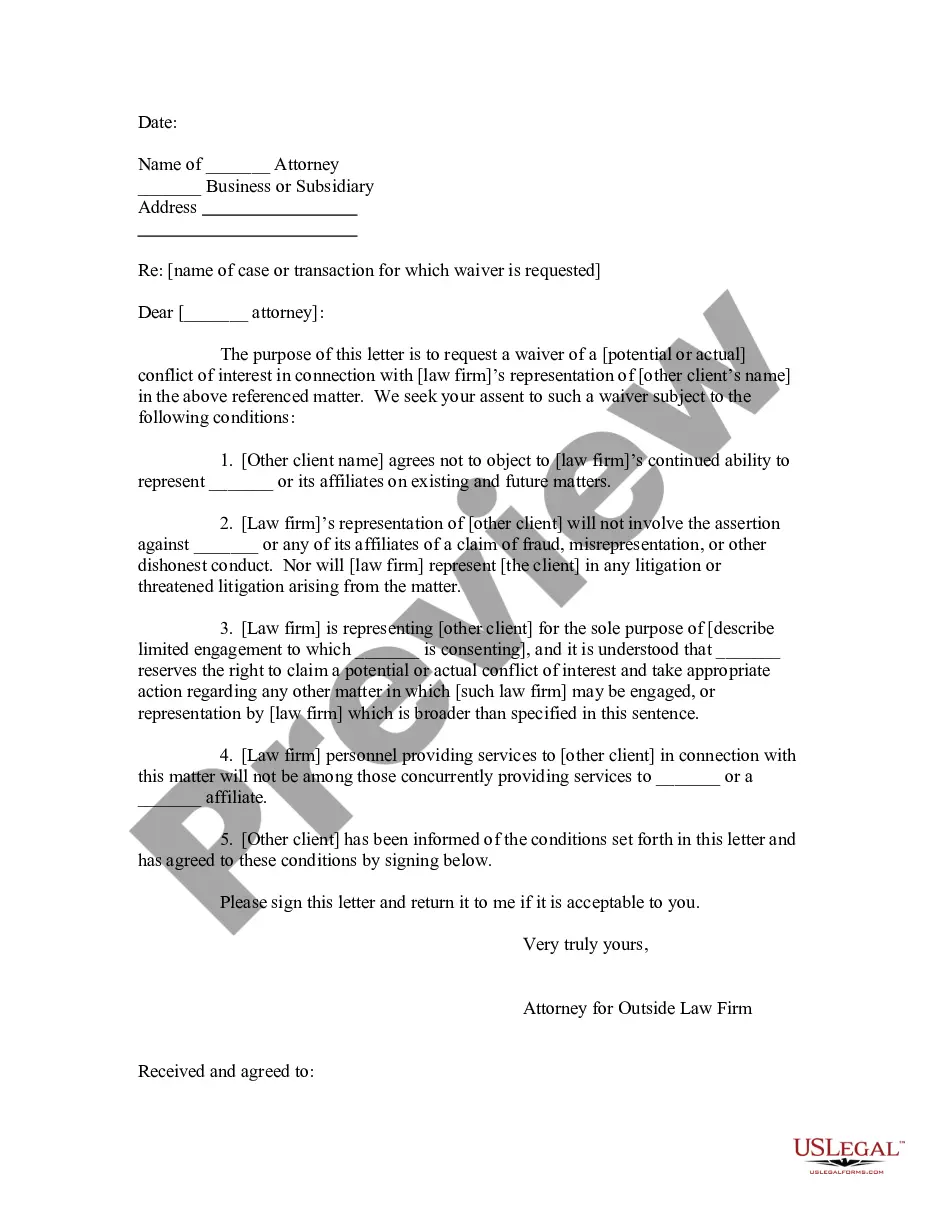

What Is Waiver Of Interest

Description

How to fill out Sample Attorney Conflict Of Interest Waiver Letter?

- Log in to your US Legal Forms account. If you're an existing user, ensure your subscription is valid to access necessary documents.

- If you're new, start by browsing the extensive library. Use the preview mode to ensure you select the right waiver of interest form that meets your jurisdictional requirements.

- In case you need a different template, utilize the search feature to find suitable alternatives.

- Once you select the correct document, proceed to purchase it by clicking on the 'Buy Now' button and choosing a subscription plan that fits your needs.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- After the payment is processed, download your waiver of interest form immediately and save it on your device for future access through the 'My Forms' section.

In conclusion, US Legal Forms empowers you to navigate the legal document landscape easily and efficiently. With an extensive collection of over 85,000 forms and expert assistance at your fingertips, your legal tasks become manageable. Start your journey to secure your waiver of interest form today!

Visit US Legal Forms now to explore the resources available to you.

Form popularity

FAQ

Yes, in many cases, to waive can mean to cancel or eliminate a payment obligation. However, waiving does not always imply a permanent cancellation, as it may apply to specific terms or conditions. Clarifying what a waiver of interest means can help you determine the potential impact on your financial commitments.

The primary purpose of a waiver is to release a party from a legal obligation or to relinquish specific rights. Waivers are common in contracts where one party may choose to forgive obligations, enhancing flexibility for both parties. Understanding the implications of a waiver of interest can help you seize opportunities while protecting your financial interests.

To waive payment means to voluntarily give up the right to collect a payment. This often occurs in legal or financial contexts, such as when a creditor decides not to enforce a payment obligation. Understanding what a waiver of interest involves can provide clarity on how such arrangements might affect your financial responsibilities.

A successful penalty abatement appeal request should include a clear explanation of why you believe the penalties should be waived, backed by supportive evidence. Include your personal details, tax identification information, and any relevant documentation to substantiate your claim. Also, connect your situation to the criteria that define what is waiver of interest, ensuring you address the core concerns of the IRS in your appeal.

An example of reasonable cause for late filing Form 8832 could be a significant disruption in business operations due to unforeseen circumstances, such as a fire or flood. If you can provide proof of the incident and how it impacted your ability to file on time, this can support your request for a waiver of interest. Proper documentation and clarity on your situation not only helps with your filing but also with understanding what is waiver of interest.

The IRS considers a reasonable cause for penalty abatement to be any circumstance that prevented a taxpayer from fulfilling their obligations, despite exercising ordinary business care. Events like natural disasters, death, or seriously debilitating health issues often fall under this category. Demonstrating that you acted responsibly under difficult circumstances strengthens your claim. In such scenarios, understanding what is waiver of interest becomes crucial for your case.

It is generally advisable to review your underpayment penalty calculation before accepting the IRS's determination. Sometimes the IRS may not consider all factors that could affect your circumstances, including reasonable cause situations. Providing your assessment can help highlight the nuances related to what is waiver of interest. You may want to consider using resources, such as uslegalforms, to guide you through the process.

Good causes for penalty abatement often involve personal hardships such as a death in the family or a significant life event affecting your financial capacity. Documenting these issues rigorously can bolster your request. When explaining your circumstances, be sure to relate it back to how this impacted your ability to meet tax obligations. This context aids in understanding what is waiver of interest when discussing your case.

In RM 20.1 1.3 2, a reasonable cause addresses scenarios where a taxpayer did not intentionally neglect their tax duties, but faced circumstances beyond their control. Examples include natural disasters or extended medical emergencies. By demonstrating such situations, you can effectively argue for a waiver of interest on incurred penalties. Exploring what is waiver of interest helps clarify your position when appealing to the IRS.

A reasonable cause might include experiencing a serious illness that prevented timely tax filing. For instance, if you were hospitalized and unable to manage your tax responsibilities, this could be a valid reason for requesting a waiver of interest. Just ensure that you provide adequate documentation and a clear explanation. Understanding what is waiver of interest can guide your decision-making in such cases.