Business Name Change Form With Irs

Description

How to fill out Sample Letter For Certificate Of Transaction Of Business Under Fictitious Name - By Partnership?

Finding a reliable source to obtain the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Identifying the appropriate legal documents requires precision and carefulness, which is why it's essential to obtain samples of the Business Name Change Form With Irs exclusively from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and prolong the issue you are facing. With US Legal Forms, you can have peace of mind. You can access and review all pertinent information regarding the document’s applicability and significance for your situation and in your jurisdiction.

Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms library to discover legal templates, verify their applicability to your circumstances, and download them promptly.

- Use the catalog navigation or search bar to locate your template.

- Check the form’s description to ensure it aligns with the requirements of your jurisdiction.

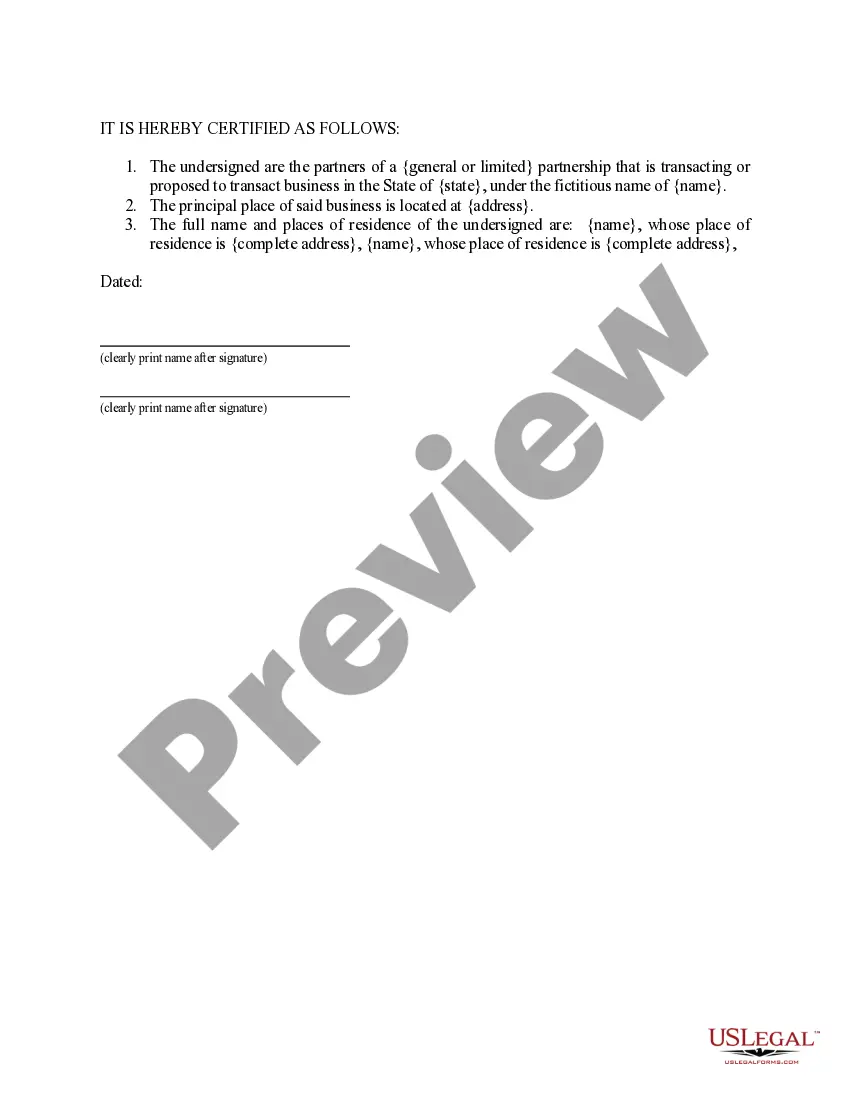

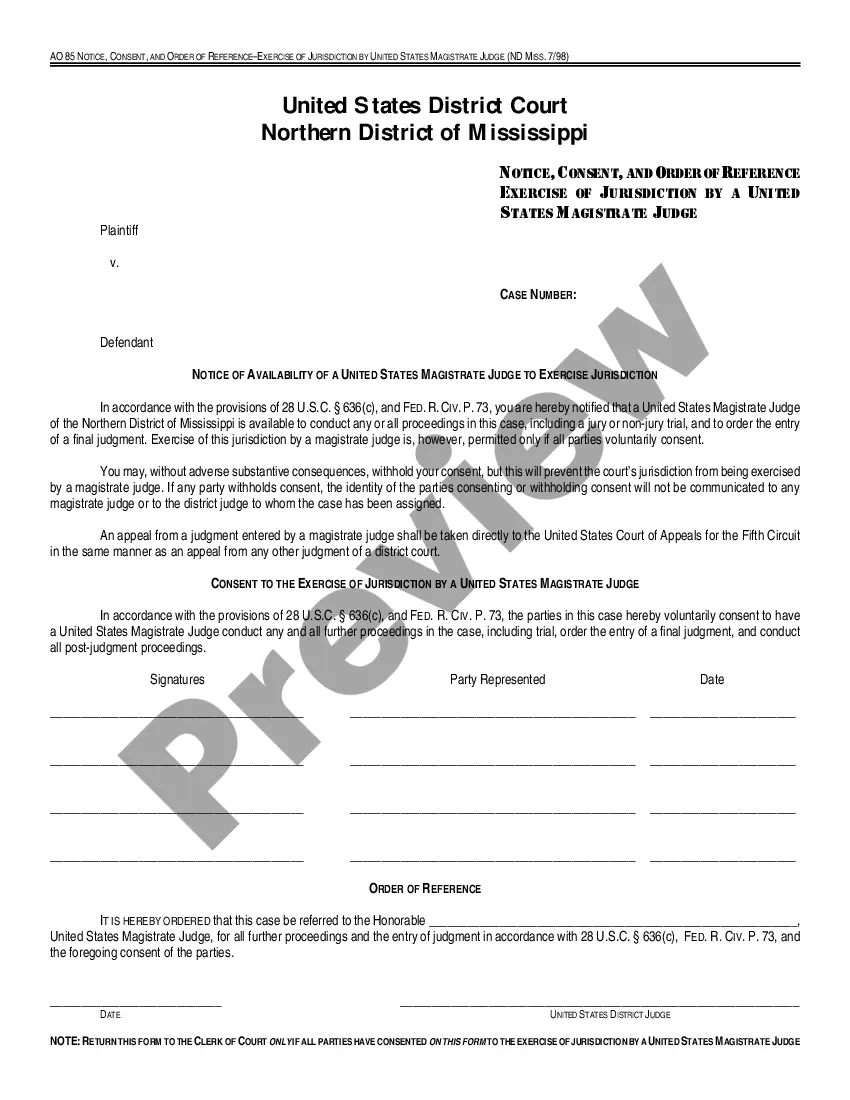

- If available, view the form preview to confirm that the template is indeed what you are looking for.

- If the Business Name Change Form With Irs does not meet your needs, return to the search to find the appropriate template.

- If you are confident about the form’s relevance, proceed to download it.

- If you are an authorized user, click Log in to verify your identity and gain access to your chosen templates in My documents.

- If you do not have an account yet, click Buy now to obtain the template.

- Select the pricing plan that meets your requirements.

- Proceed to register to complete your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Business Name Change Form With Irs.

- Once you have the form on your device, you can edit it using the editor or print it for manual completion.

Form popularity

FAQ

To submit a business name change to the IRS, begin by completing Form 8822-B accurately. After filling out the form, submit it by mail to the address specified in the form instructions. By using platforms like US Legal Forms, you can streamline this process, ensuring that all requirements are met and that you receive the correct guidance throughout.

To submit Form SS-4, you can do so online, by mail, or by fax, depending on your preference. If you're applying for an Employer Identification Number (EIN), fill out the application correctly and ensure it reflects your new business name. Additionally, using online services like US Legal Forms can simplify the process, providing you with guidance and the necessary templates to ensure accurate submission.

To notify the IRS of a business name change, you can write a formal letter or use a specific business name change form with the IRS. In your communication, include your old business name, new business name, and Employer Identification Number (EIN). Sending this information promptly helps maintain accurate records with the IRS.

When filing a current year tax return, you can change your business name with the IRS by checking the name change box on the entity's respective form: Corporations ? Form 1120, Page 1, Line E, Box 3. S-Corporation ? Form 1120S, Page, 1, Line H, Box 2.

Write to us at the address where you filed your return, informing the Internal Revenue Service (IRS) of the name change. Note: The notification must be signed by the business owner or authorized representative.

To transfer EIN to new owner isn't possible. EINs, or Employer Identification Numbers, are not transferable from one business owner to another. There are circumstances in which a business owner may need a new EIN, however.

An LLC with 2 or more Members is, by default, taxed like a Partnership. You don't have to mail a special letter to the IRS to change your LLC name. Simply check off ?name change? at the top of Form 1065 when taxes are filed.

Generally, businesses need a new EIN when their ownership or structure has changed. Although changing the name of your business does not require you to obtain a new EIN, you may wish to visit the Business Name Change page to find out what actions are required if you change the name of your business.