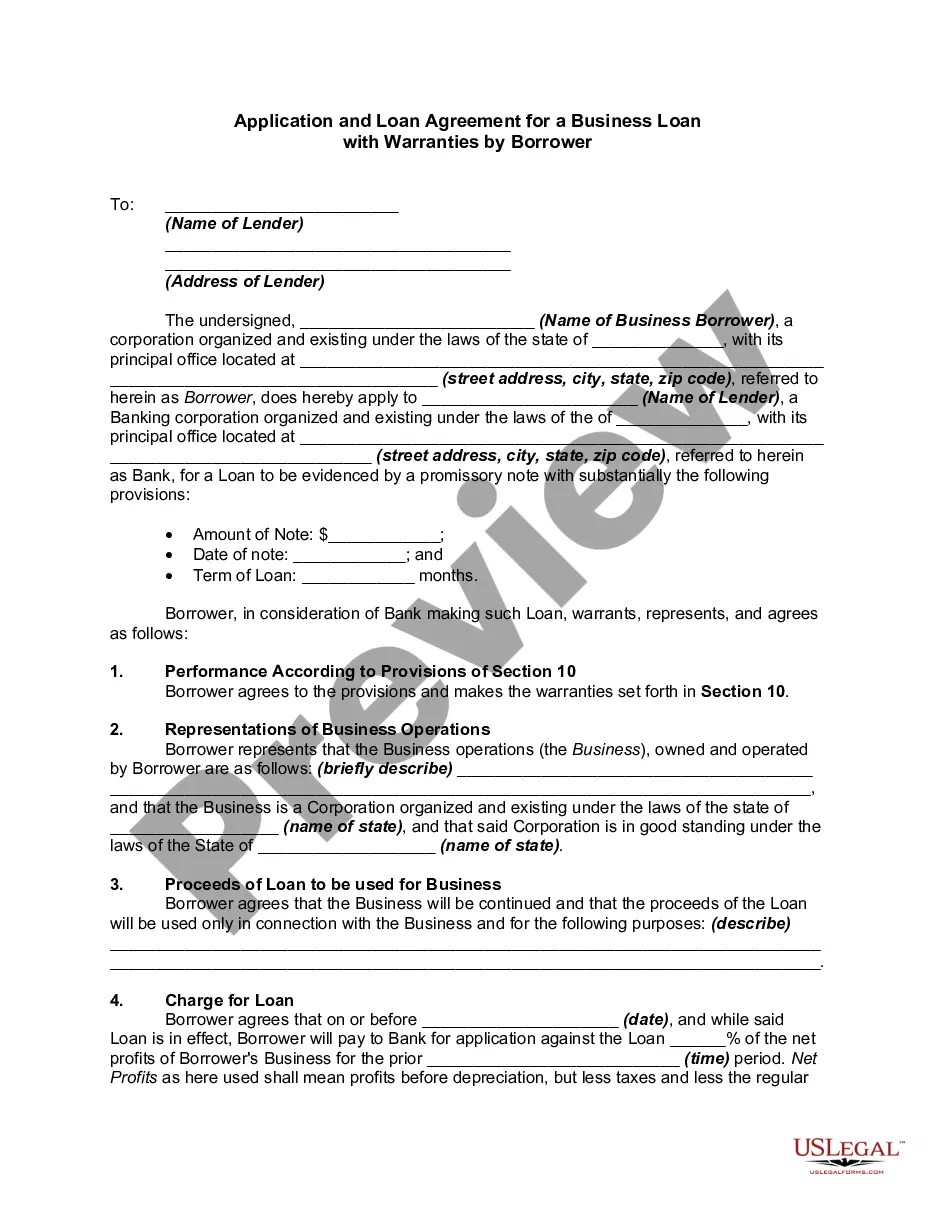

Transfer ownership of an LLC in Colorado refers to the process of transferring the ownership rights and responsibilities of a limited liability company (LLC) from one party to another. This can occur due to various reasons, such as the retirement of a member, the sale of ownership interest, or the addition of new members. The transfer process typically involves several steps and legal formalities to ensure a smooth transition. The following are some key aspects of transferring LLC ownership in Colorado: 1. Operating Agreement: The LLC's operating agreement outlines the procedures and guidelines for ownership transfer. It is essential to review this agreement thoroughly to understand the specific requirements for transferring ownership interests. 2. Approval of existing members: Before transferring ownership, the existing members of the LLC usually need to approve the proposed transfer. This approval may be obtained through a formal vote or as specified in the operating agreement. 3. Valuation of the LLC: In cases where ownership interest is being sold, a valuation of the LLC may be necessary to determine the fair market value of the transferred interest. Professional appraisers can perform this valuation based on factors such as the company's financial performance, assets, liabilities, and market conditions. 4. Drafting a Purchase Agreement: A purchase agreement or a transfer agreement is usually prepared to document the terms and conditions of the ownership transfer. This agreement outlines the purchase price, payment terms, and any conditions or warranties pertaining to the transfer. 5. Amendment of Articles of Organization: The LLC's Articles of Organization may need to be amended to reflect the changes in ownership. This typically involves filing the necessary forms with the Colorado Secretary of State, along with any required fees. Types of Transfer Ownership of LLC in Colorado: 1. Sale of Ownership Interest: This type of transfer occurs when an existing member sells their ownership stake to another party. The purchase agreement outlines the terms and conditions of the sale, including the purchase price, payment schedule, and any restrictions or rights associated with the ownership interest. 2. Addition of New Members: LCS can also transfer ownership by adding new members to the existing ownership structure. This is often done by amending the operating agreement to accommodate the new member, specifying their rights and responsibilities, and adjusting the profit-sharing or decision-making arrangements. 3. Change in Ownership Due to Death or Bankruptcy: In cases where an LLC member passes away or becomes bankrupt, their membership interests may be transferred to other members or beneficiaries as per the operating agreement or applicable laws. This transfer usually involves legal procedures and documentation. It's important to note that while this description outlines the general process and types of transfer for LLC ownership in Colorado, consulting an attorney or legal professional familiar with Colorado's specific laws and regulations is advisable to ensure compliance and a smooth transfer of ownership.

Transfer Ownership Of Llc In Colorado

Description

How to fill out Transfer Ownership Of Llc In Colorado?

It's clear that you can't instantly become a legal authority, nor can you easily learn how to swiftly draft a Transfer Ownership Of Llc In Colorado without possessing a specialized skill set.

Crafting legal documents is a lengthy undertaking that demands specific education and expertise. So why not entrust the creation of the Transfer Ownership Of Llc In Colorado to the experts.

With US Legal Forms, one of the most extensive libraries of legal templates, you can access anything from court documents to templates for internal correspondence. We recognize how vital compliance and adherence to federal and state laws and regulations are. That's why, on our platform, all forms are location-specific and current.

Click Buy now. Once the transaction is finalized, you can acquire the Transfer Ownership Of Llc In Colorado, complete it, print it, and deliver it or send it via mail to the necessary individuals or entities.

You can regain access to your forms from the My documents tab at any time. If you are an existing client, simply Log In and find and download the template from the same tab.

- Begin by visiting our website to obtain the document you need in just a few minutes.

- Find the form you're looking for using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to ascertain whether the Transfer Ownership Of Llc In Colorado is what you seek.

- If you require a different form, start your search again.

- Create a free account and choose a subscription plan to purchase the form.

Form popularity

FAQ

You can change the name of your LLC and retain the same EIN, as the EIN is associated with the business entity rather than its name. However, you must ensure that you report the name change to the IRS to maintain compliance. If you're considering transferring ownership of an LLC in Colorado and also changing its name, keeping your EIN allows for smoother business operations without the need to obtain a new number.

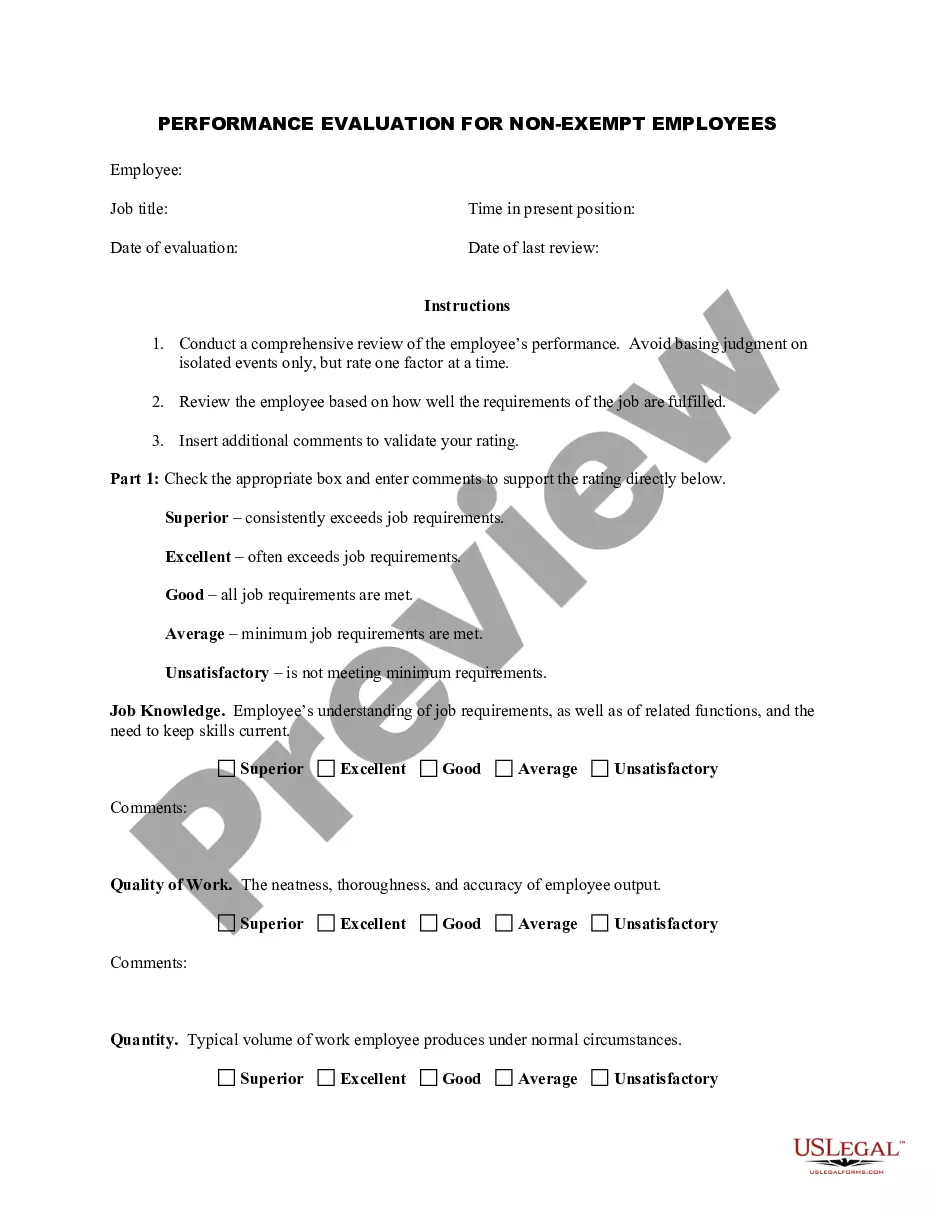

To change the ownership percentage of an LLC, you need to follow your operating agreement's guidelines, which usually require member consent. You may also need to draft and sign an amendment to the operating agreement that explicitly states the new ownership percentages. For those looking to transfer ownership of an LLC in Colorado, platforms like US Legal Forms offer easy-to-use templates to help facilitate these changes.

Documenting ownership of an LLC typically involves maintaining an operating agreement, which details each member's ownership percentage and roles. It is also wise to keep records of any member contributions and transfers of ownership. When you transfer ownership of an LLC in Colorado, you should update the operating agreement to reflect any changes in ownership to ensure clarity and legal standing.

Renaming your LLC can be straightforward, but the steps vary based on your specific situation. First, you must check for name availability in Colorado to ensure your new name is unique. After that, you need to file a name change amendment with the state. Many business owners find the process easier with the help of online services like US Legal Forms, especially when seeking to transfer ownership of an LLC in Colorado.

To transfer property from an LLC to an individual, the LLC must draft a formal bill of sale or property transfer document. Both the LLC and the individual must agree on the terms of the transfer. It’s essential to properly document this transaction to ensure clarity and legal standing. For a seamless experience, consider using platforms like US Legal Forms to access templates and guidance.

When you transfer ownership of an LLC in Colorado, tax implications may arise, including capital gains taxes on the appreciation of interest. Additionally, transferring membership can affect how income is reported on personal tax returns. It’s advisable to consult a tax professional to understand the full impact of the transfer on both you and the LLC. Resources on US Legal Forms can help you explore tax considerations during ownership changes.

The process to transfer ownership of an LLC in Colorado involves drafting an amendment to the operating agreement and possibly preparing an assignment of membership interest. Make sure that all current members consent to the change to prevent future conflicts. Following this, you may need to file appropriate forms with the state, which can be conveniently processed through US Legal Forms, ensuring everything is in order.

To remove a partner from an LLC in Colorado, you should consult your operating agreement, as it often outlines the process for such actions. Generally, a vote from the remaining members is required to agree on the removal. Document this decision formally and ensure any existing ownership interest is addressed properly. For assistance with the legal documentation, US Legal Forms can provide tailored solutions.

To transfer ownership of an LLC in Colorado, the members must determine the new owner and document the transfer in an operating agreement or by using a bill of sale. Ensure that all members approve this transfer to avoid disputes. Afterward, you should file necessary forms with the Colorado Secretary of State's office to formally update the ownership records. Utilizing the resources on US Legal Forms can simplify this process significantly.