Qualified Domestic Trust Sample Format

Description

How to fill out Qualified Domestic Trust Agreement?

Dealing with legal documents and processes can be a lengthy addition to your routine.

Qualified Domestic Trust Sample Format and similar forms typically necessitate you to search for them and comprehend how to fill them out proficiently.

Thus, regardless of whether you are managing financial, legal, or personal issues, maintaining a thorough and user-friendly online directory of forms readily available will be immensely beneficial.

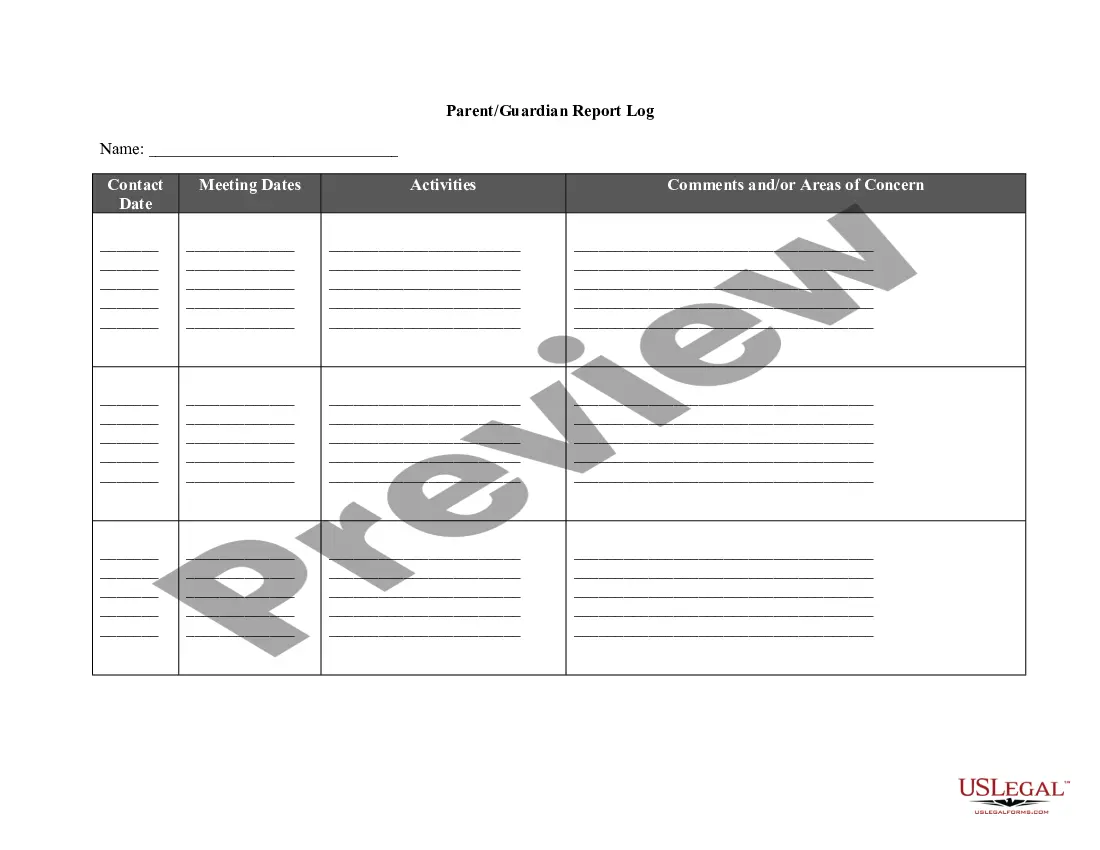

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific forms and a variety of tools to help you complete your documents effortlessly.

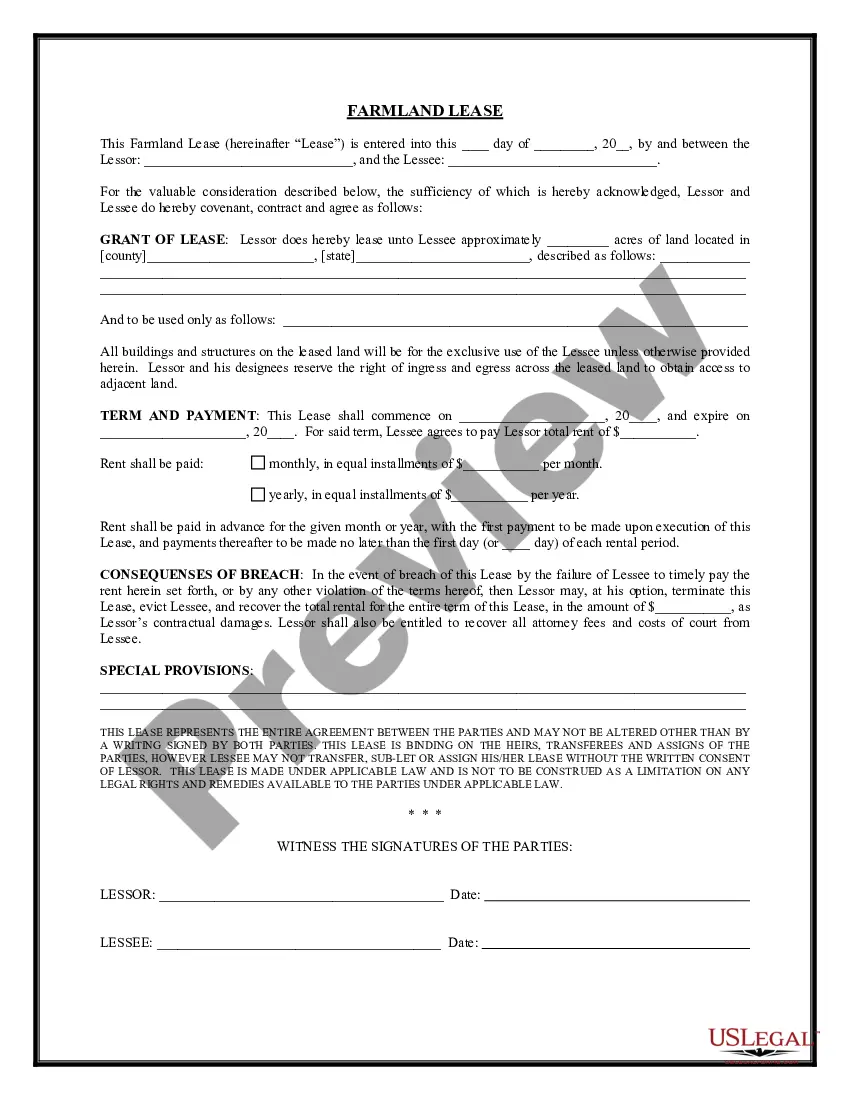

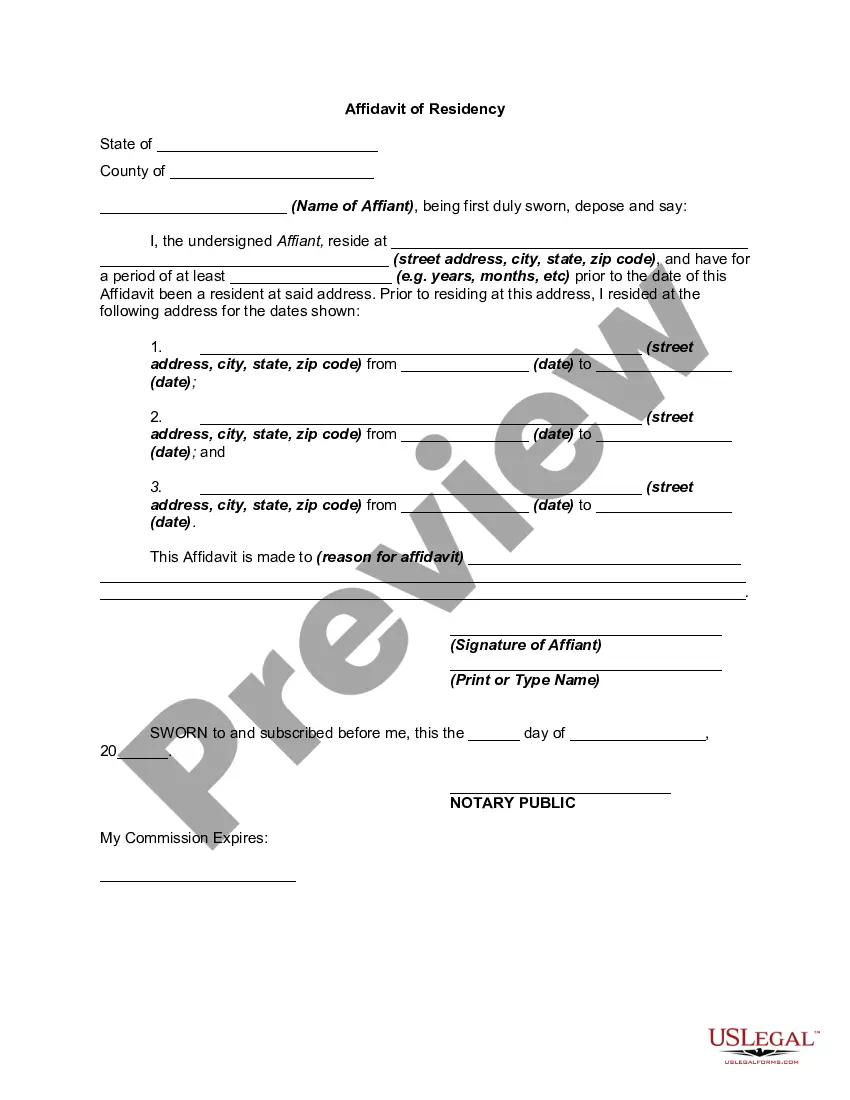

Is this your first time using US Legal Forms? Register and create an account in a few minutes, and you’ll gain access to the forms directory and Qualified Domestic Trust Sample Format. Then, follow the steps below to complete your form: Ensure you have located the correct form using the Preview feature and reviewing the form description. Select Buy Now when ready, and choose the monthly subscription plan that fits your requirements. Click Download, then fill out, sign, and print the form. US Legal Forms has twenty-five years of experience assisting clients with their legal documents. Obtain the form you need today and enhance any process without unnecessary effort.

- Explore the collection of relevant documents accessible to you with just a single click.

- US Legal Forms offers you state- and county-specific forms available anytime for downloading.

- Protect your document management processes by utilizing a premium service that allows you to create any form in minutes without additional or concealed charges.

- Simply Log In to your account, locate Qualified Domestic Trust Sample Format, and download it instantly within the My documents section.

- You can also access previously downloaded documents.

Form popularity

FAQ

A qualified domestic trust (QDOT) allows surviving spouses who are not U.S. citizens to take the full marital deduction on estate taxes. If you are married to someone who is a citizen of another country, it may make sense to establish and fund a QDOT.

A QTIP (qualified terminable interest property) is a special kind of trust that allows married people to control distribution of assets to their spouses while still taking advantage of the marital deduction. A QDOT allows the same, but is usually used by couples that have one U.S. citizen and one non-citizen spouse.

To legally be a QDOT, a trust must be a US trust that meets the following requirements: It must be structured as a power of appointment trust, a qualified terminable interest property trust (QTIP trust), a qualified charitable remainder trust (qualified CRT), or an estate trust.

A qualified domestic trust (QDOT) is a special kind of trust that allows taxpayers who survive a deceased spouse to take the marital deduction on estate taxes, even if the surviving spouse is not a U.S. citizen.

What Is an Example of a QDOT Trust? For example, if the tax bill on your estate amounts to $15 million upon your death, a QDOT prevents that $15 million from immediately going to the government when your estate tax return is filed.