Notice Letters For Foreclosure Withdrawal

Description

How to fill out Sample Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice?

It’s obvious that you can’t become a law professional immediately, nor can you grasp how to quickly prepare Notice Letters For Foreclosure Withdrawal without the need of a specialized set of skills. Putting together legal forms is a long process requiring a particular training and skills. So why not leave the creation of the Notice Letters For Foreclosure Withdrawal to the professionals?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court paperwork to templates for in-office communication. We understand how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our platform and obtain the document you require in mere minutes:

- Discover the form you need with the search bar at the top of the page.

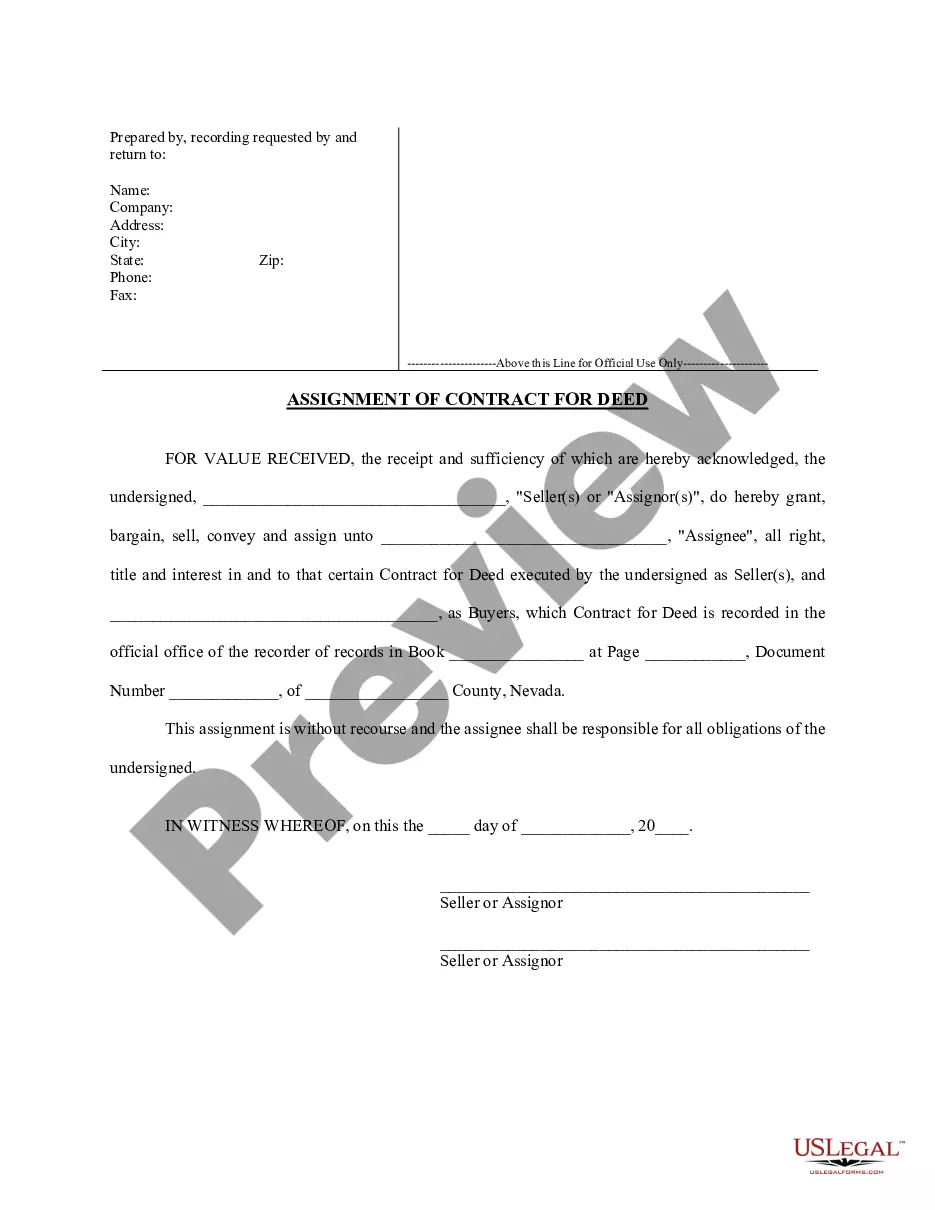

- Preview it (if this option available) and read the supporting description to determine whether Notice Letters For Foreclosure Withdrawal is what you’re looking for.

- Begin your search over if you need a different form.

- Register for a free account and choose a subscription plan to purchase the template.

- Choose Buy now. As soon as the transaction is complete, you can download the Notice Letters For Foreclosure Withdrawal, complete it, print it, and send or mail it to the designated people or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

A loan closure letter is issued to employees who have availed of loans from the Company for their personal use and have fully repaid them either through their salaries or by direct repayments.

You must draft the legal notice clearly and concisely with all the details of the loan, i.e., the amount borrowed, the repayment schedule, and the non-payment of the loan. The notice should also specify the consequences of non-payment, such as legal action.

Address. Dear Sir/Madam, With utmost respect we, _____ and ____ husband/father/mother and wife/daughter (any relationship) respectively run a combined home loan account in your bank under the loan account number _____________. We now want to foreclose on our home loan, and we paid the outstanding loan amount of Rs.

Dear Sir/Madam, I XYZ, holding a loan account in your branch with account number 76180991. I am currently having a loan of INR xx, for (state the reason). To sum up, I am writing this letter to inform you that I wish to foreclose the loan.

Types of Personal Loan Foreclosures Loan foreclosure by the bank. ... Loan foreclosure by the borrower. ... Step 1: Locate the nearest branch. ... Step 2: Submit an application for foreclosure. ... Step 3: Provide all the required documents. ... Step 4: Intimation by the bank. ... Step 5: Repayment of the personal loan.