Trust Form Transfer Document With Trust

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

Whether for commercial reasons or personal affairs, everyone must confront legal circumstances at some stage in their life.

Completing legal documents requires meticulous focus, starting from selecting the appropriate form template.

Select the file format you prefer and download the Trust Form Transfer Document With Trust. Once it's saved, you can fill out the form using editing software or print it and complete it manually. With an extensive US Legal Forms library available, you no longer need to waste time searching for the suitable template online. Utilize the library’s straightforward navigation to find the right form for any occasion.

- For example, if you choose an incorrect version of a Trust Form Transfer Document With Trust, it will be rejected upon submission.

- Therefore, it is vital to have a reliable source of legal documents such as US Legal Forms.

- If you need to acquire a Trust Form Transfer Document With Trust template, follow these straightforward steps.

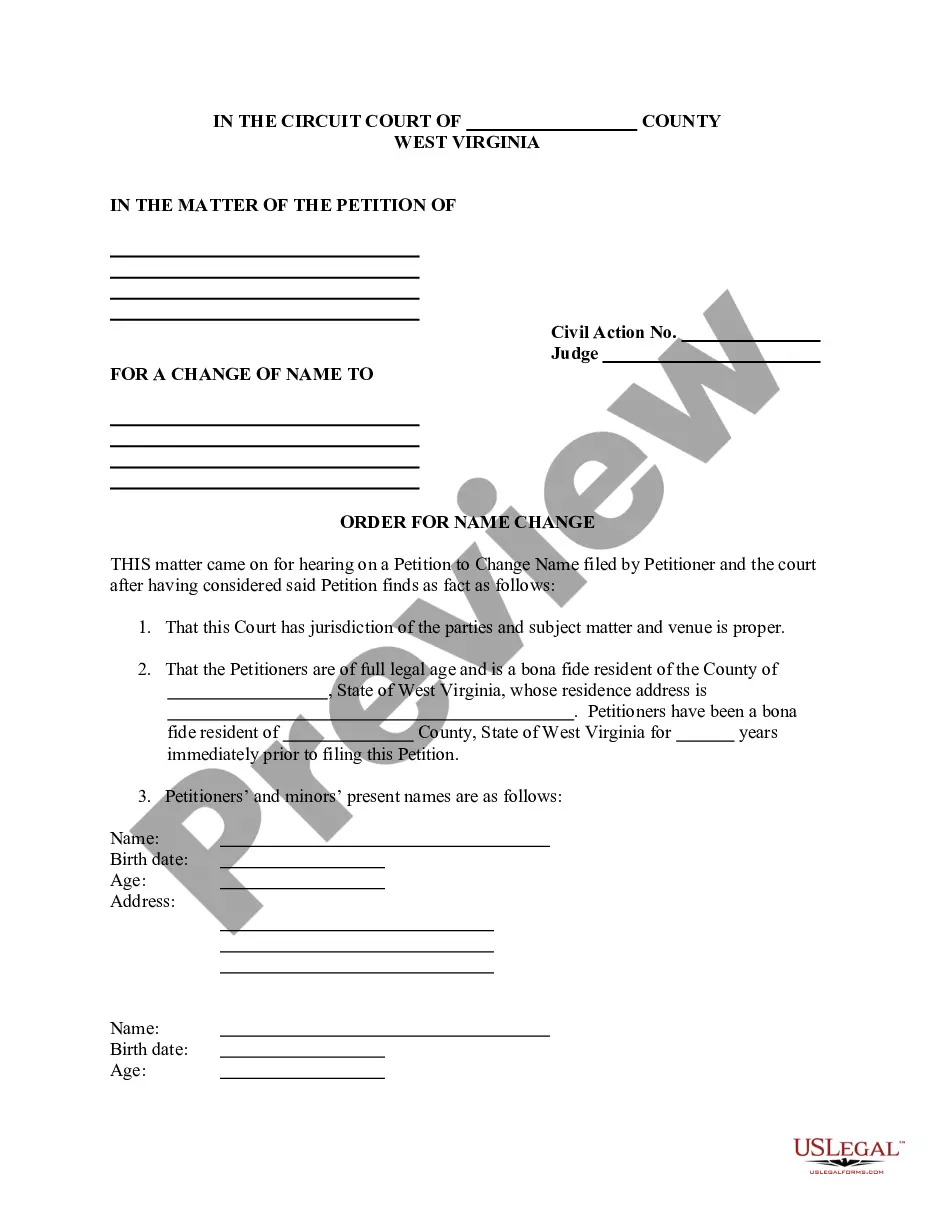

- Obtain the template you require using the search bar or catalog browsing.

- Review the form’s description to confirm it aligns with your needs, state, and area.

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search feature to find the Trust Form Transfer Document With Trust template you need.

- Obtain the template if it satisfies your criteria.

- If you possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- In case you do not have an account yet, you can purchase the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

Form popularity

FAQ

To get a copy of your declaration of trust, first, check with the trustee or the law firm that created the trust for you. If you do not have direct access to it, the US Legal Forms platform offers tools to help you create or retrieve necessary trust documents, including a trust form transfer document with trust. This can simplify the process and ensure you have the correct paperwork when you need it.

To obtain a certificate of trust, you need to contact the trustee or the entity that holds the trust. Usually, this document can be found within the trust documents that were created during the establishment of the trust. If you cannot locate it, consider using a reliable service like US Legal Forms, which can assist you in generating a trust form transfer document with trust. This way, you can ensure that your documentation is accurate and meets legal requirements.

The 2 year rule for trusts refers to a specific timeframe within which certain actions regarding the trust must be completed. Typically, this rule is associated with asset transfers and tax regulations affecting trusts. Understanding this rule is crucial, and utilizing a trust form transfer document with trust helps you navigate these regulations efficiently.

To transfer property from one trust to another, you typically need to draft a trust transfer deed specifying the property being moved. You must also adhere to the terms governing both trusts to ensure compliance with legal requirements. Using a trust form transfer document with trust can guide you through this process, making it straightforward and secure.

Yes, you can transfer assets from one trust to another under certain conditions. It's essential to follow the legal requirements for such transfers, ensuring they comply with the terms of both trusts. Using a trust form transfer document with trust simplifies this process, making it easier to manage your assets efficiently.

A trust transfer deed is a legal document that facilitates the transfer of property into a trust. This document allows the trustee to manage and distribute the assets in accordance with the trust's terms. Utilizing a trust form transfer document with trust ensures a smooth transition of ownership while avoiding probate complications.

How do I transfer the shares I own to my trust? You will need to inform the company issuing the shares that you will be holding them through a trust and also provide your trust's details. This is necessary to ensure the company's internal records reflect this change.

When you transfer assets to a trust you are changing the legal ownership of your assets. Your assets are no longer owned by you, they are now owned by the trust. Also known as funding a trust, when you transfer assets to a trust you are giving the trustee control of those assets.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

It is generally better to retitle your investment accounts to your trust during your lifetime rather than rely on a TOD to transfer your accounts at death. That way, if you become incapacitated during your lifetime, your successor trustee can step in and handle your trust accounts.