Special Trust Trustor Download With Example

Description

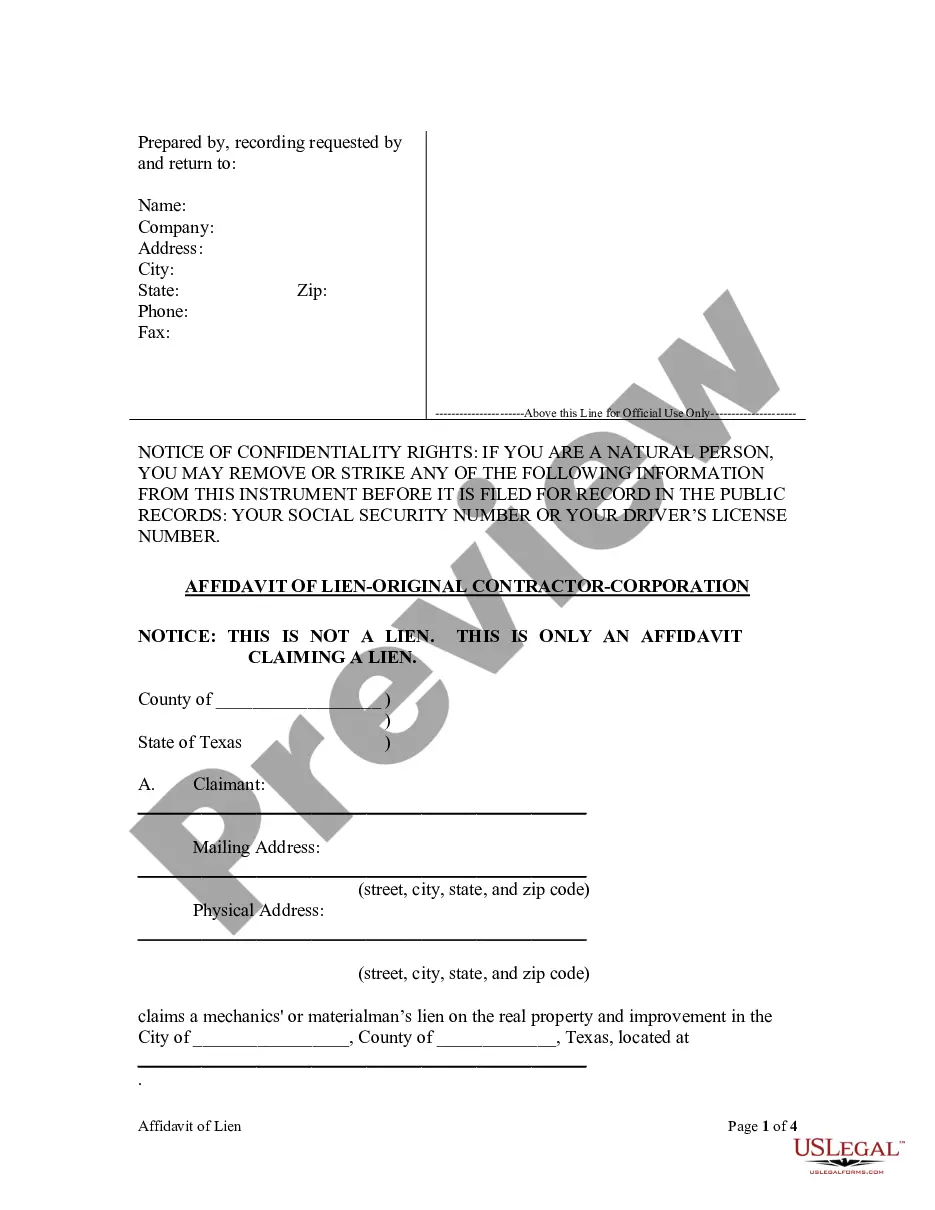

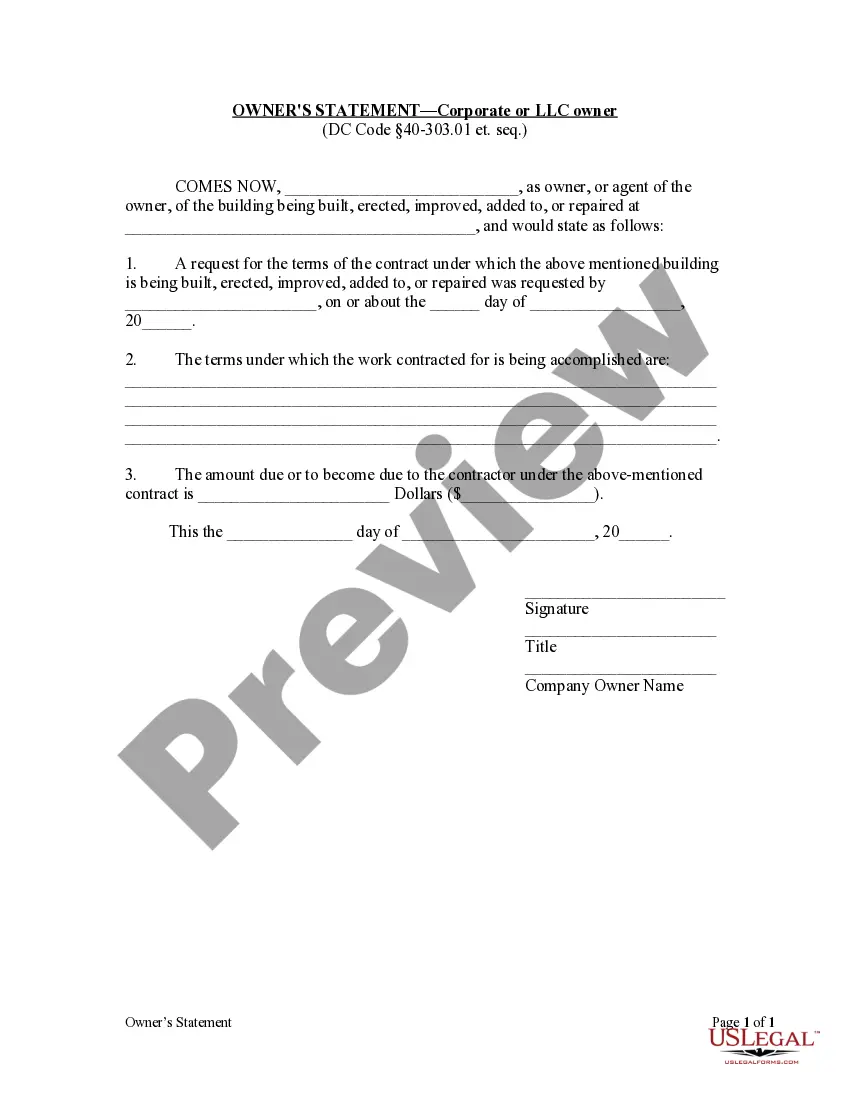

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

- Log in to your US Legal Forms account if you are a returning user and ensure your subscription is active. Click the Download button to obtain the template.

- If you’re new to our service, start by exploring the Preview mode and form description to confirm you’ve selected the right document for your needs.

- If necessary, refine your search using the Search tab to find another suitable template that meets your local jurisdiction's requirements.

- Once you have identified the correct document, click the Buy Now button and select your preferred subscription plan to proceed.

- Complete your purchase by entering your payment information, either through credit card or PayPal, to finalize the subscription.

- Finally, download the template to your device, ensuring immediate access to your form in the My Forms section of your profile for future reference.

In conclusion, utilizing US Legal Forms can significantly streamline the process of obtaining legal documents, saving you both time and effort. With access to over 85,000 fillable and editable forms, you can ensure your documents are accurate and compliant.

Ready to get started? Visit US Legal Forms today and secure your special trust trustor document!

Form popularity

FAQ

A trustor, or grantor, is an individual who creates a trust and transfers assets into it. For example, a parent may set up a trust for their child, detailing how the assets should be managed and distributed. To see practical examples and templates, check out the Special trust trustor download with example on our platform.

The main purpose of a trust is to manage and protect assets for the benefit of others. Trusts help avoid probate, minimize estate taxes, and ensure that assets are distributed according to the trustor's wishes. For more clarity on how trusts work, you can explore our Special trust trustor download with example on our website.

The 5-year rule refers to a tax regulation that impacts the distribution of assets from certain types of trusts, particularly when dealing with Medicaid eligibility. This rule states that if a trustor transfers assets into a trust within five years of applying for Medicaid, those assets may be subject to penalties. Understanding this rule is crucial, and our platform provides a Special trust trustor download with example to assist you.

A trust consists of four essential elements: the trustor, the trustee, the beneficiaries, and the trust res (assets). The trustor creates the trust, the trustee manages it, the beneficiaries receive the benefits, and the trust res includes the property and assets involved. For easy documentation, consider our Special trust trustor download with example available on our platform.

The three main types of trust are revocable trusts, irrevocable trusts, and charitable trusts. A revocable trust can be modified or revoked by the trustor, while an irrevocable trust cannot be changed once established. Charitable trusts are set up to benefit a specific charity or purpose. Our platform offers a Special trust trustor download with example to help clarify these concepts.

A trust PDF is a digital document that outlines the terms of a trust agreement. It provides all necessary information regarding the trustor, beneficiaries, assets, and distribution of those assets. You can easily access such documents through our platform, which includes a Special trust trustor download with example to guide you.

Certain assets typically do not go into a trust, such as retirement accounts and certain types of insurance policies. Additionally, jointly owned property may not be included, as it generally passes directly to the co-owner. Understanding what assets do not belong in a trust can be clarified through a Special trust trustor download with example, helping you make the best choices for your estate planning.

Deciding whether to place your bank accounts in a trust depends on your financial goals and specific needs. Transferring ownership can provide benefits, such as avoiding probate, but it may also limit your access. To guide your decision, consider a Special trust trustor download with example, which can clarify the advantages and drawbacks of this choice.

Filling out a trust fund typically involves detailing your assets, beneficiaries, and the terms of distribution. Each section requires careful consideration of your wishes and the needs of your beneficiaries. A Special trust trustor download with example can provide a clear framework, guiding you through the essential steps to complete your trust effectively.

Filing taxes for a special needs trust can be complex. Generally, the trust must obtain its own tax identification number and file Form 1041 annually. Using a Special trust trustor download with example can help you navigate the nuances of this process, ensuring you understand the specific requirements and tax implications.