Letter Of Testamentary Without Probate

Description

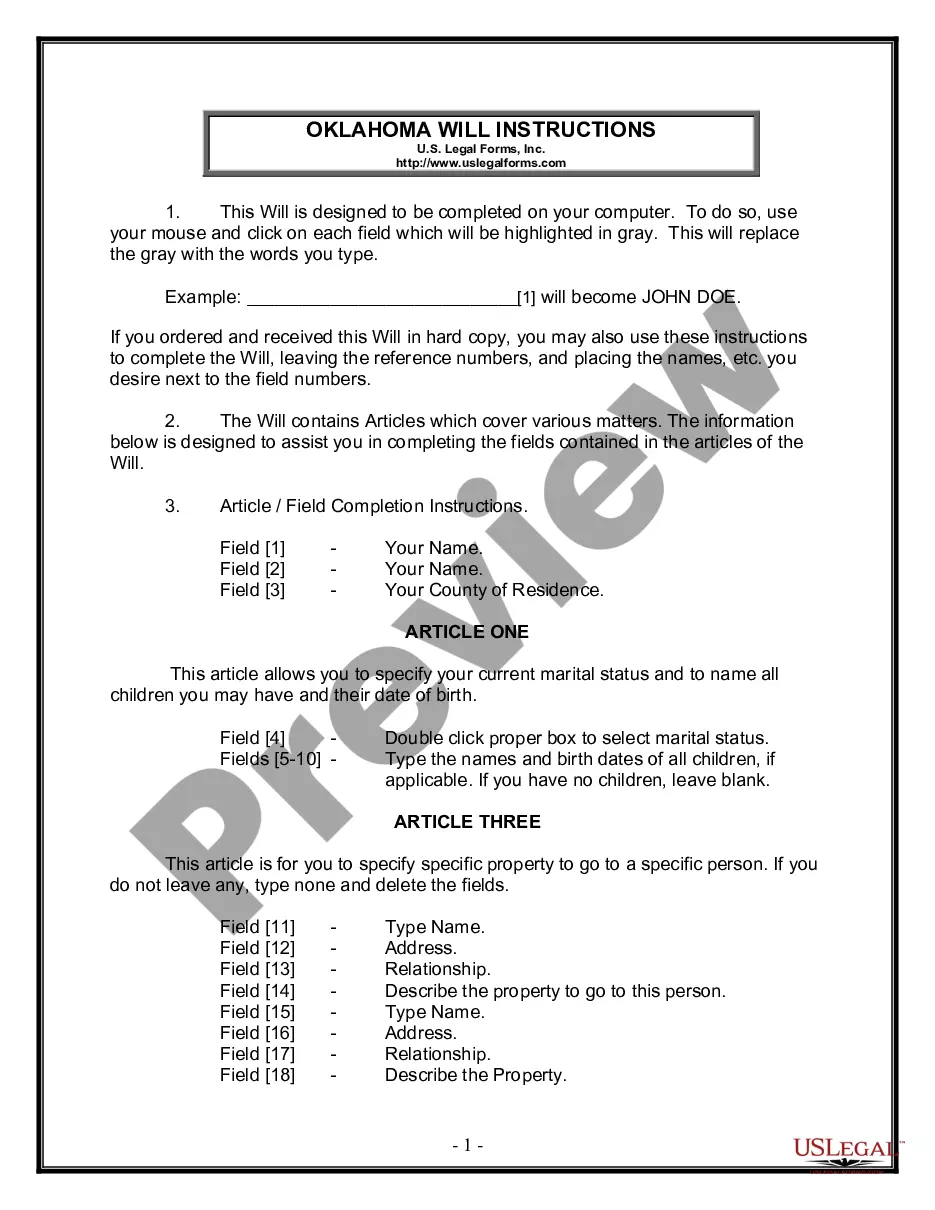

How to fill out Letter Of Testamentary Without Probate?

Red tape requires accuracy and attention to detail.

Unless you manage the completion of documents such as Letter Of Testamentary Without Probate regularly, it may lead to certain misinterpretations.

Selecting the appropriate template from the outset will guarantee that your document submission proceeds smoothly and avert any troubles of resending a file or repeating the same tasks from the beginning.

- Access the correct template for your documentation at US Legal Forms.

- US Legal Forms is the largest online collection of forms that provides over 85 thousand templates for various domains.

- You can obtain the latest and most applicable version of the Letter Of Testamentary Without Probate by simply searching on the website.

- Find, store, and download forms in your account or verify with the description to confirm you have the right one available.

- With an account at US Legal Forms, you can easily obtain, store in one central location, and peruse the templates you keep for quick access.

- When on the site, click the Log In button to authenticate.

- Then, navigate to the My documents section, where your forms are stored.

- Review the descriptions of the forms and download those you need at any time.

Form popularity

FAQ

Yes, letters of testamentary are generally considered public records. This means that anyone can access them once they are filed with the court. However, specific details can vary by state, so it's good to check local regulations. Educating yourself through resources like US Legal Forms can help you understand the implications of this public record status regarding privacy.

To order a letter of testamentary without probate, start by gathering the necessary documents, such as the will and death certificate. You will then need to file a petition with the probate court responsible for your area. If you prefer convenience, you can use platforms like US Legal Forms, which provide forms and guidance to streamline ordering your testamentary letter efficiently.

The time it takes to obtain a letter of testamentary without probate can range from a few days to several weeks, depending on the court's schedule and the complexity of the estate. If you submit a complete and correct application, the process can be quicker. Knowing your state's specific timelines can also help manage your expectations. Using US Legal Forms can expedite preparation of your documents and help you stay informed.

Yes, you can obtain a letter of testamentary without a lawyer in some cases, especially if the estate is simple. However, you will need to understand the necessary procedures and documentation required by your state. Self-help resources, including platforms like US Legal Forms, provide guidance to assist you with the process. This way, you can navigate the requirements with confidence.

The costs associated with obtaining a letter of testamentary without probate can vary depending on your state and specific circumstances. Generally, you might incur filing fees, costs for document preparation, and possibly court fees. It’s wise to factor in these costs when planning your estate management. Utilizing resources such as US Legal Forms can help you find clarity on these expenses.

To receive a letter of testamentary without probate, you typically need to present pertinent documents to the court. This may include the deceased person's will, a death certificate, and proof of your identity. It's essential to ensure all paperwork is accurate to streamline the process. If you are unsure, consider using a service like US Legal Forms to simplify your journey.

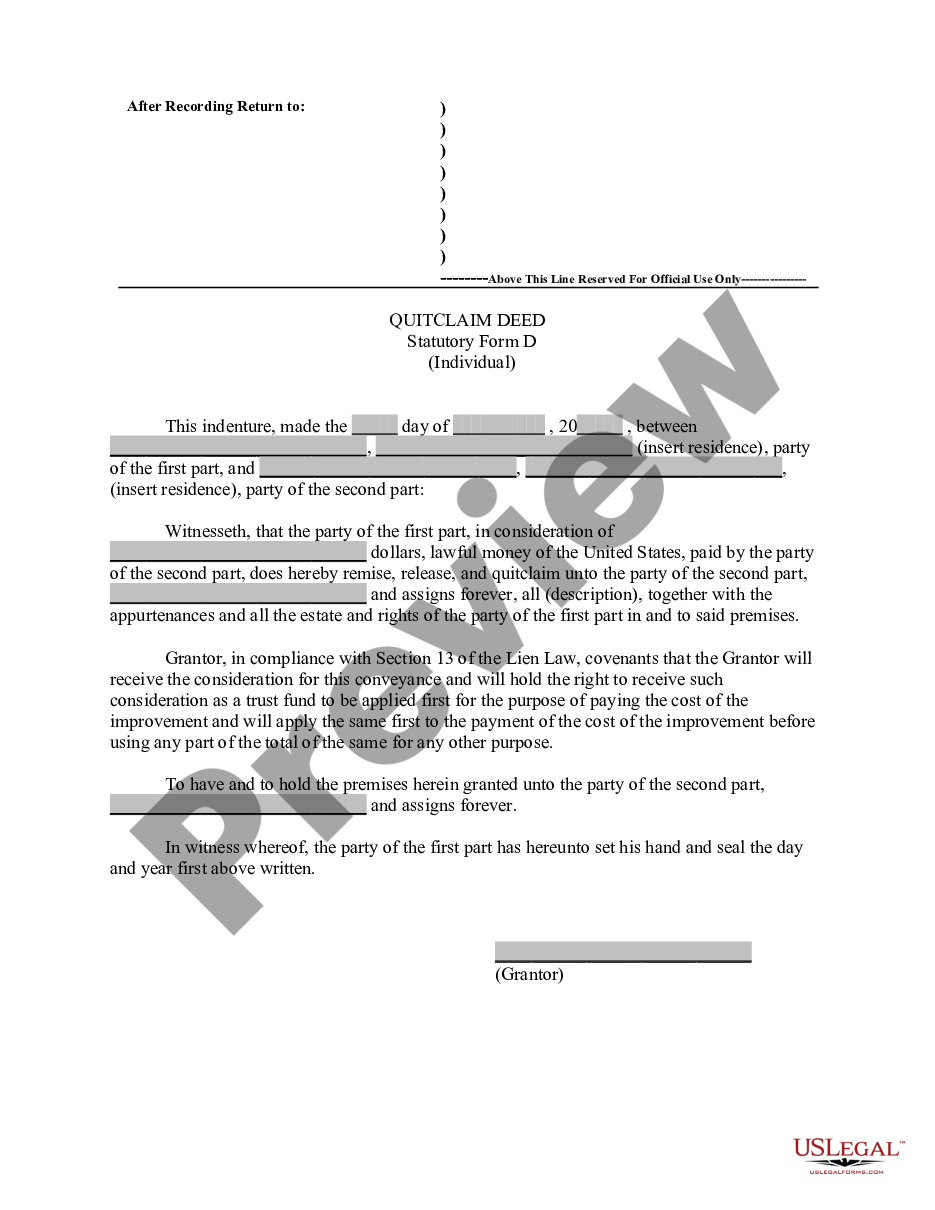

One of the most effective methods to avoid probate is to establish a living trust. By placing your assets in a trust, they can be distributed to your beneficiaries without undergoing probate. Additionally, using a letter of testamentary without probate can further streamline the transition of your estate.

Assets that would pass through probate include solely owned properties and individual bank accounts not designated to a beneficiaries. These assets must go through probate to ensure that legal obligations and debts are settled first. Understanding this can help you strategize how to minimize probate in your estate planning.

Assets that do not go through probate include joint ownership properties, life insurance benefits, and assets held in revocable trusts. These assets can be directly transferred to beneficiaries, thereby avoiding the probate process. Knowing these details allows you to make informed decisions regarding estate planning.

To write a letter of testamentary, you first need to fill out a petition for probate and either create a will or demonstrate that the decedent’s assets qualify as non-probate assets. Once the court grants you this authority, you will receive a formal letter, which allows you to act on behalf of the deceased's estate. This letter is crucial for managing assets without probate.