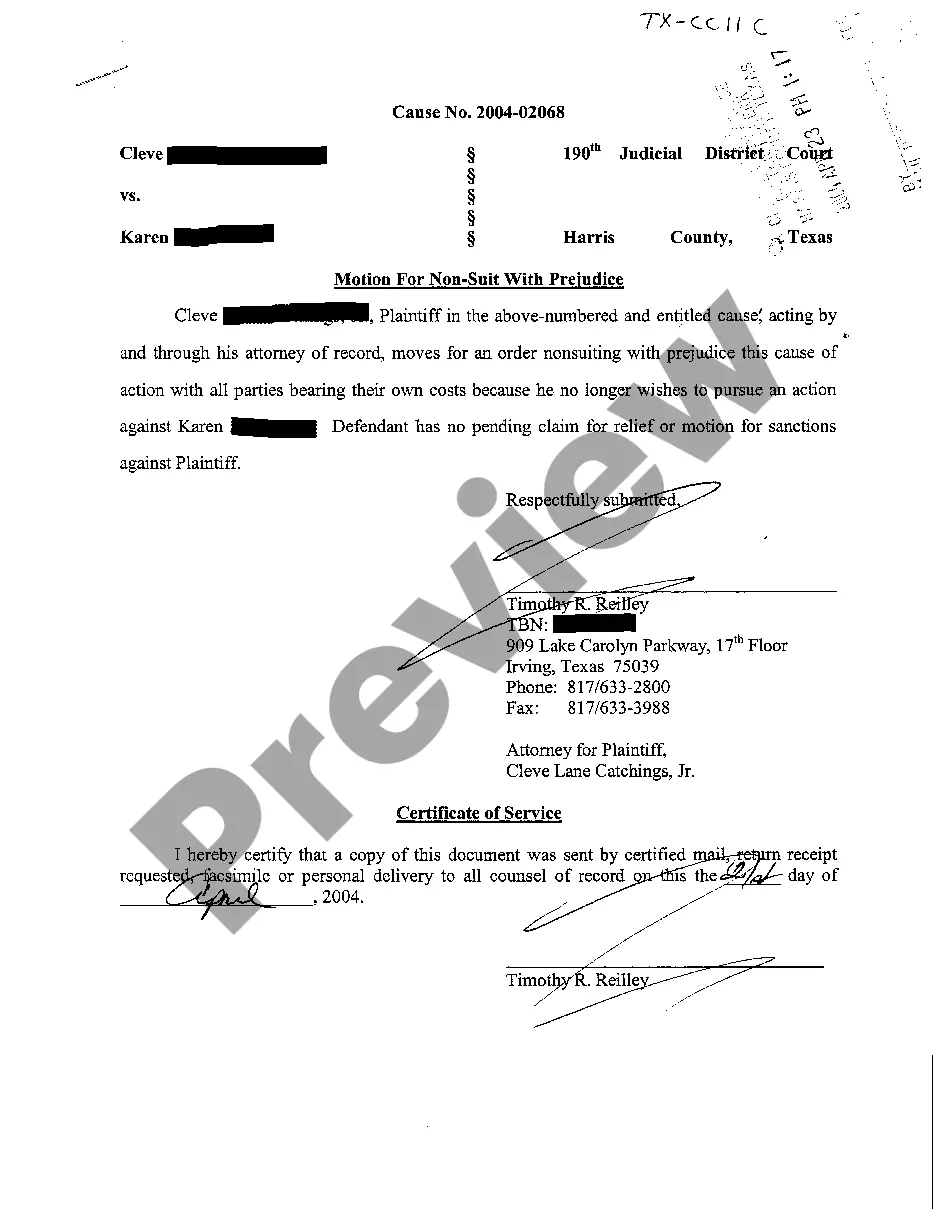

- Examine the preview or check the description that contains the information on the application of the template.

- When the outcome aligns with your search, click the Buy Now button.

- Select the suitable option from the proposed subscription plans.

- Log In to your account or create a new one.

- Complete the purchase using a credit card or PayPal payment method.

- Download the form in the format that suits you.

Form popularity

FAQ

If you've started an S-corporation in mid-2023, you’ll need to file Form 1120-S for your first year. Make sure to attach Schedule K-1 for each shareholder to detail their earnings and deductions. It may also be beneficial to review your state’s requirements, as they can vary. Using U.S. Legal Forms can provide you with templates and guidance to streamline this process effectively.

Filing for your first year as an S-corporation does involve some specific steps. To begin, you will need to submit Form 1120-S, which is the Subchapter S Corporation form. Don't forget to also include Schedule K-1 for each shareholder, as it reports their share of income. Additionally, consult with a tax professional or utilize U.S. Legal Forms to ensure all documents are filed correctly and on time.

To file for an S Corporation in California, you must first register your corporation with the California Secretary of State. After obtaining your articles of incorporation, you will need to file Form 2553 with the IRS to declare your S Corp status. Additionally, California has its own tax requirements for S Corporations, so be sure to check local regulations. Using US Legal Forms can help you navigate these steps efficiently.

Creating an S Corporation starts with incorporating under your state's regulations to form a C Corporation. After that, you will file Form 2553 with the IRS to elect S Corporation status. This involves gathering necessary information about your corporation and its shareholders. It’s beneficial to use services such as US Legal Forms to simplify the documentation process for the Subchapter S Corporation form.

To form an S Corporation, you must first establish a C Corporation by filing articles of incorporation with your state. Once your corporation is set up, you need to file IRS Form 2553, which elects your entity as an S Corp. This form must be submitted within a specific timeframe after your corporation is formed. Platforms like US Legal Forms can streamline the formation process and ensure you meet all requirements.

One notable disadvantage of an S Corporation is the limit on the number of shareholders. An S Corp can only have up to 100 shareholders, which may hinder growth for larger businesses. Additionally, all shareholders must be U.S. citizens or residents, which can restrict your options as your business expands. Weighing these disadvantages against the benefits is essential when considering the Subchapter S Corporation form.

The main difference between a C Corporation and a Subchapter S Corporation lies in taxation. A C Corp is taxed at the corporate level, while an S Corp allows income to pass through to shareholders, avoiding double taxation. This means that shareholders report the income on their personal tax returns. Understanding this distinction is crucial when deciding which entity type is right for your business.

To elect S corporation status, you need to file IRS Form 2553, also known as the Election by a Small Business Corporation form. This form allows your business to officially choose the Subchapter S corporation form, enabling it to enjoy tax benefits. It's crucial to file this form promptly after forming your corporation to ensure that your business can take advantage of these tax advantages in the current tax year. For convenience, uslegalforms offers templates and guides that simplify the process of completing and filing Form 2553.

An S corporation, often referred to as a Subchapter S corporation, is a special type of corporation that meets specific Internal Revenue Code requirements. This structure allows income, deductions, and tax credits to pass through directly to shareholders, avoiding double taxation. By choosing the Subchapter S corporation form, businesses can benefit from limited liability while enjoying the tax advantages associated with pass-through taxation. If you want to explore this option further, uslegalforms provides excellent resources and templates to get you started.