Sue Settlement With The Irs

Description

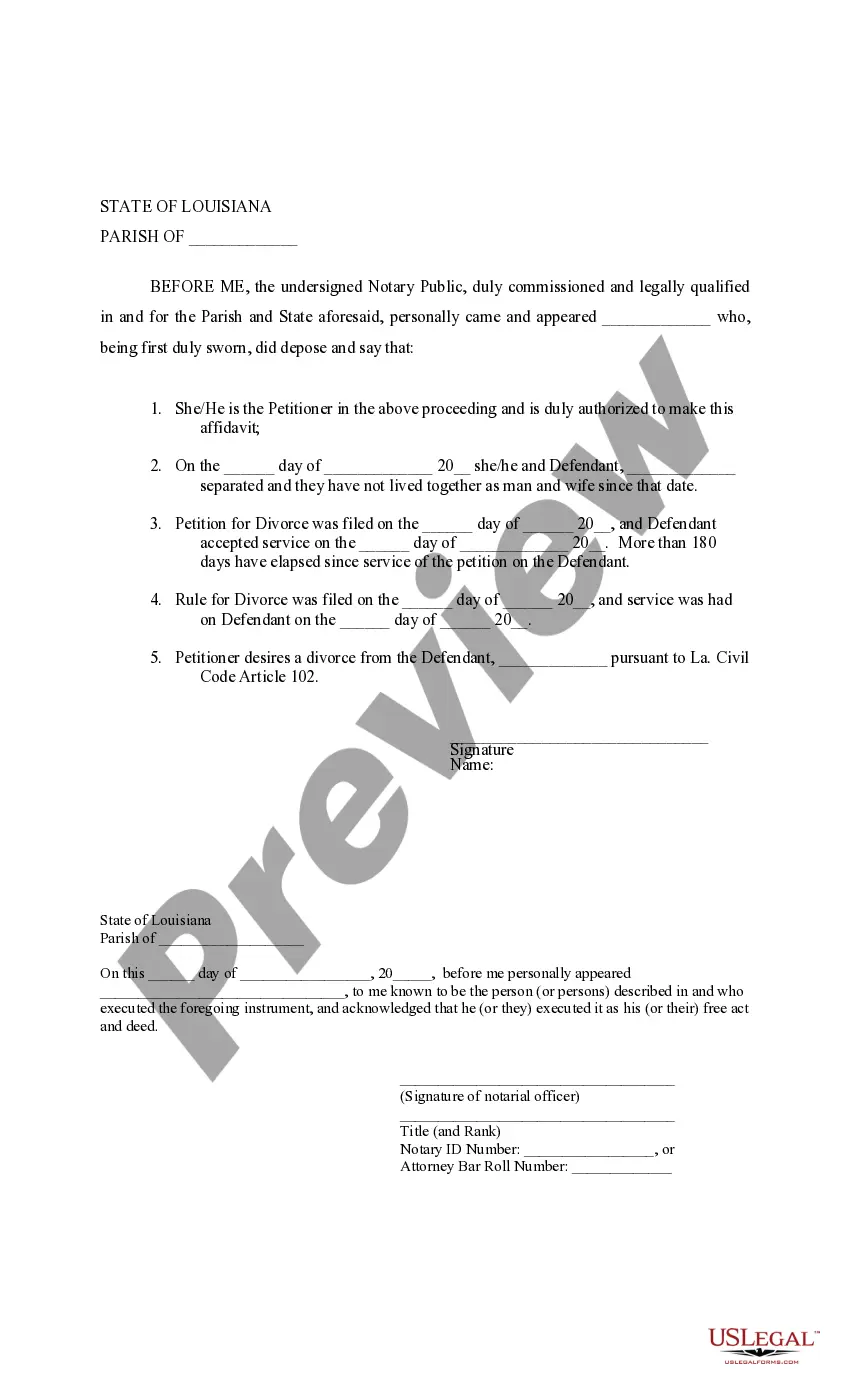

How to fill out Sample Letter Of Intent To Sue - With Settlement Demand?

Creating legal documents from the beginning can frequently be intimidating.

Certain situations may require extensive investigation and significant financial expenditure.

If you seek a simpler and more economical method of producing Sue Settlement With The Irs or any other documents without the hassle, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal templates encompasses nearly every aspect of your financial, legal, and personal matters.

However, before proceeding to download Sue Settlement With The Irs, consider these suggestions: Review the document preview and descriptions to ensure you have located the form you seek. Confirm that the form you choose adheres to the laws and regulations of your state and county. Select the most appropriate subscription plan to acquire the Sue Settlement With The Irs. Download the document, then complete, validate, and print it. US Legal Forms has a strong reputation and over 25 years of experience. Join us today and make the form-filling process simple and efficient!

- With just a couple of clicks, you can swiftly obtain state- and county-specific documents meticulously prepared for you by our legal professionals.

- Utilize our platform whenever you need a dependable and trusted service through which you can easily find and retrieve the Sue Settlement With The Irs.

- If you’re familiar with our services and have set up an account in the past, simply Log In to your account, select the document, and download it or retrieve it again at any time from the My documents section.

- Don't have an account? No problem. It takes just a few minutes to establish it and browse the catalog.

Form popularity

FAQ

The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61. This section states all income is taxable from whatever source derived, unless exempted by another section of the code.

If you receive a settlement in California that is considered taxable income, you will need to report it on your tax return. You will typically receive a Form 1099-MISC, which reports the amount of taxable income you received during the year.

The IRS can only pursue those portions of the settlement not intended as reimbursement for property loss or physical injury. So, while this may not always happen, it is possible that the IRS might take at least some of your personal injury settlement.

General rule relative to taxability of amounts received from lawsuit settlements is IRC §61 that states that all income is taxable from whatever source derived, unless exempted by another section of the Code.

The IRS Has The Final Say If you receive a settlement in California that is considered taxable income, you will need to report it on your tax return. You will typically receive a Form 1099-MISC, which reports the amount of taxable income you received during the year.