Assignment Of Business Interest To Trust Without Being Naive

Description

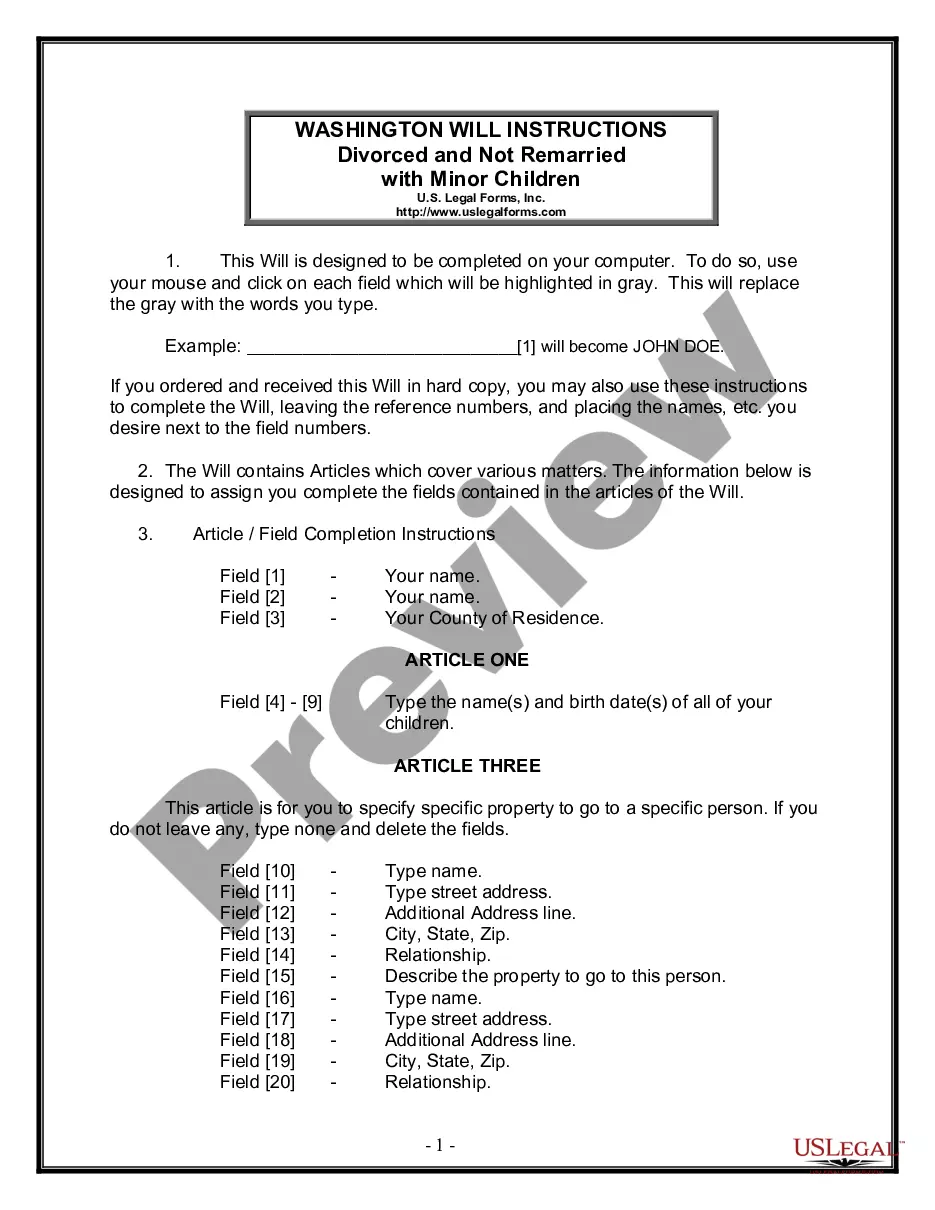

How to fill out Assignment Of LLC Company Interest To Living Trust?

It's well-known that you can't transform into a legal expert instantly, nor can you comprehend how to swiftly draft the Assignment Of Business Interest To Trust Without Being Naive without possessing a specialized background.

Drafting legal documents is a lengthy endeavor that necessitates specific education and abilities. So why not entrust the creation of the Assignment Of Business Interest To Trust Without Being Naive to the professionals.

With US Legal Forms, one of the most extensive legal template archives, you can discover everything from court documents to templates for in-office correspondence.

Click Buy now. Once the payment is processed, you can download the Assignment Of Business Interest To Trust Without Being Naive, fill it out, print it, and send or mail it to the appropriate parties or entities.

You can regain access to your documents from the My documents tab at any time. If you are an existing client, simply Log In, and locate and download the template from the same tab.

- Begin by visiting our website and obtain the document you require in just minutes.

- Utilize the search bar at the top of the page to find the document you need.

- Preview it (if this option is available) and review the supporting description to verify whether Assignment Of Business Interest To Trust Without Being Naive is what you seek.

- If you need any other template, start your search anew.

- Create a free account and select a subscription option to purchase the form.

Form popularity

FAQ

To transfer LLC interest to a trust, begin by drafting a formal assignment document that specifies the transfer details. Next, update the LLC's operating agreement and notify other members of the transfer. Utilizing resources from uslegalforms can guide you through this procedure, ensuring the Assignment of business interest to trust without being naive is executed properly and aligned with your financial goals.

An Assignment of LLC membership interest to a trust is the process of transferring your membership rights in the LLC to a trust. This action places the LLC’s membership interest under the control of the trustee, who then manages the assets according to your wishes. Engaging in this kind of transfer helps in protecting your assets and can minimize tax implications, embodying the concept of Assignment of business interest to trust without being naive.

To put your LLC under a trust, you must first establish the trust and then transfer the ownership of your LLC to that trust. This involves updating the registration documents to reflect the trust as the new owner. Using a service like uslegalforms can simplify this transition, ensuring that the Assignment of business interest to trust without being naive is done correctly, maximizing your asset protection and estate planning.

Yes, you can assign your interest in a trust. This process involves transferring your ownership rights, which allows the trustee to manage those interests on your behalf. By doing so, you can benefit from the trust's advantages, such as tax protection and estate planning. Effectively, this is part of the broader concept of Assignment of business interest to trust without being naive.

To assign LLC interest to a trust, you must first check your LLC operating agreement for any specific requirements. Next, prepare a formal assignment document that states your intention to transfer the business interest to the trust. This document should clearly outline the terms of the transfer and should be signed by all parties involved. It's crucial to complete this process correctly to ensure the assignment of business interest to trust without being naive, as improper execution can lead to legal complications.

While there are benefits, there are also disadvantages to consider when putting an LLC in a trust. One key concern is the potential for added complexity in managing the trust and LLC. Additionally, you may face tax implications or limitations on control over your business. Being mindful of these factors is important to securely navigate the assignment of business interest to trust without being naive.

Yes, transferring your LLC to a trust is possible and often done as part of estate planning. You'll need to follow specific legal procedures, which may include updating the operating agreement and notifying relevant parties. This transfer can ensure your business continues seamlessly under the trust's management. Remember, prioritize the assignment of business interest to trust without being naive to avoid complications down the line.

Establishing a trust for your business can be a smart move for many owners. It provides legal protection and can facilitate the transfer of ownership. By doing so, you can maintain operational continuity and set clear guidelines for your successors. However, always consider the overall implications, including the assignment of business interest to trust without being naive.

You might place your LLC in a trust to simplify asset management and enhance estate planning. This approach allows for smoother transitions of business assets to heirs while avoiding probate. Additionally, a trust can protect your business interests from potential creditors. Ensuring a wise assignment of business interest to trust without being naive can safeguard your family's future.

Putting an LLC into a trust can be beneficial, especially for estate planning. You ensure that your business interests are managed according to your wishes upon your passing. However, make sure to consider how this transfer impacts control and tax obligations. Properly managing the assignment of business interest to trust without being naive is key to a successful transition.