The Certificate of Rent Paid (CRP) is a significant document in the state of Minnesota that serves as proof of rent paid by tenants to landlords. It is required by the Minnesota Department of Revenue for income tax filing purposes and must be issued by landlords or property managers to their tenants every year. The CRP contains vital information about the rental property and the tenant including the property address, the landlord's name and address, the tenant's name, the rental period, and the total amount of rent paid during the year. The primary purpose of the CRP is for tenants to claim the renter's refund, a state program that provides tax refunds to eligible renters based on their income and the amount of rent paid. Landlords are responsible for providing this form to their tenants no later than January 31 of each year. In Minnesota, there is only one type of Certificate of Rent Paid. However, it should be noted that there are specific requirements and guidelines that landlords must follow when preparing and issuing the CRP. Failure to provide the CRP to tenants in a timely and accurate manner can result in penalties imposed by the Minnesota Department of Revenue. To ensure compliance with the law, landlords must keep accurate records of rent payments and verify the information provided on the CRP. It is essential to include all necessary details and accurately calculate the rent paid to avoid any discrepancies or potential issues during tax filing. The Certificate of Rent Paid is crucial for both tenants and landlords in Minnesota. For tenants, it serves as valid proof for claiming the renter's refund program, while landlords must issue this form to fulfill their obligations and avoid penalties. Understanding the importance of the CRP and complying with the necessary requirements contributes to a smooth and hassle-free tax filing process for both parties involved.

Certificate Of Rent Paid In Minnesota

Description

How to fill out Certificate Of Rent Paid In Minnesota?

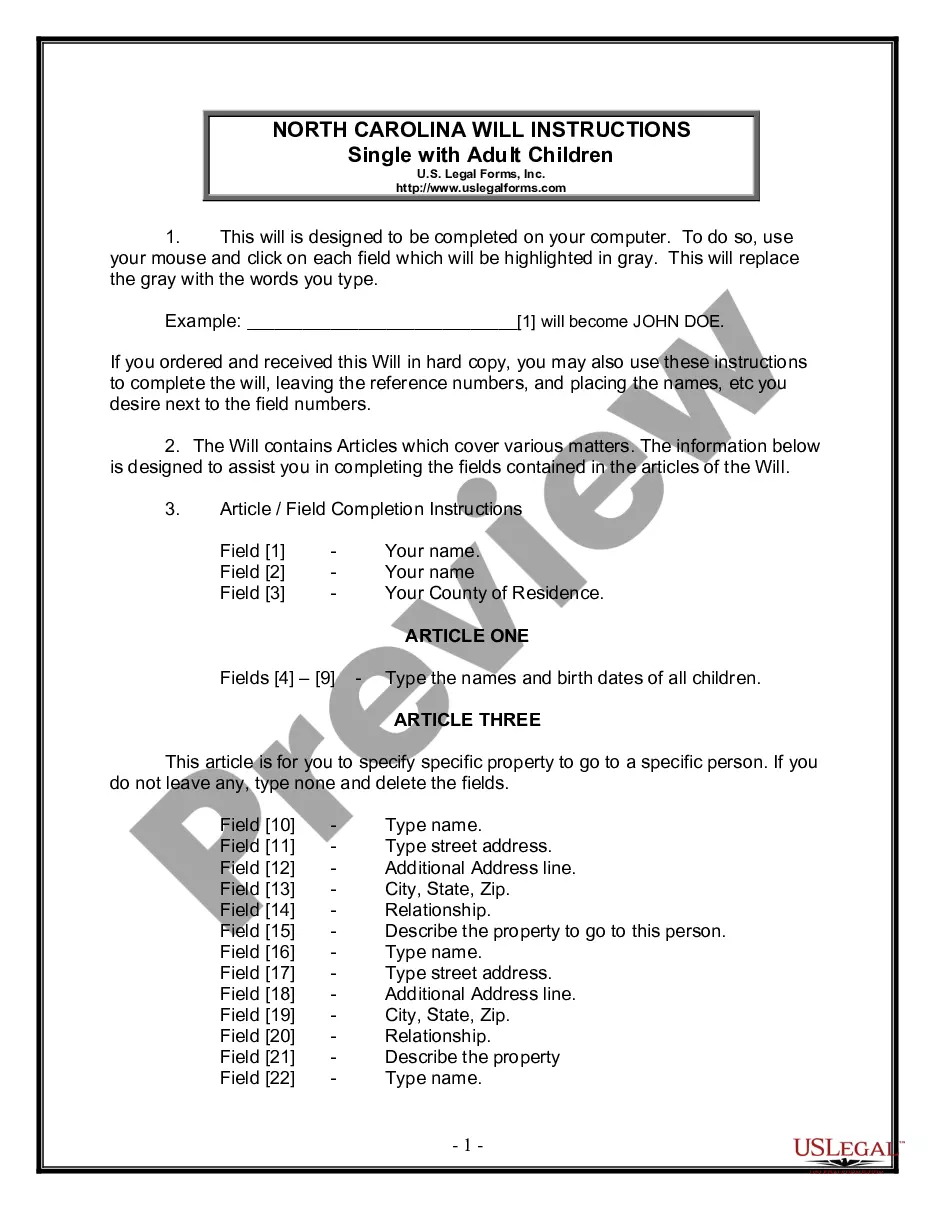

Obtaining legal document samples that comply with federal and local regulations is crucial, and the internet offers many options to choose from. But what’s the point in wasting time looking for the right Certificate Of Rent Paid In Minnesota sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life scenario. They are easy to browse with all papers arranged by state and purpose of use. Our specialists keep up with legislative changes, so you can always be confident your form is up to date and compliant when obtaining a Certificate Of Rent Paid In Minnesota from our website.

Obtaining a Certificate Of Rent Paid In Minnesota is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, adhere to the steps below:

- Analyze the template using the Preview feature or via the text outline to ensure it meets your requirements.

- Locate another sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and select a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Certificate Of Rent Paid In Minnesota and download it.

All documents you locate through US Legal Forms are reusable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Property owners and managers registered in e-Services can submit CRPs for one or more properties by uploading a file in e-Services. To learn more, see Certificates of Rent Paid File Formats. You can also use a certified software product. See Certificate of Rent Paid Software.

Deductions are allowed for dependents and for claimants who are over age 65 or disabled. What are the maximums? For refund claims filed in 2022, based on rent paid in 2021 and 2021 household income, the maximum refund is $2,280. Renters whose income exceeds $64,920 are not eligible for refunds.

To fill out the Certificate of Rent Paid information in the TaxAct program: From within your TaxAct return (Online or Desktop), click State, then click Minnesota (or MN). ... Click Property Tax Refund in the Minnesota Quick Q&A Topics menu to expand, then click Certificate of rent paid.

Certificate of Rent Paid (CRP) Requirements If you own or manage a rental property and rent living space to someone, you must provide a CRP to each renter if either of these apply: Property tax was payable in 2022 on the property. The property is tax-exempt, but you made payments in lieu of property taxes.

Certificate of Rent Paid (CRP) is at the very end of the state return, after the questions about penalties, extensions, etc. Look for a page titled "Other Forms You May Need". Check the first box, Property Tax Refund (Form M1PR). That will take you through the section for the renter's credit.