Nonprofit Purpose Withdrawal

Description

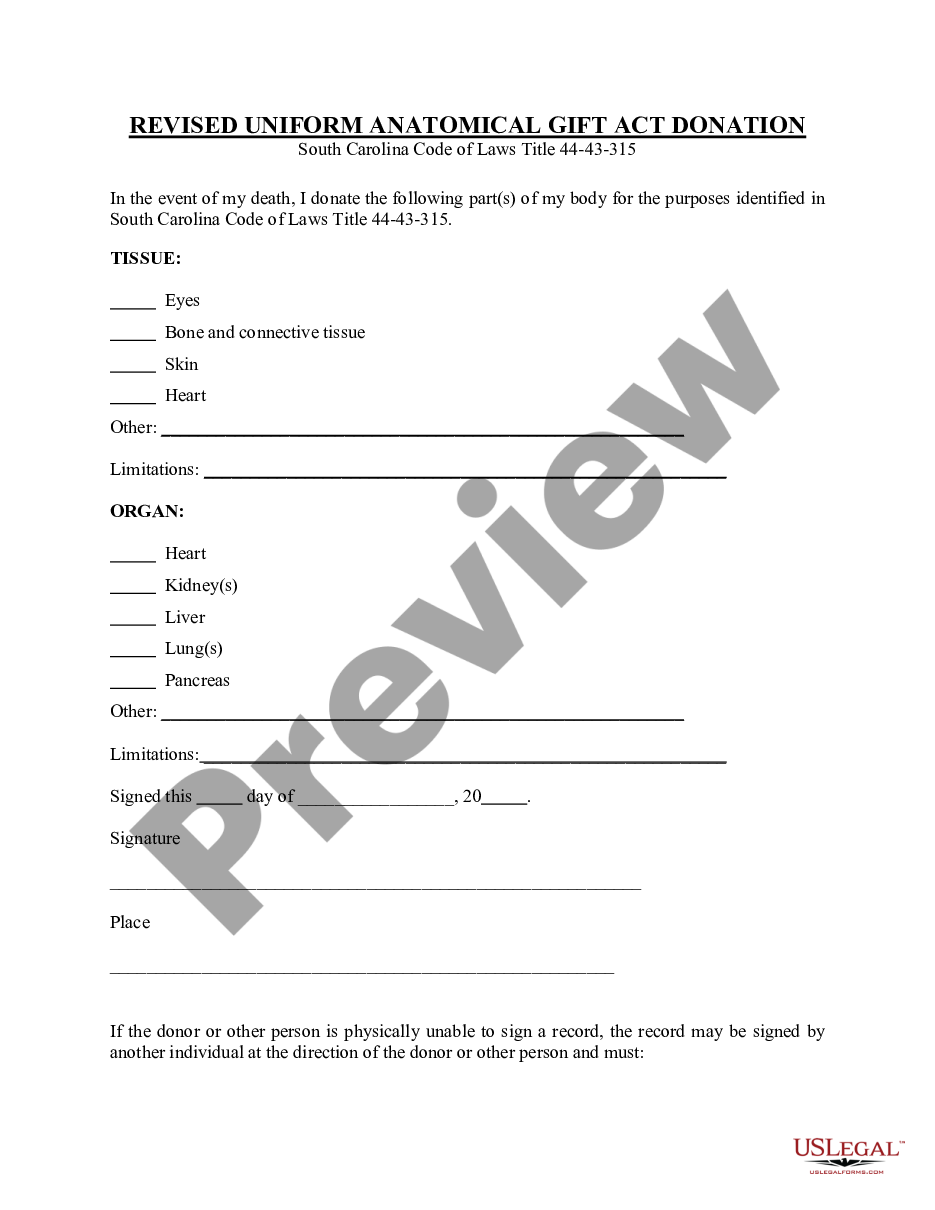

How to fill out Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement Of Purpose?

Dealing with legal documents and operations can be a lengthy addition to your entire day.

Nonprofit Purpose Withdrawal and similar forms often require you to search for them and comprehend how to complete them accurately.

Therefore, whether you are managing financial, legal, or personal issues, having a comprehensive and straightforward online library of forms accessible when you need it will be extremely beneficial.

US Legal Forms is the premier online platform for legal templates, providing over 85,000 state-specific forms and a variety of resources to help you complete your documentation easily.

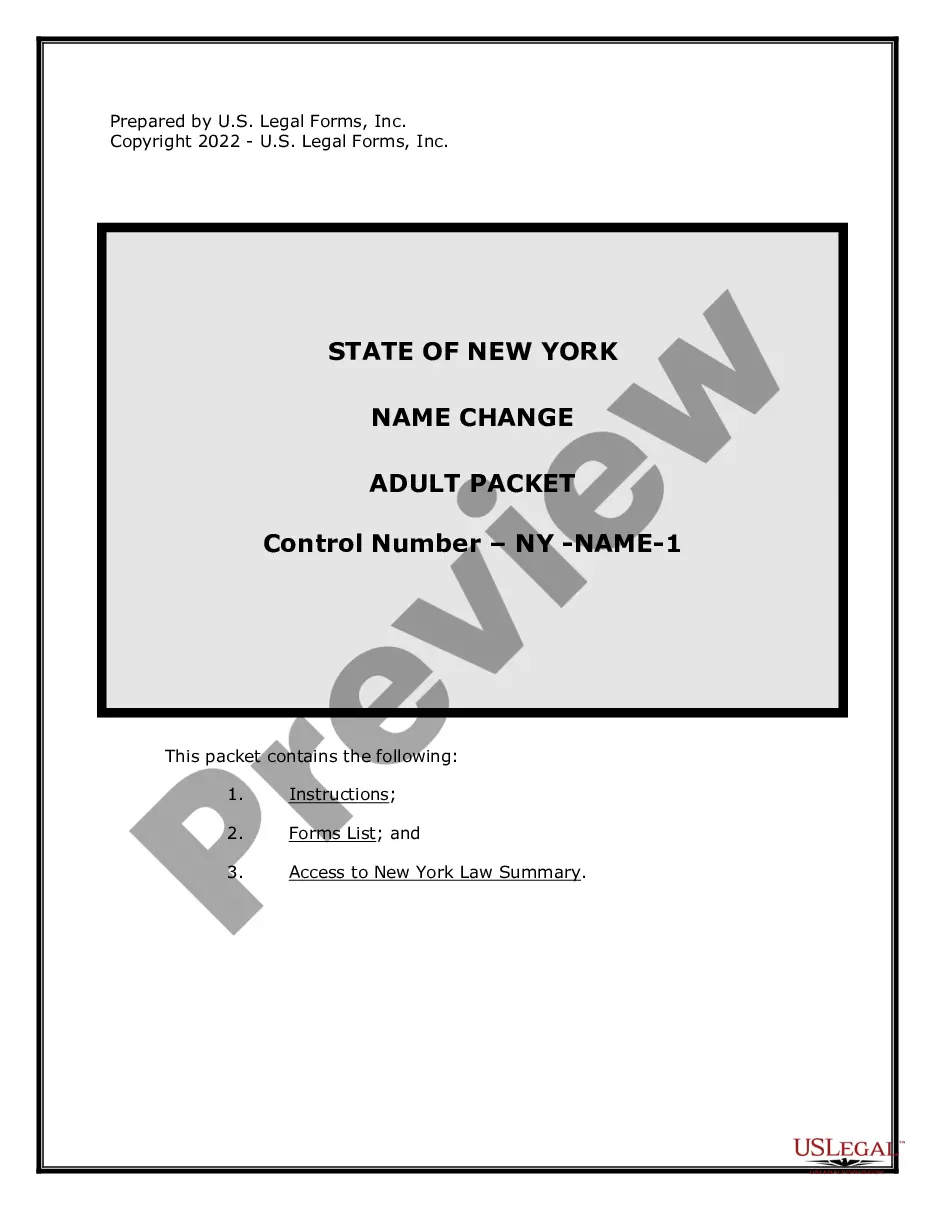

Is this your first time using US Legal Forms? Register and establish an account in just a few minutes, and you will gain entry to the form library and Nonprofit Purpose Withdrawal. Then, follow the outlined steps below to complete your form: Ensure you have located the correct form using the Preview option and reviewing the form description. Choose Buy Now when prepared, and select the monthly subscription plan that suits you best. Click Download, then fill out, eSign, and print the form. US Legal Forms has 25 years of experience assisting individuals with their legal documentation. Acquire the form you require today and simplify any process effortlessly.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms supplies you with state- and county-specific forms available at any time for download.

- Safeguard your document management processes with high-quality support that enables you to create any form within minutes without extra or concealed fees.

- Simply Log In to your account, find Nonprofit Purpose Withdrawal, and download it immediately from the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

The purpose statement should generally be fifty words or less, allowing it to be specific, memorable, and easy to share with others. It should be broad enough to allow for growth and program expansion, yet narrow enough to demonstrate tax-exempt qualification and to shape organizational decision-making.

Any charitable organization organized, operating, or raising funds in Massachusetts must register with the Non-Profit Organizations/Public Charities Division by filing the appropriate registration documents based on whether the organization is based in Massachusetts or out of state, and/or has passed its first fiscal ...

Dissolving a New York State not-for-profit corporation requires a plan approved by the New York State Attorney General. Before you take any steps towards dissolving a New York State not-for-profit, contact the Attorney General's office to develop a dissolution plan: (212) 416-8401. charities.bureau@ag.ny.gov.

Dissolving Charitable Corporations With Remaining Assets Step One: Confirm and/or achieve compliance with all registration and filing requirements. ... Step Two: Take and confirm the required board action. ... Step Three: Complete a Form PC-F. ... Step Four: Complete the Dissolution Worksheet.

4 Ways to Further Your Nonprofit Career with Continued Learning Take Nonprofit Courses. Individual courses are a great way to make sure you have the tools and skills necessary to accomplish specific aspects of your nonprofit's strategy. ... Get a Nonprofit Certification. ... Read More Books. ... Subscribe to Informational Journals.