Sample Letter Of Credit Application Form

Description

How to fill out Sample Letter Of Credit?

Navigating through the red tape of standard documents and molds can be arduous, particularly when one does not engage in that professionally.

Even selecting the appropriate mold to secure a Sample Letter Of Credit Application Form will consume considerable time, as it must be legitimate and precise to the last detail.

However, you will need to invest significantly less time acquiring an appropriate mold from a source you can trust.

Obtain the correct document in just a few simple steps: Enter the document title in the search field; select the appropriate Sample Letter Of Credit Application Form from the results; review the outline of the sample or view its preview; if the mold fits your requirements, click Buy Now; continue to choose your subscription option; utilize your email and create a secure password to register an account on US Legal Forms; select a credit card or PayPal as your payment method; save the mold file on your device in your preferred format. US Legal Forms can help you save significant time in verifying if the document you located online meets your needs. Establish an account and gain unlimited access to all the forms you require.

- US Legal Forms is a platform that streamlines the process of finding the correct documents online.

- US Legal Forms is the singular destination you require for the most current examples of documents, consulting their usage, and downloading these examples to complete them.

- It serves as a repository with over 85K forms applicable in various professional fields.

- When searching for a Sample Letter Of Credit Application Form, you will not have to doubt its authenticity since all forms are authenticated.

- Creating an account with US Legal Forms will ensure you have all the necessary examples at your fingertips.

- You can save them in your history or add them to the My documents catalog.

- Retrieve your saved documents from any device by simply clicking Log In at the library site.

- If you do not yet have an account, you can always look for the mold you require.

Form popularity

FAQ

LC submission refers to the process of providing required documents to a bank to fulfill the terms of a letter of credit. This submission ensures that the seller receives payment under the agreed-upon conditions. Using a sample letter of credit application form can streamline this process, as it helps organize the necessary details required by the bank.

Filling out a letter of credit requires attention to detail and understanding of the transaction terms. Start by referring to a sample letter of credit application form to gather necessary information. Fill in all relevant details such as parties involved, amounts, and conditions for payment. Accuracy is key to avoid any delays in processing.

You should submit LC documents through your bank following their specific guidelines. Many banks accept submissions online, allowing for a faster review process. It's crucial to ensure that all documents match the terms outlined in your letter of credit, including the details provided in the sample letter of credit application form.

To submit a letter of credit document, gather all required paperwork as outlined in the LC agreement. You can typically submit these documents to your bank, either electronically or in hard copy, depending on your bank's preferences. Make sure to include a copy of the sample letter of credit application form for reference.

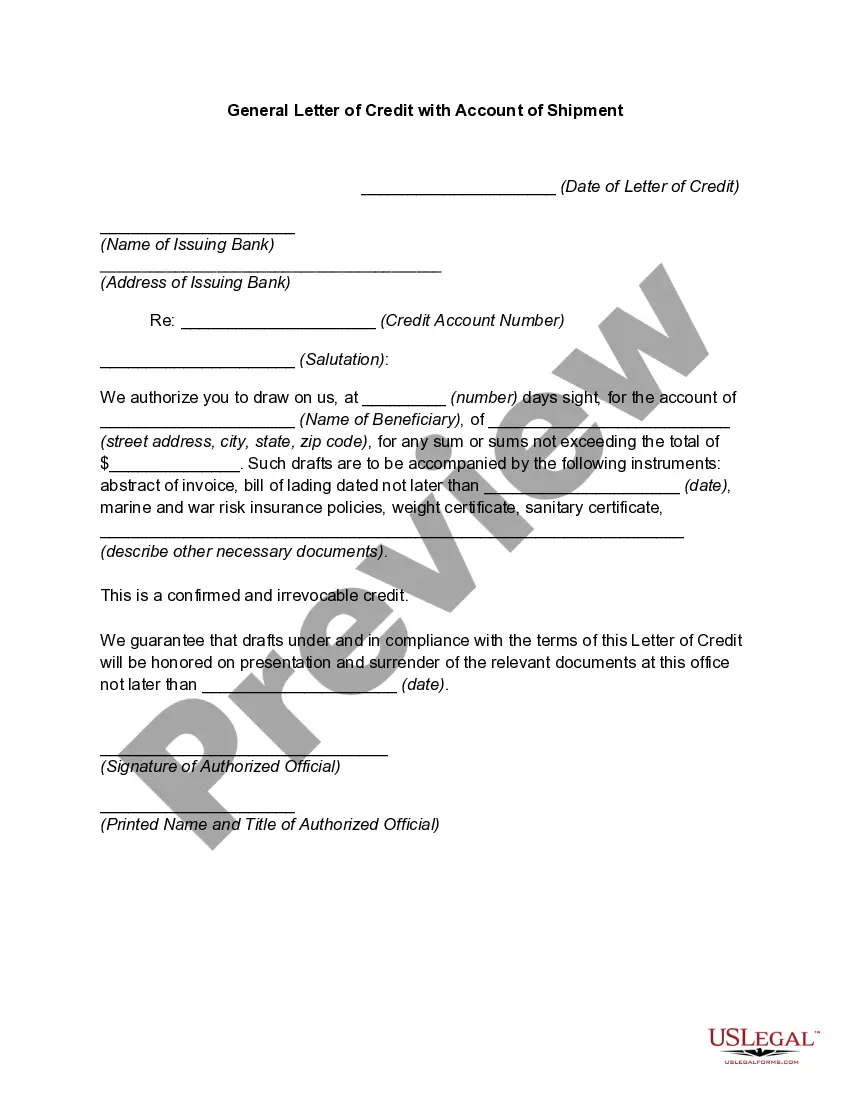

Applying for a letter of credit involves filling out a sample letter of credit application form with relevant details about the transaction. You need to provide information about the buyer, seller, and amounts involved. After completing the form, submit it to your bank for review. They will guide you through any additional requirements.

The process of issuing a letter of credit (LC) begins when the buyer applies for one through their bank, using a sample letter of credit application form. The bank then assesses the buyer's creditworthiness and determines the terms of the LC. Once approved, the bank issues the LC to the seller's bank, ensuring payment upon receipt of the required documents.

Filling out a credit explanation letter requires clarity and accuracy. Start by providing your personal information and the purpose of the letter. Use a Sample letter of credit application form to better understand the necessary components. Our platform offers resources to ensure you craft a strong and effective letter, addressing your needs with confidence.

To complete a letter of credit, you must gather the necessary information, such as the details of the transaction and the involved parties. You can find a comprehensive Sample letter of credit application form that guides you through this process. Be sure to fill in all required fields accurately to ensure smooth processing. If you have questions, consider reaching out to our platform for assistance.

To fill out a letter of credit application form, start by providing accurate details about the buyer and seller, including names, addresses, and banking information. Next, specify the terms of the transaction, such as the amount, shipment details, and any required documentation. Using a sample letter of credit application form can guide you through the process, ensuring you include all essential components for effective processing.

An example of a letter of credit might include a situation where a clothing retailer in the U.S. wants to import garments from overseas. The retailer requests a letter of credit from their bank, describing the payment terms contingent upon receiving the shipment and the accompanying documents. By using a sample letter of credit application form, they ensure that all relevant details are included, allowing for a smooth transaction.