Personal Representative Form Without Bond Mean

Description

How to fill out Personal Representative Form Without Bond Mean?

No matter if you routinely handle documents or if you occasionally need to transmit a legal document, it is essential to possess a reliable resource where all the samples are interconnected and current.

The initial action you must take with a Personal Representative Form Without Bond Mean is to verify that it is indeed the most recent version, as this determines its eligibility for submission.

If you wish to streamline your quest for the latest document examples, look for them on US Legal Forms.

Utilize the search menu to locate the form you desire. Inspect the Personal Representative Form Without Bond Mean preview and outline to confirm it is exactly what you need. After double-checking the form, simply click Buy Now. Choose a subscription plan that suits you. Register for an account or Log In to your existing one. Use your debit or credit card details or PayPal account to complete the transaction. Select the document format for download and confirm it. Eliminate the confusion associated with legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal forms encompassing nearly every document example you could want.

- Search for the templates you require, immediately check their relevance, and discover more about their application.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Find the Personal Representative Form Without Bond Mean samples in just a few clicks and save them in your profile at any time.

- A US Legal Forms profile will provide you with easy access to all the samples you need with added convenience and reduced hassle.

- You only need to click Log In in the site header and navigate to the My documents section where all the forms you need await, eliminating the need to spend time searching for the best template or verifying its authenticity.

- To obtain a form without an account, adhere to these steps.

Form popularity

FAQ

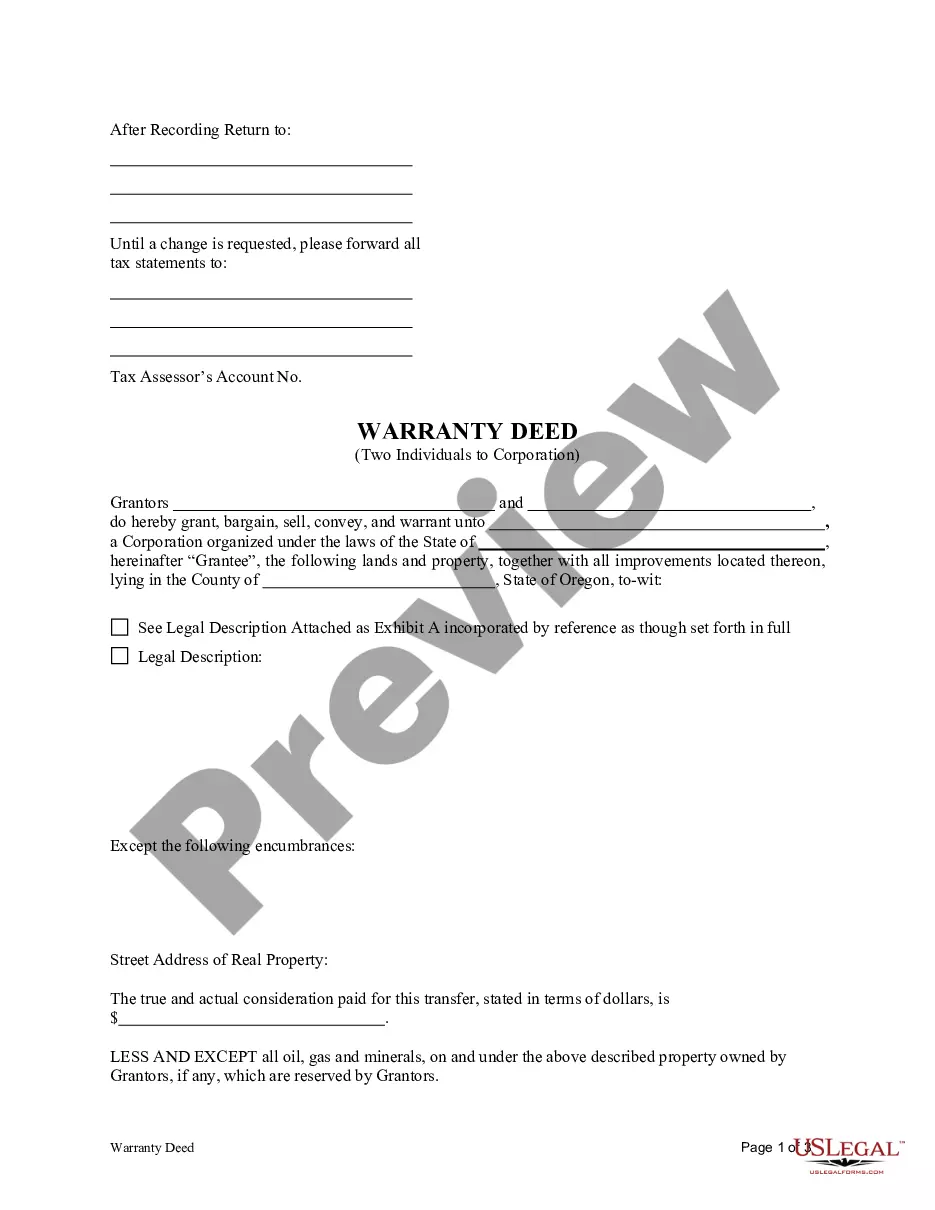

A personal representative form is a legal document that appoints an individual to manage the estate of a deceased person. This form is crucial because it delineates the powers and responsibilities of the personal representative. When discussing the personal representative form without bond mean, it indicates that the appointed individual does not need to secure a bond, which can simplify the process. Understanding this form helps ensure that estate matters are handled efficiently and in accordance with the law.

Proving an executor of an estate without a will can be challenging but is possible. In such cases, you can request the court to appoint an administrator to manage the estate. Documentation like a personal representative form without bond mean can serve as a basis for requesting court approval, ensuring the estate is administered correctly.

Serving with bond means an executor is required to obtain a financial guarantee as part of their duties; conversely, serving without bond means they can manage the estate without this requirement. The choice of bond typically reflects the testator’s wishes and the court’s confidence in the executor. Understanding these terms is crucial for smooth estate administration.

An executor may need to be bonded depending on the specifics of the will and the court's requirements. If the will specifies a bond or if beneficiaries request one, the executor must secure it. However, many wills include a provision allowing the executor to serve without a bond, which minimizes extra steps and costs.

When a will states 'without bond,' it conveys that the chosen executor or personal representative can administer the estate without needing to post a financial bond. This phrase indicates the testator's trust in the representative's integrity and their commitment to fulfilling the estate's obligations. It simplifies the process and reduces any associated costs.

When a personal representative serves without a bond, it means they are allowed to manage the estate without providing additional financial security. This designation often results from the court’s confidence in their abilities. It helps streamline the administration process, making it easier for the representative to perform their duties effectively.

Without bond in a will indicates that the designated personal representative will not need to secure a financial guarantee to carry out their duties. This occurs when the testator trusts the chosen representative and believes they will handle the estate responsibly. It allows for a smoother process, as it eliminates the need for additional financial arrangements.

In a will, a bond is a form of insurance designed to protect the estate's assets and the beneficiaries. It requires the executor or personal representative to obtain a financial guarantee from an insurance company. This bond ensures that they will administer the estate properly and be held accountable for any potential mismanagement.

Being held without a bond means that the court has determined a personal representative can manage an estate without needing to secure a financial guarantee. This situation typically arises when the court trusts the personal representative's capabilities. Essentially, it signifies that they can fulfill their duties without additional financial backing.

'With or without bond' refers to the choice of whether a personal representative must post a bond to protect the estate's assets. In some situations, a court may require a bond to ensure equitable management of the estate. However, options like a personal representative form without bond mean suggest an easier pathway in numerous cases. Understanding this distinction helps you make informed decisions about estate management.