Trust After Death Without A Will

Description

How to fill out Revocable Trust For Lifetime Benefit Of Trustor For Lifetime Benefit Of Surviving Spouse After Death Of Trustor's With Annuity?

Acquiring legal document examples that adhere to federal and state laws is essential, and the web provides numerous alternatives to choose from.

However, what is the benefit of spending time searching for the properly drafted Trust After Death Without A Will sample online if the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by lawyers for various professional and personal circumstances. They are simple to navigate, with all documents categorized by state and intended use. Our specialists stay informed about legislative changes, ensuring that your form is always current and compliant when obtaining a Trust After Death Without A Will from our site.

Select Buy Now once you have found the correct form and pick a subscription plan. Create an account or Log In and make a payment using PayPal or a credit card. Choose the format for your Trust After Death Without A Will and download it. All documents sourced from US Legal Forms are reusable. To re-download and fill out previously purchased forms, access the My documents tab in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- Acquiring a Trust After Death Without A Will is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the required document sample in the appropriate format.

- If you are new to our site, follow the steps below.

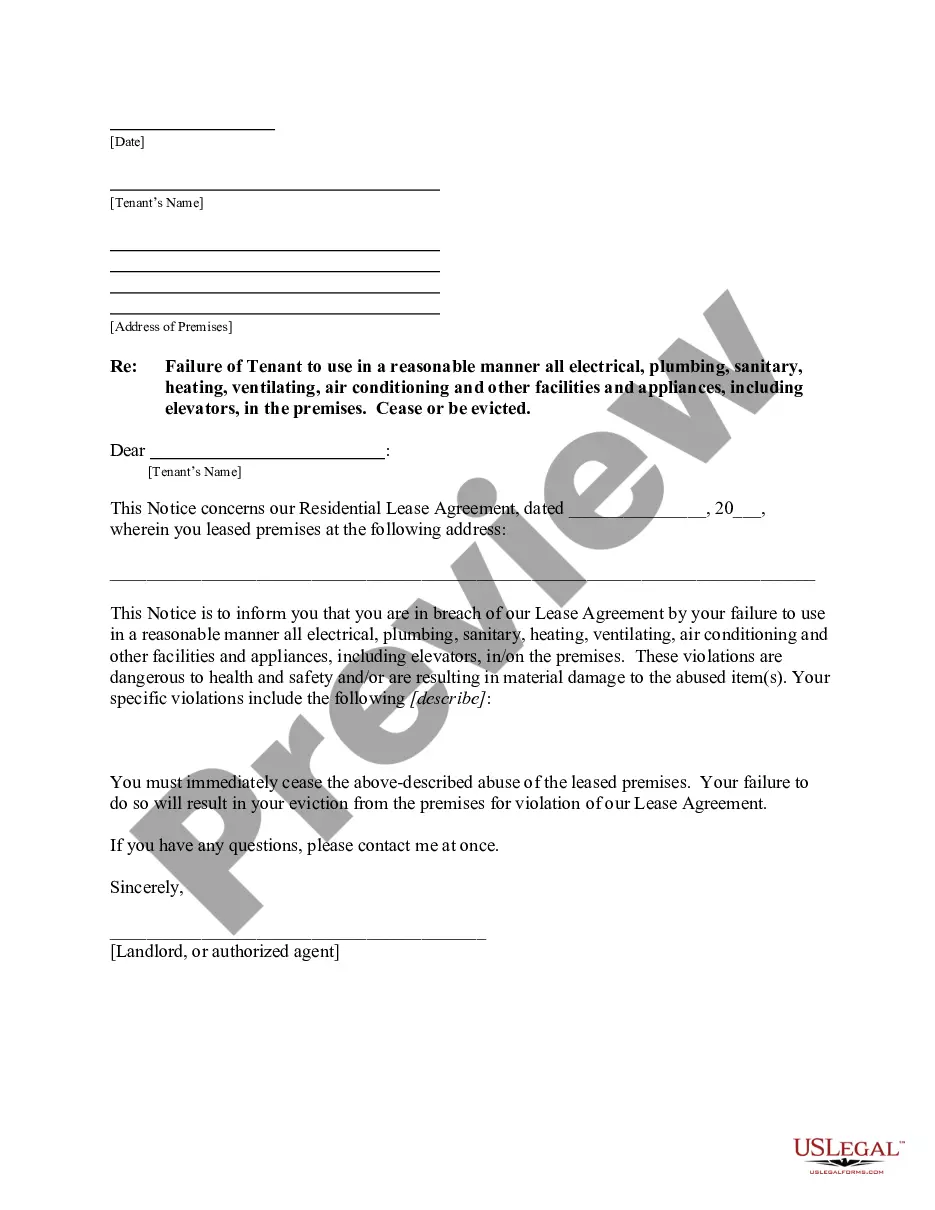

- Examine the template using the Preview option or through the text description to confirm it meets your requirements.

- If needed, search for another sample using the search feature at the top of the page.

Form popularity

FAQ

If there is no designated beneficiary, the deceased’s estate typically follows the rules of intestate succession established by state law. Generally, this means the estate passes to the closest living relatives, such as a spouse or children. However, in cases where no relatives exist, the state may claim the assets. Setting up a trust after death without a will can help ensure your assets go to your desired recipients, even if you face such a situation.

First off, you must be an Ontario resident to apply. Aside from that, the following people are granted trusteeship, in order of preference: A partner the deceased who the deceased was legally married to or in a common-law relationship with immediately before death. The deceased's closest living relative.

Dying without a will means that the government gets to use provincial laws to decide how to distribute your estate and appoint your executor. Your estate includes all of your assets (anything you possess of financial or other value) and any debts.

A trust is considered a taxpayer in Canada even though it is not considered a legal entity. A trust pays tax at the highest personal marginal tax rate on its taxable income and doesn't have the benefit of individual tax credits.

In general, setting up a Canadian trust costs no less than $1,500 as a minimum. But keep in mind that a legal professional generally charges you on a per-hour basis.

While wills are commonly used, living trusts offer advantages such as avoiding probate, providing for minor children, and efficient asset management. However, living trusts can be more complex and involve higher upfront costs.