Foreclosure Attorney Law Fordham

Description

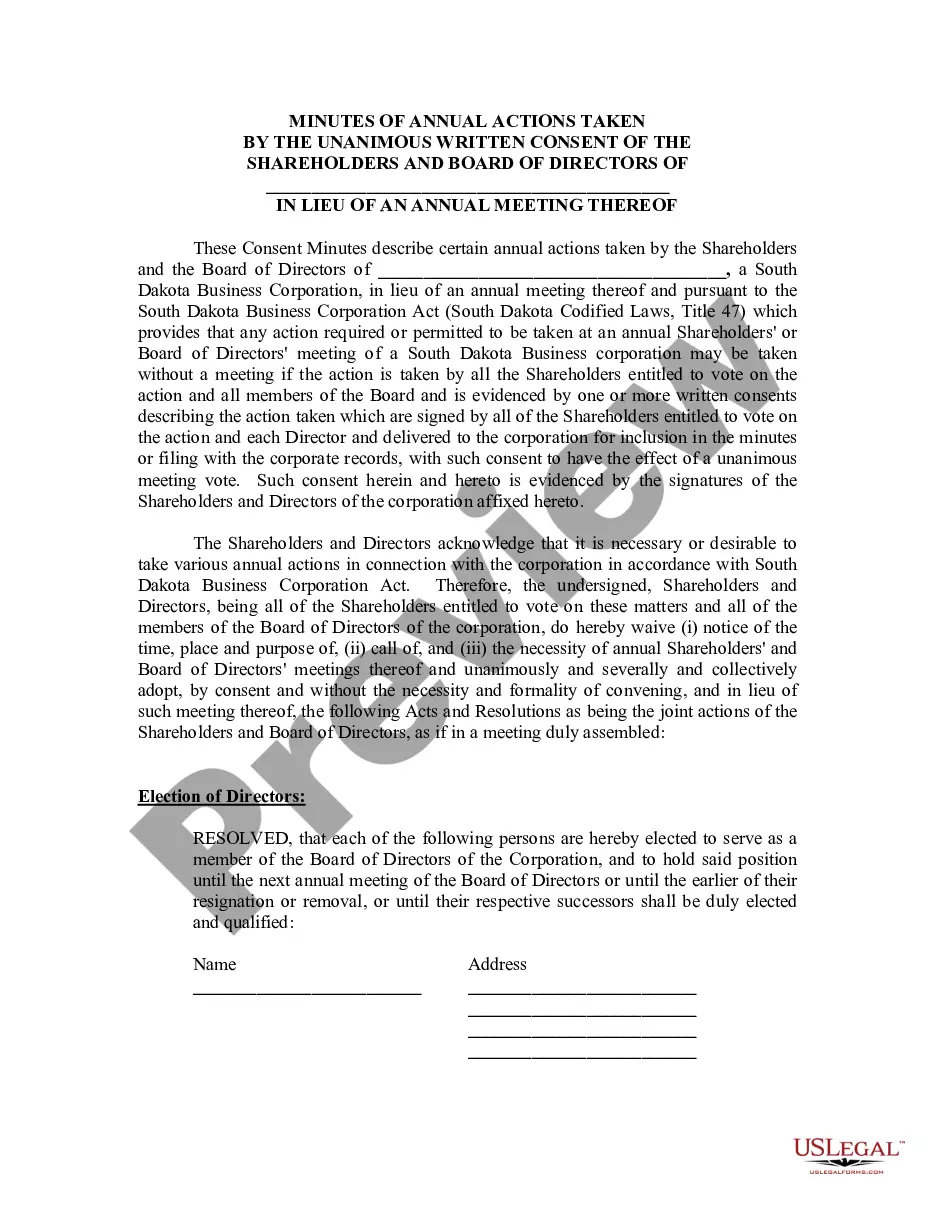

How to fill out Sample Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice?

Legal managing may be mind-boggling, even for skilled experts. When you are searching for a Foreclosure Attorney Law Fordham and do not get the a chance to spend searching for the right and up-to-date version, the procedures could be stressful. A strong web form catalogue might be a gamechanger for anyone who wants to deal with these situations effectively. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you anytime.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any demands you could have, from individual to enterprise papers, all-in-one spot.

- Make use of innovative tools to complete and handle your Foreclosure Attorney Law Fordham

- Gain access to a resource base of articles, tutorials and handbooks and materials relevant to your situation and needs

Save time and effort searching for the papers you will need, and use US Legal Forms’ advanced search and Preview tool to discover Foreclosure Attorney Law Fordham and download it. In case you have a membership, log in in your US Legal Forms account, look for the form, and download it. Take a look at My Forms tab to view the papers you previously saved and to handle your folders as you see fit.

Should it be your first time with US Legal Forms, register a free account and acquire unlimited access to all advantages of the library. Listed below are the steps to consider after accessing the form you need:

- Validate this is the correct form by previewing it and reading through its description.

- Be sure that the sample is accepted in your state or county.

- Pick Buy Now when you are ready.

- Select a monthly subscription plan.

- Pick the file format you need, and Download, complete, sign, print out and deliver your document.

Benefit from the US Legal Forms web catalogue, backed with 25 years of experience and trustworthiness. Enhance your everyday document administration in to a easy and intuitive process right now.

Form popularity

FAQ

Foreclosure Remedies means the taking of any action to enforce or realize upon any Lien, including the institution of any foreclosure proceedings (judicially or non-judicially) or the noticing of any public or private sale pursuant to Article 9 of the UCC, or taking any action to sell or otherwise dispose of (whether ...

The ?statute of limitations? in the State of New York for foreclosure actions, per CPLR 213(4), is a six (6) year statute of limitations that measures the time period starting from the lender's ?acceleration? of the mortgage by an overt and unequivocal act, until the lender actually commences a foreclosure action.

Avoiding Foreclosure (Loss Mitigation) Pay arrears, become current on the loan. ... Work out a period of loan forbearance. ... Loan modification. ... Refinance with another lender. ... Deed in lieu of foreclosure. ... Sell home, negotiate short sale.

New York is a judicial foreclosure state, which means that the lender has to sue the borrower in order to enforce their rights under the mortgage and note. If the lender wins the lawsuit, it obtains a judgment from the court, which allows the lender to sell the property at an auction.

New York law provides that a lender has six years to commence a mortgage foreclosure action from the earlier of (i) the date that the lender accelerates the loan based on a borrower default or (ii) the maturity date. The most common default is, of course, a borrower's failure to make timely loan payments.