Inheritance Husband Wife Foreign

Description

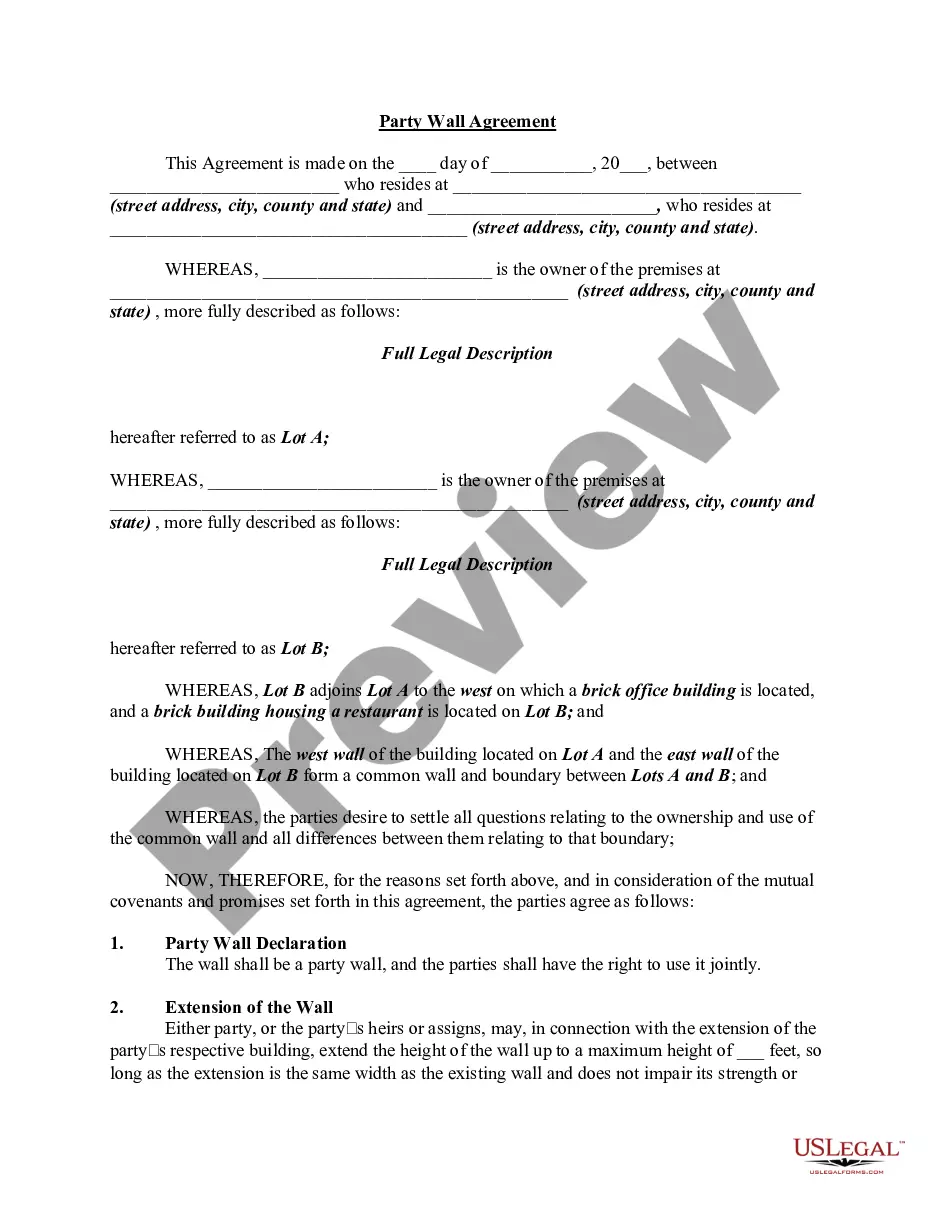

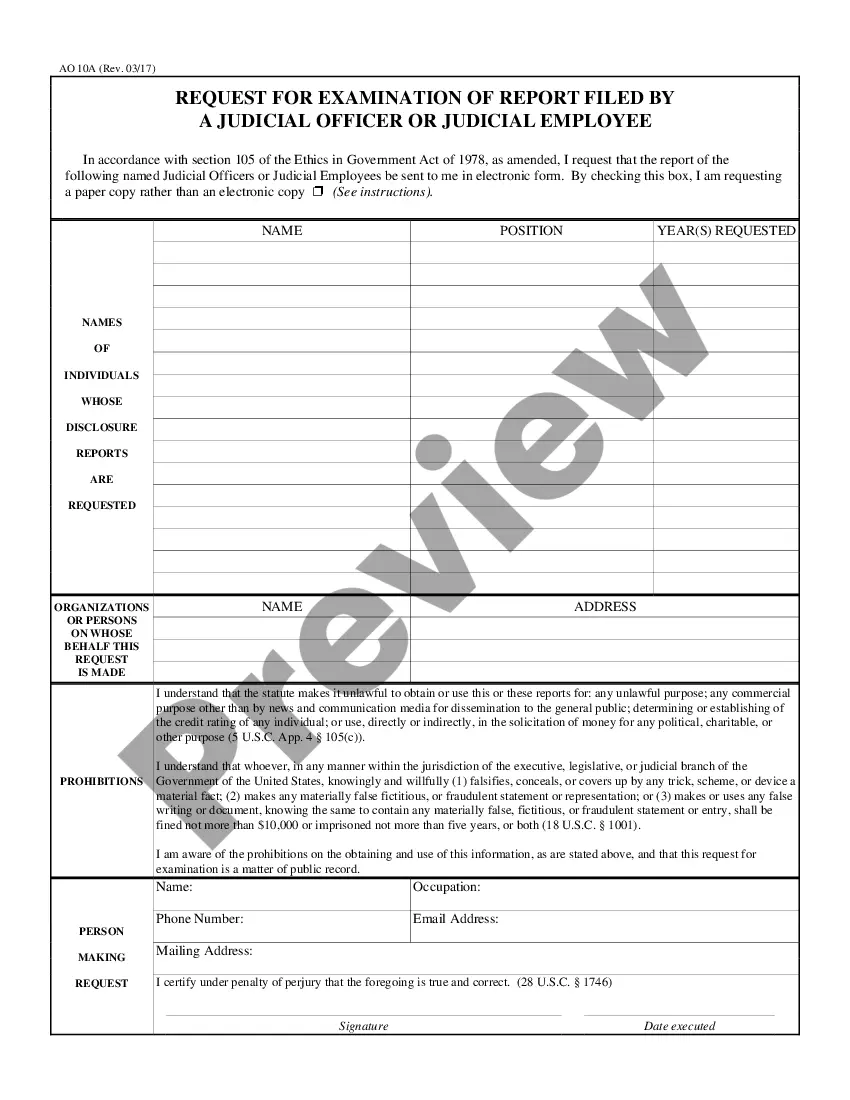

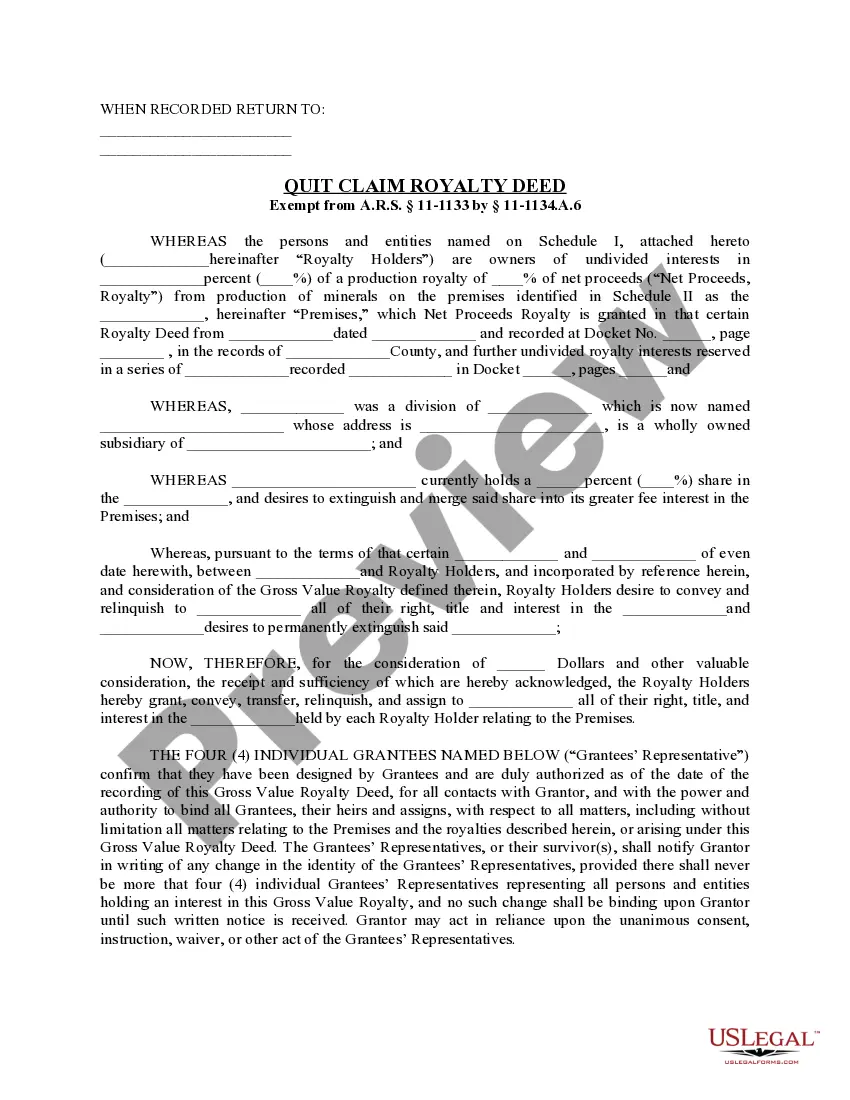

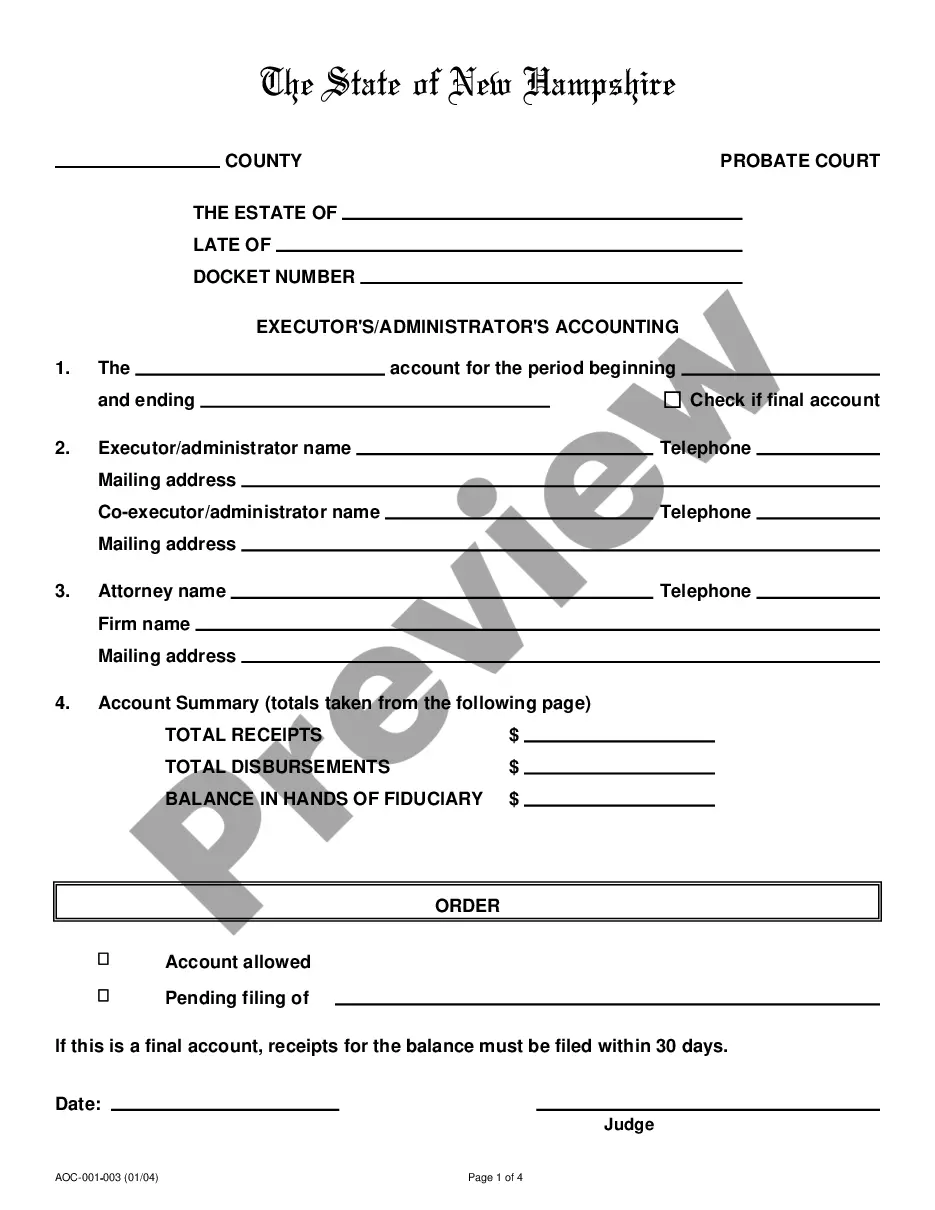

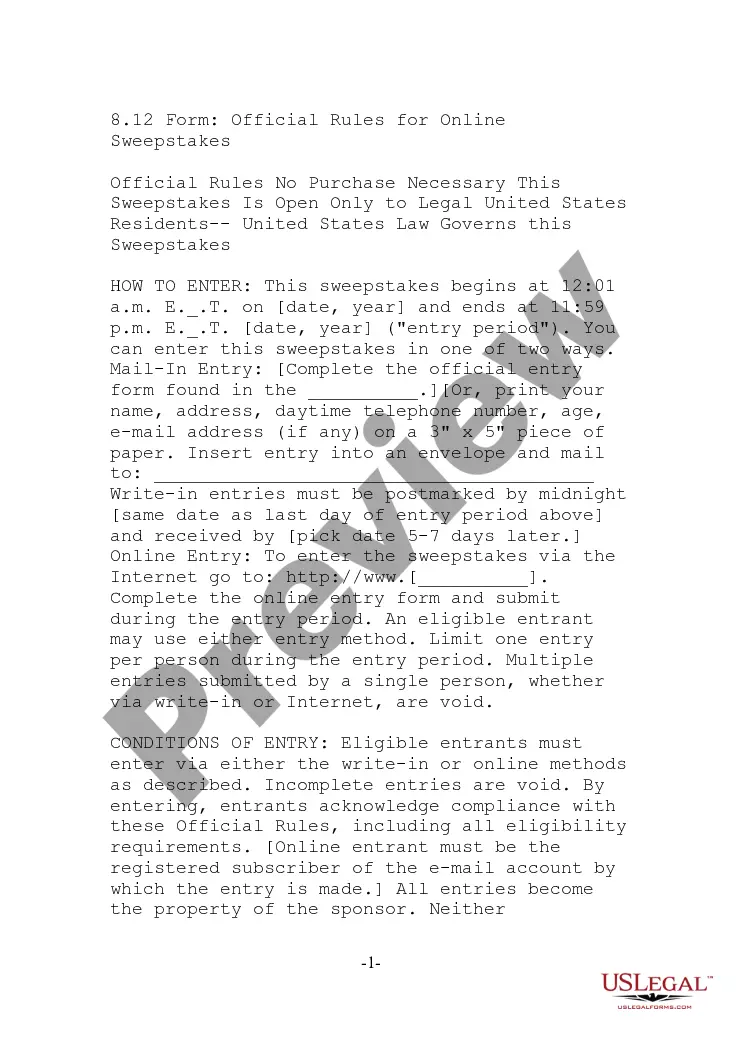

How to fill out Agreement Waiving Right Of Inheritance Between Husband And Wife In Favor Of Children By Prior Marriages?

It’s clear that you cannot transform into a legal expert instantly, nor can you swiftly master how to draft Inheritance Husband Wife Foreign without a necessary specialized skill set.

Formulating legal documents is a lengthy procedure that demands specific training and expertise. So why not leave the formulation of the Inheritance Husband Wife Foreign to the experts.

With US Legal Forms, one of the most extensive libraries of legal templates, you can access everything from court documents to templates for internal communication.

If you require a different form, restart your search.

Establish a free account and select a subscription plan to purchase the form. Click Buy now. Once payment is processed, you can obtain the Inheritance Husband Wife Foreign, complete it, print it, and send or mail it to the required persons or entities.

- We recognize how crucial compliance and adherence to federal and state regulations are.

- That’s why, on our site, all forms are location-specific and current.

- Begin with our website to obtain the document you need in just minutes.

- Discover the form you seek by utilizing the search bar located at the top of the page.

- Preview it (if this option is available) and review the supporting description to determine if Inheritance Husband Wife Foreign is what you desire.

Form popularity

FAQ

The annual gift tax exclusion allows you to gift up to $17,000 to a non-US citizen spouse without incurring gift tax, contributing to your plans for inheritance husband wife foreign. If you wish to gift more than this amount, any excess will be subject to gift tax. However, if both spouses elect to treat the non-citizen spouse as a U.S. citizen, you can gift unlimited amounts without tax implications. Utilizing platforms like US Legal Forms can help you navigate these options effectively and ensure compliance with tax requirements.

You may have rights to your husband's inheritance depending on state laws and your marital arrangements. In many cases, spouses are entitled to a portion of each other’s estate, including foreign inheritance. Understanding the specific laws that apply to your situation is vital. USLegalForms can equip you with the right documentation to clarify your rights and responsibilities.

If your beneficiary is not a U.S. citizen, they still have rights to inherit your assets in the USA. There may be additional tax obligations for non-citizen beneficiaries, so consulting a legal professional is wise. It is important to ensure your estate planning reflects the potential complexities of foreign inheritance laws. Let USLegalForms help you with the necessary forms to simplify this process.

You can absolutely leave your inheritance to someone living in another country. However, the process may involve additional legal steps and tax considerations. It’s crucial to specify your intentions clearly in your will to avoid any confusion. USLegalForms can assist you in drafting documents that honor your wishes while considering international laws.

Yes, your family can inherit assets in the USA even if they are not American citizens. However, there may be specific tax implications and legal requirements that apply to foreign beneficiaries. It is advisable to consult with a legal expert to navigate these complexities effectively. USLegalForms offers resources to help you manage foreign inheritance issues smoothly.

To bring foreign inheritance to the USA, you must first report the inheritance to the IRS if it exceeds a certain value. You may need to file additional forms, depending on the amount and nature of the inheritance. Working with a legal professional can simplify the process, especially if the inheritance involves multiple jurisdictions. USLegalForms can provide the necessary documents to ensure you comply with all regulations.

In most cases, a wife is entitled to her deceased husband's inheritance. The rules can vary based on whether the widow is a U.S. citizen or a foreign national, impacting the legal implications of inheritance husband wife foreign situations. It's essential to know your rights, and using a platform like US Legal Forms can streamline the process of understanding and asserting those rights effectively.

Yes, foreigners have the right to inherit property in the United States. Property ownership laws allow individuals, regardless of citizenship, to inherit real estate. Understanding the specifics of inheritance husband wife foreign scenarios is key to managing your rights effectively. It is beneficial to seek help from seasoned professionals who can guide you through the legal process.

citizen spouse can inherit unlimited assets from their spouse without incurring U.S. estate taxes when the assets fall under the unlimited marital deduction. However, specific rules apply, especially in cases involving inheritance husband wife foreign dynamics. Be sure to consider how these parameters affect your estate planning, and consult a professional for detailed recommendations.

Inheritance tax rates for non U.S. citizen spouses can vary widely depending on state laws. Generally, as a non-citizen spouse, you may face higher tax rates compared to citizens. When dealing with inheritance husband wife foreign issues, understanding state-specific laws becomes essential. It is advisable to seek resources or professional guidance tailored to your situation.