Transfer Interest In Llc With Death

Description

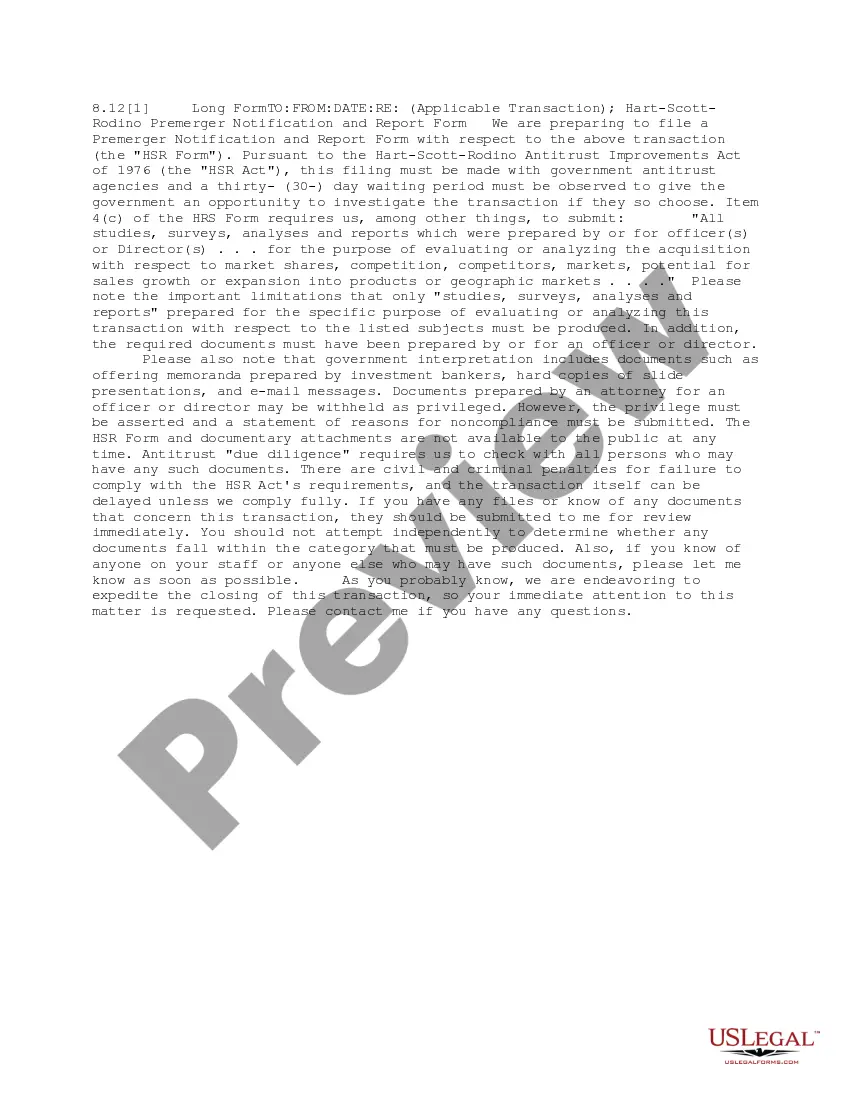

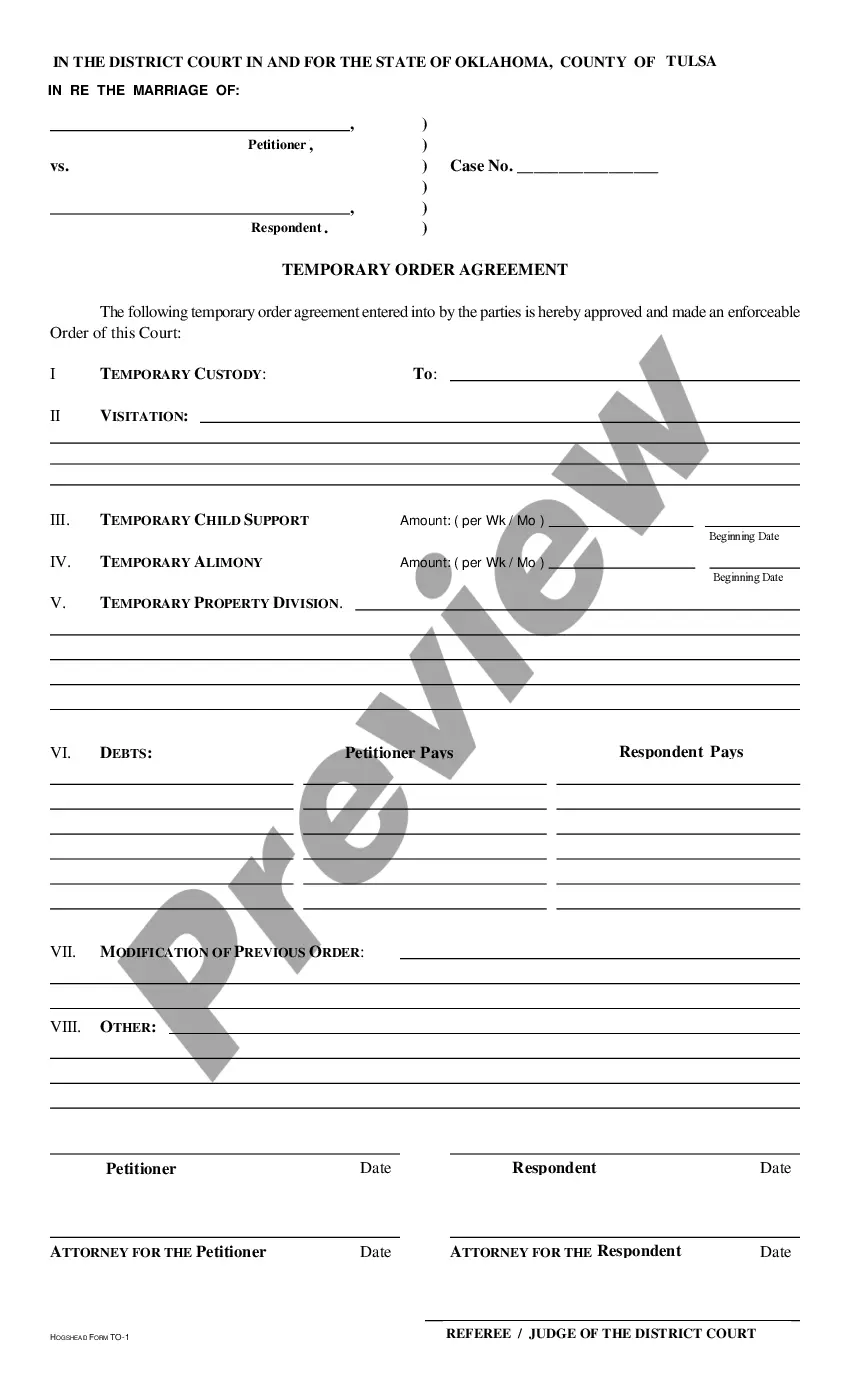

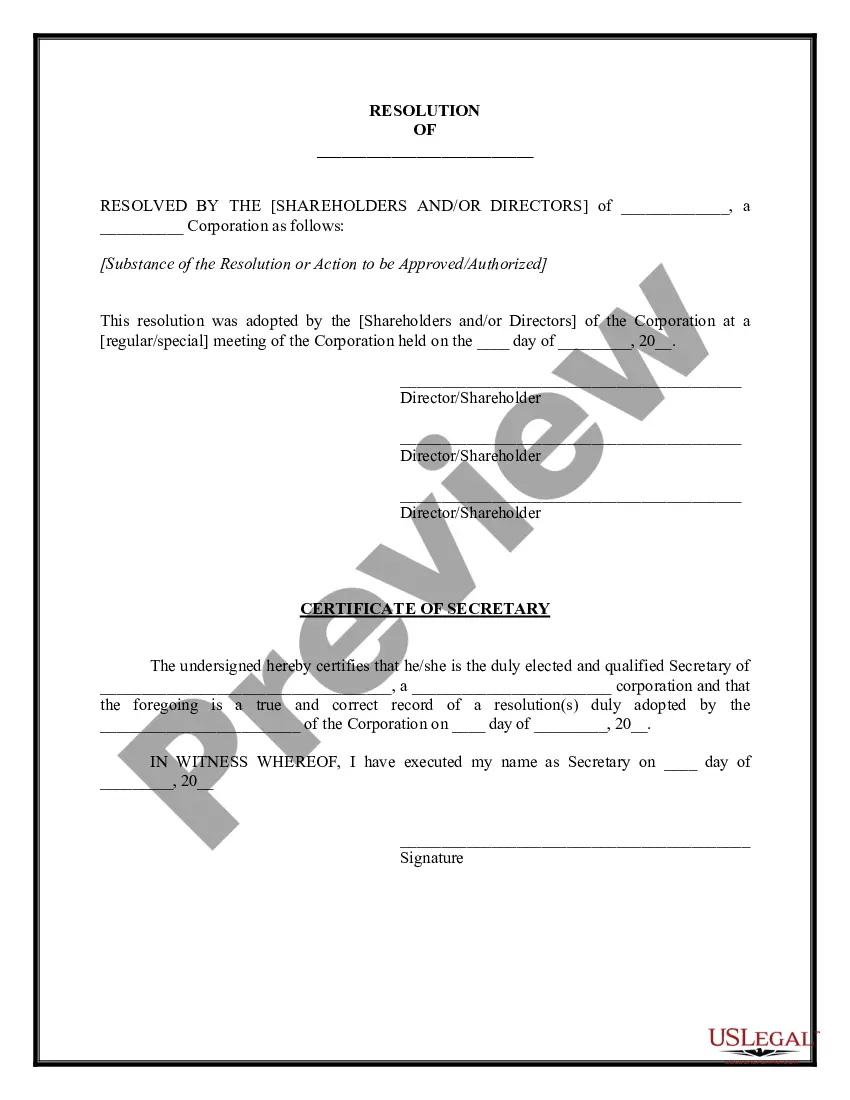

How to fill out Assignment Of LLC Company Interest To Living Trust?

It’s no secret that you can’t become a legal professional immediately, nor can you grasp how to quickly prepare Transfer Interest In Llc With Death without having a specialized background. Creating legal forms is a time-consuming venture requiring a specific education and skills. So why not leave the creation of the Transfer Interest In Llc With Death to the professionals?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court documents to templates for internal corporate communication. We understand how important compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our website and get the document you require in mere minutes:

- Find the document you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Transfer Interest In Llc With Death is what you’re looking for.

- Start your search again if you need any other template.

- Register for a free account and select a subscription option to buy the form.

- Pick Buy now. As soon as the payment is complete, you can get the Transfer Interest In Llc With Death, complete it, print it, and send or send it by post to the necessary individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your paperwork-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Most importantly, a TOD provision is a probate avoidance tool. An LLC's operating agreement specifies who will receive a member's ownership interest in the company upon their death without having to go through probate.

Generally speaking, the process for how to add an LLC member involves amending the LLC's operating agreement that brings in the new member. Current LLC members must then vote on the amendment for it to pass?and most states, as well as many LLC operating agreements, require unanimous approval.

Tax Issues Related to Transferring an LLC Membership Interest. A transfer of an LLC interest where compensation is being paid is treated as a sale or exchange. The selling member will usually have a taxable gain or loss on the sale.

When a taxpayer sells an LLC interest, the taxpayer will usually have a capital gain or loss on the sale of the interest. However, capital gain or loss treatment does not apply to the sale of every LLC interest.

However, in the absence of an operating agreement, many states will allow you to name a beneficiary for your LLC by creating a transfer-on-death document. This is a legal document that you can use to transfer your membership interest to a beneficiary if you pass away.