Assignment Llc Interest Trust With Interest

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

Handling legal documentation and processes can be a lengthy addition to your schedule.

Forms like Assignment Llc Interest Trust With Interest typically require you to locate them and comprehend the best method to fill them out accurately.

Consequently, whether you are managing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online repository of forms readily available will be beneficial.

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific documents and a variety of resources to assist you in completing your paperwork with ease.

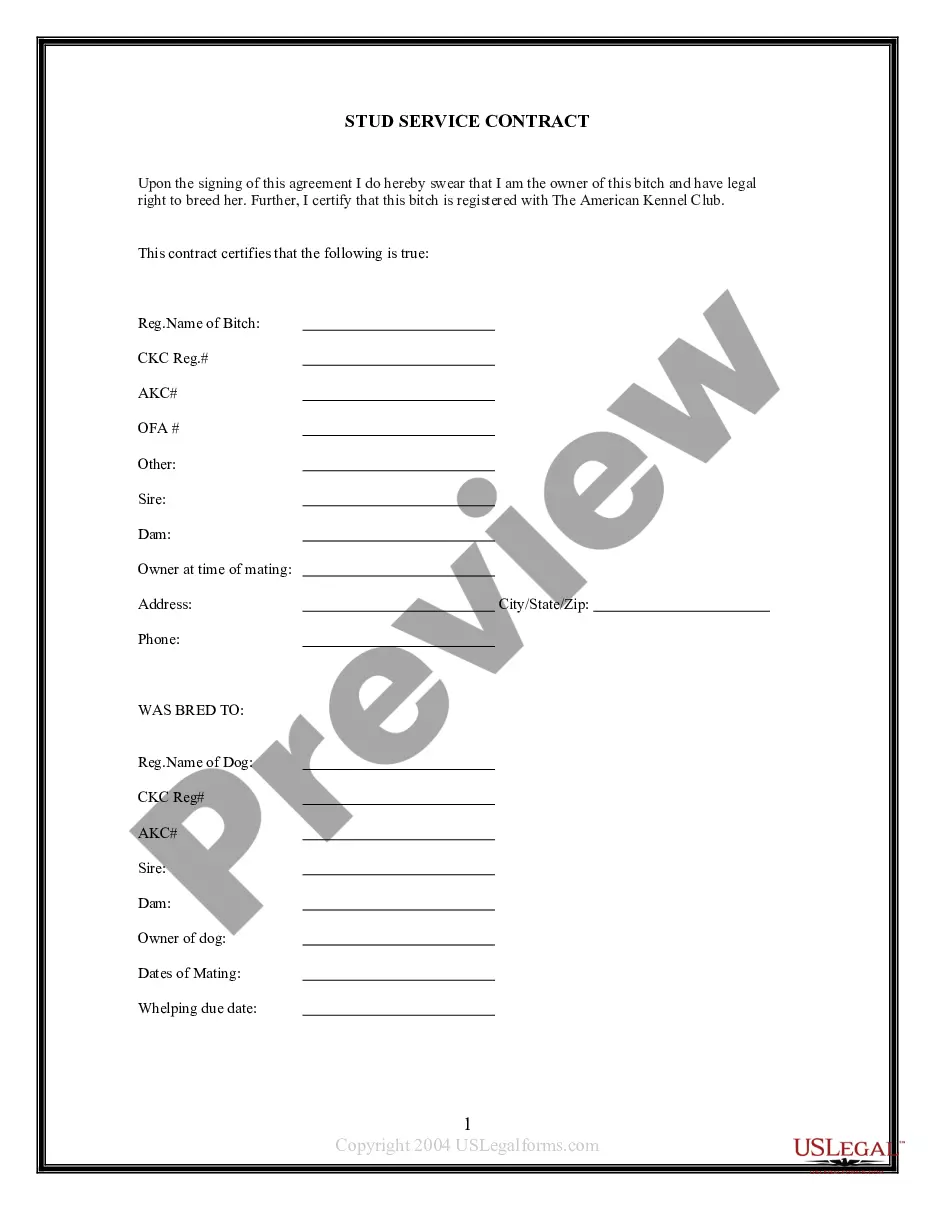

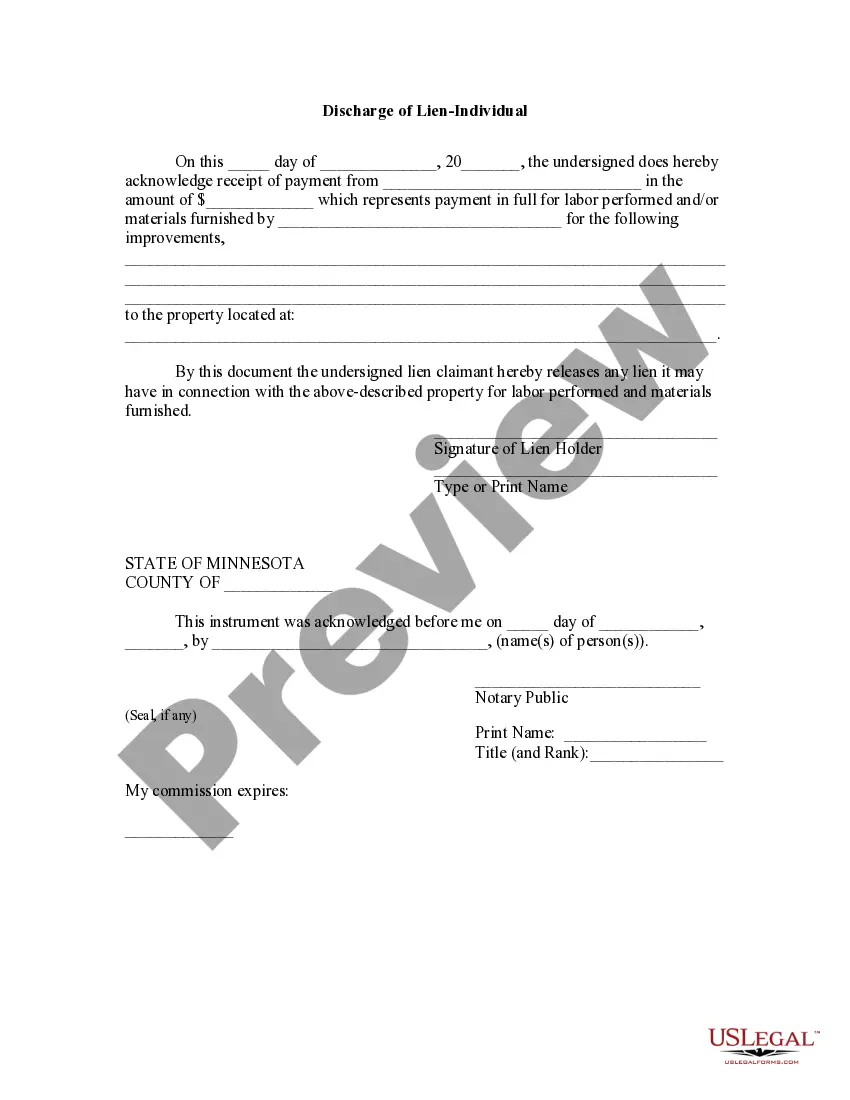

Is this your first time using US Legal Forms? Register and create an account in a matter of minutes and gain access to the form library and Assignment Llc Interest Trust With Interest. Then, follow the steps below to finalize your form: Make sure you have located the correct form using the Review option and examining the form description. Click Buy Now when prepared, and select the monthly subscription plan that suits your requirements. Choose Download then complete, sign, and print the form. US Legal Forms has 25 years of expertise assisting clients with their legal documentation. Find the form you need today and streamline any process without hassle.

- Explore the library of pertinent documents accessible to you with a single click.

- US Legal Forms offers state- and county-specific forms available for download at any time.

- Protect your document management processes with a superior service that allows you to generate any form in just a few minutes without extra or concealed fees.

- Simply Log In to your account, find Assignment Llc Interest Trust With Interest, and obtain it immediately from the My documents section.

- You can also retrieve previously downloaded forms.

Form popularity

FAQ

Yes, you can assign your interest in a trust, but the process may vary based on the trust's terms. This assignment allows you to transfer your beneficial interest to another party, ensuring that the new party receives the benefits of the trust. Understanding the legal implications of this assignment is vital, especially concerning the assignment LLC interest trust with interest.

Transferring LLC interest to a trust involves executing an assignment of interest document, similar to the process of assigning it. You will also need to update the LLC's operating agreement to reflect the trust as the new owner. Resources like uslegalforms can help you with the necessary documentation for a smooth transfer in line with the assignment LLC interest trust with interest.

While putting an LLC in a trust offers benefits, there are some disadvantages to consider. This arrangement may complicate the management of the LLC and could trigger tax consequences depending on your situation. It's crucial to weigh these factors and consult with a professional to navigate the complexities of an assignment LLC interest trust with interest.

To assign LLC interest to a trust, you typically need to draft an assignment document that outlines the transfer of ownership. Ensure that the document complies with state laws and the operating agreement of the LLC. Utilizing services like uslegalforms can simplify this process by providing templates and guidance for the assignment LLC interest trust with interest.

Assigning your LLC to your trust can be a strategic move for estate planning and asset protection. This assignment allows your assets to pass directly to beneficiaries without going through probate, providing a smoother transition. However, it's vital to evaluate your specific circumstances and perhaps consult with a professional regarding the assignment LLC interest trust with interest.

Yes, a trust can own an LLC interest. This arrangement allows the trust to benefit from the income generated by the LLC while providing asset protection and estate planning advantages. It's essential to understand the implications of such an ownership structure, especially when considering an assignment LLC interest trust with interest.

A transfer of a California LLC interest may refer to a transfer of a current member's membership status to a new member, or it may refer to transfer of a member's transferable interest (or both). In either case, the LLC's California operating agreement primarily governs transfers of ownership interests.

The person who receives a transferred membership interest (the assignee) obtains whatever economic rights in the LLC are held by the person who makes the transfer (the assignor)?such as the right to receive distributions and to share in the LLC's profits and losses.

Assignment of Membership Interest Agreement This is a document for reallocating a given member's level of ownership in a company. In this instance, it will be used to transfer Florida LLC membership interest to your chosen trust, rather than to another member or individual.

The person who receives a transferred membership interest (the assignee) obtains whatever economic rights in the LLC are held by the person who makes the transfer (the assignor)?such as the right to receive distributions and to share in the LLC's profits and losses.