Dissolving A Corporation With Assets

Description

How to fill out Dissolving A Corporation With Assets?

There's no longer a necessity to squander time searching for legal documents to comply with your local state laws. US Legal Forms has gathered all of them in one location and made them easily accessible.

Our website provides over 85,000 templates for any business and individual legal matters categorized by state and purpose. All forms are properly drafted and verified for accuracy, so you can be confident in obtaining an up-to-date Dissolving A Corporation With Assets.

If you're acquainted with our service and already possess an account, ensure your subscription is active before obtaining any templates. Log In to your account, select the document, and click Download. You can also revisit all previously acquired documents whenever necessary by accessing the My documents tab in your profile.

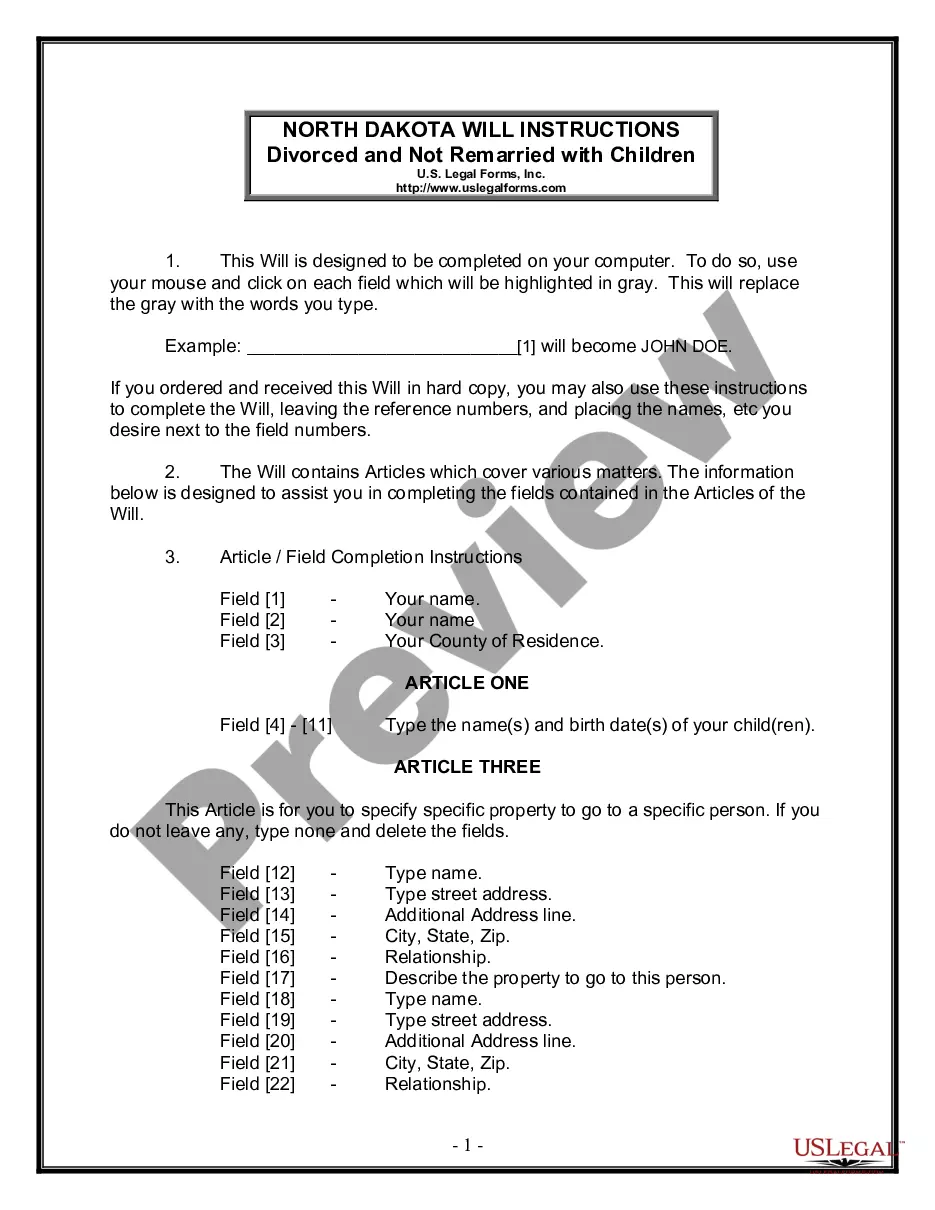

Print your document to fill it out manually or upload the template if you prefer to work with an online editor. Preparing legal documents under federal and state laws and regulations is quick and simple with our library. Try US Legal Forms today to keep your paperwork organized!

- If you've never utilized our service before, the process will involve a few more steps to finalize.

- Here's how new users can obtain the Dissolving A Corporation With Assets from our catalog.

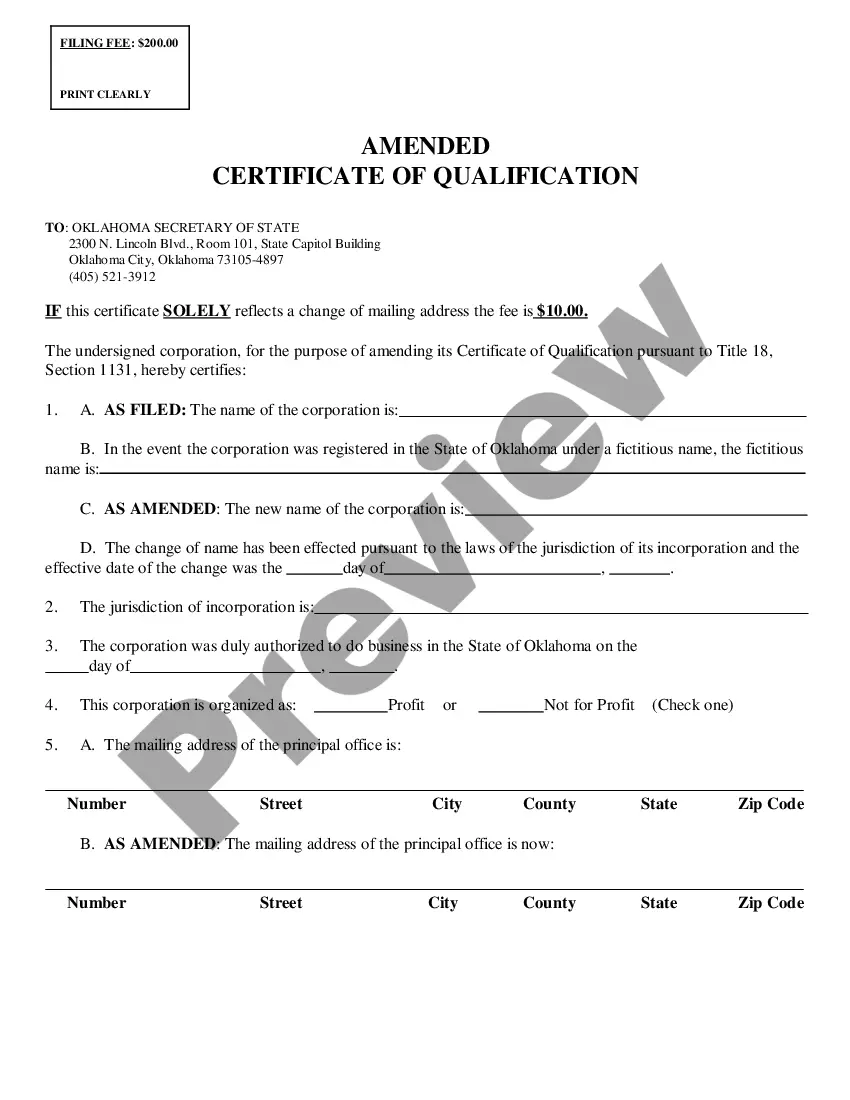

- Read the page information thoroughly to ensure it includes the template you require.

- To assist with this, use the form description and preview options if available.

- Employ the Search field above to look for another template if the previous one didn't meet your needs.

- Click Buy Now next to the template title once you find the right one.

- Select the most appropriate pricing plan and register for an account or Log In.

- Make your payment for the subscription with a credit card or through PayPal to proceed.

- Choose the file format for your Dissolving A Corporation With Assets and download it to your device.

Form popularity

FAQ

During the dissolution of a corporation, assets are liquidated and distributed to creditors and shareholders as per legal requirements. Firstly, all debts and obligations must be settled, then any remaining assets are divided among shareholders. Knowing how to manage these assets can significantly impact your financial outcome, making it crucial to be informed about the process of dissolving a corporation with assets.

When a company dissolves, its stock becomes worthless, as the company is no longer in operation. Shareholders may receive a portion of the assets after the company settles its debts, but any value linked to the stock is lost once the dissolution process starts. It's important for shareholders to be aware of their rights regarding asset distribution when dissolving a corporation with assets.

When a company is dissolved, it effectively ceases to exist as a legal entity. This means it can no longer conduct business, collect debts, or enter into contracts. However, the process of dissolving a corporation with assets involves settling all outstanding liabilities and distributing any remaining assets to shareholders. Understanding this process ensures that you follow the necessary legal steps during dissolution.

Dissolving a corporation with assets involves several important steps to ensure compliance with legal requirements. First, you will need to hold a meeting with shareholders to decide on the dissolution. After that, you must file the necessary paperwork with your state and notify creditors about the dissolution. It is also essential to distribute any remaining assets among shareholders before you finalize the process.

There are several methods for dissolving a corporation, including voluntary and involuntary dissolution. In voluntary dissolution, the company’s owners agree to cease operations and distribute any assets. Involuntary dissolution can result from legal actions or failure to comply with regulations. Knowing these methods can help you choose the appropriate strategy for dissolving a corporation with assets effectively.

When a company is dissolved, shareholders may receive distributions from the remaining assets once debts and obligations are resolved. If the corporation has no assets left after settling liabilities, shareholders can end up with little or nothing. Therefore, understanding the implications of dissolving a corporation with assets is essential for shareholder protection. Being informed can guide shareholders through this challenging process.

When a corporation is dissolved, shareholders may receive a portion of any remaining assets after all debts are settled. This process is known as liquidation and is a key feature of dissolving a corporation with assets. Shareholders are entitled to distributions based on their ownership stakes. It is important for shareholders to be aware of their rights during the dissolution process to ensure they receive their fair share.

Generally, shareholders are not personally liable for the debts of a corporation, as the corporation is a separate legal entity. This protects shareholders' personal assets, provided they haven't personally guaranteed any debts. However, if the corporation has insufficient assets during the dissolving process, shareholders may have diminished recoveries. Knowing these protections helps you understand the implications of dissolving a corporation with assets.

Dissolving a corporation with assets can occur through three primary modes: voluntary dissolution, involuntary dissolution, and administrative dissolution. Voluntary dissolution happens when the owners decide to close the business, while involuntary dissolution occurs by court order or state actions. Administrative dissolution may result from failing to comply with state requirements. Understanding these modes can help you choose the path that best fits your corporate needs.

When a company shuts down, shareholders may lose their investments, depending on the company's remaining assets. If the corporation undergoes dissolving with assets, shareholders typically receive a distribution if there are any assets left after debts and obligations are settled. This process ensures that what remains is allocated fairly among shareholders based on their ownership percentage. Thus, the financial impact on shareholders can vary widely depending on the company's financial condition at the time of dissolution.