Fees Attorney Costs With Closing

Description

How to fill out Sample Letter To Client Regarding Defendant's Offer Of Judgment?

Whether for business purposes or for individual affairs, everybody has to manage legal situations at some point in their life. Completing legal papers needs careful attention, starting with choosing the appropriate form sample. For instance, if you choose a wrong version of a Fees Attorney Costs With Closing, it will be turned down once you submit it. It is therefore essential to get a reliable source of legal files like US Legal Forms.

If you need to obtain a Fees Attorney Costs With Closing sample, follow these easy steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Look through the form’s description to make sure it suits your case, state, and region.

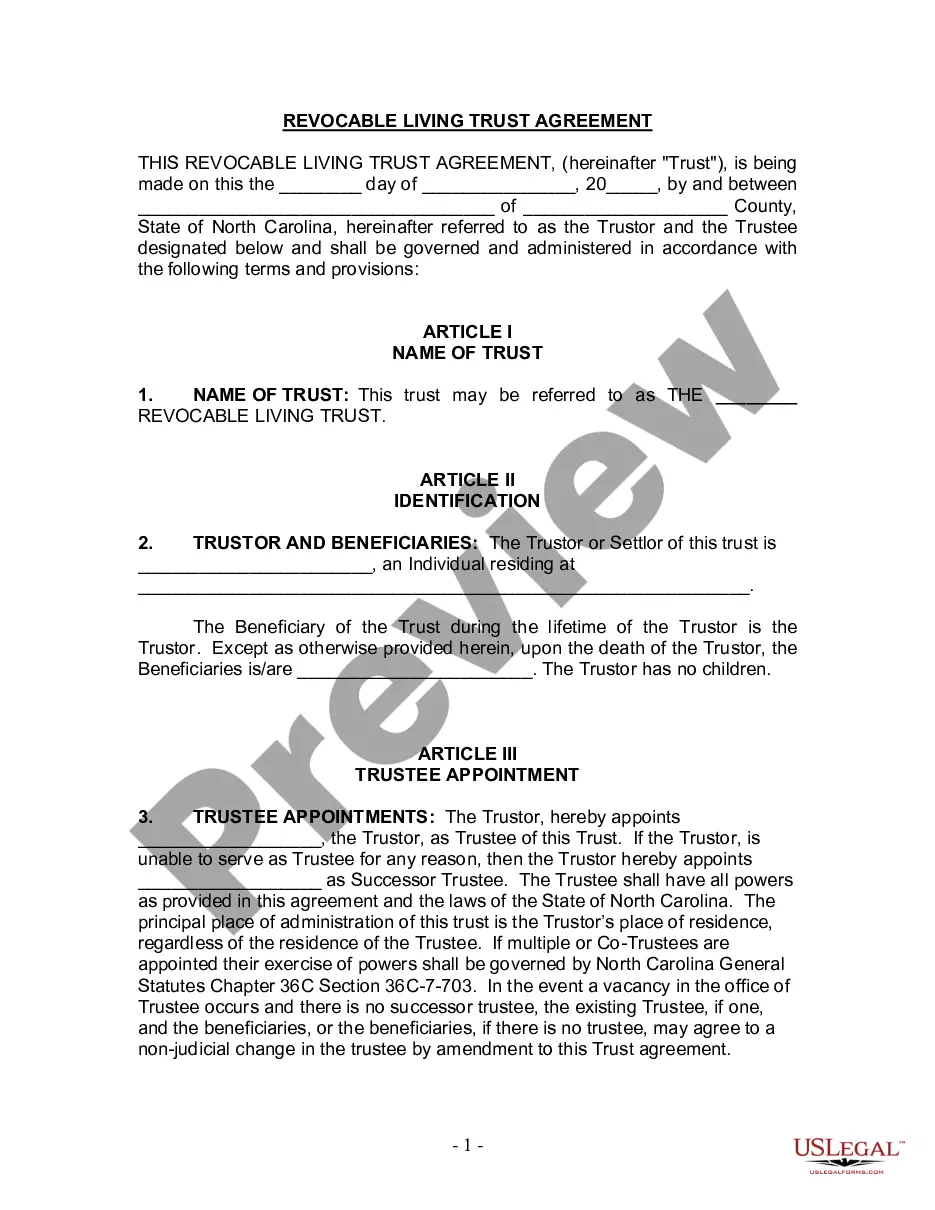

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search function to find the Fees Attorney Costs With Closing sample you require.

- Get the template if it meets your requirements.

- If you have a US Legal Forms profile, click Log in to access previously saved templates in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Pick the appropriate pricing option.

- Complete the profile registration form.

- Pick your payment method: you can use a bank card or PayPal account.

- Pick the file format you want and download the Fees Attorney Costs With Closing.

- After it is saved, you are able to fill out the form with the help of editing software or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you never need to spend time seeking for the right template across the internet. Take advantage of the library’s simple navigation to find the appropriate template for any occasion.

Form popularity

FAQ

You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment.

Costs on the Sale of a Property State Conveyance Tax.75% x Sales Price (1.25% x Sales Price over $800,000)Realtor's Fee6% (varies)Attorney's Fee$1000+Recording Fee - Release$10 (1 page) - $15 (2 pages)Real Estate TaxesUnpaid Amount3 more rows ? 03-Mar-2023

Closing costs are the expenses over and above the property's price that buyers and sellers incur to complete a real estate transaction. These costs may include loan origination fees, discount points, appraisal fees, title searches, title insurance, surveys, taxes, deed recording fees, and credit report charges.

Closing costs are paid ing to the terms of the purchase contract made between the buyer and seller. Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too.

Usually, it is the responsibility of the buyer to pay the closing cost at the end of a real estate deal.