A nonprofit corporation is one that is organized for charitable or benevolent purposes. These corporations include certain hospitals, universities, churches, and other religious organizations. A nonprofit entity does not have to be a nonprofit corporation, however. Nonprofit corporations do not have shareholders, but have members or a perpetual board of directors or board of trustees.

Examples Of Articles Of Incorporation For Nonprofit

Description

How to fill out Articles Of Incorporation For Non-Profit Organization, With Tax Provisions?

Legal administration can be daunting, even for seasoned professionals.

When you seek Examples Of Articles Of Incorporation For Nonprofit and find yourself unable to dedicate time to searching for the proper and up-to-date version, the procedures can become taxing.

Access a collection of articles, guides, and resources pertinent to your needs and situation.

Conserve time and effort in locating the documents you require, and take advantage of US Legal Forms' sophisticated search and Review feature to find Examples Of Articles Of Incorporation For Nonprofit and download it.

Select Buy Now when you're prepared, choose a monthly subscription plan, then select the format you desire and Download, complete, eSign, print, and dispatch your documents.

Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and dependability. Streamline your everyday document management with a straightforward and intuitive process today.

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to access the documents you have saved previously and manage your folders as needed.

- If this is your first time with US Legal Forms, create a free account for unlimited access to all platform benefits.

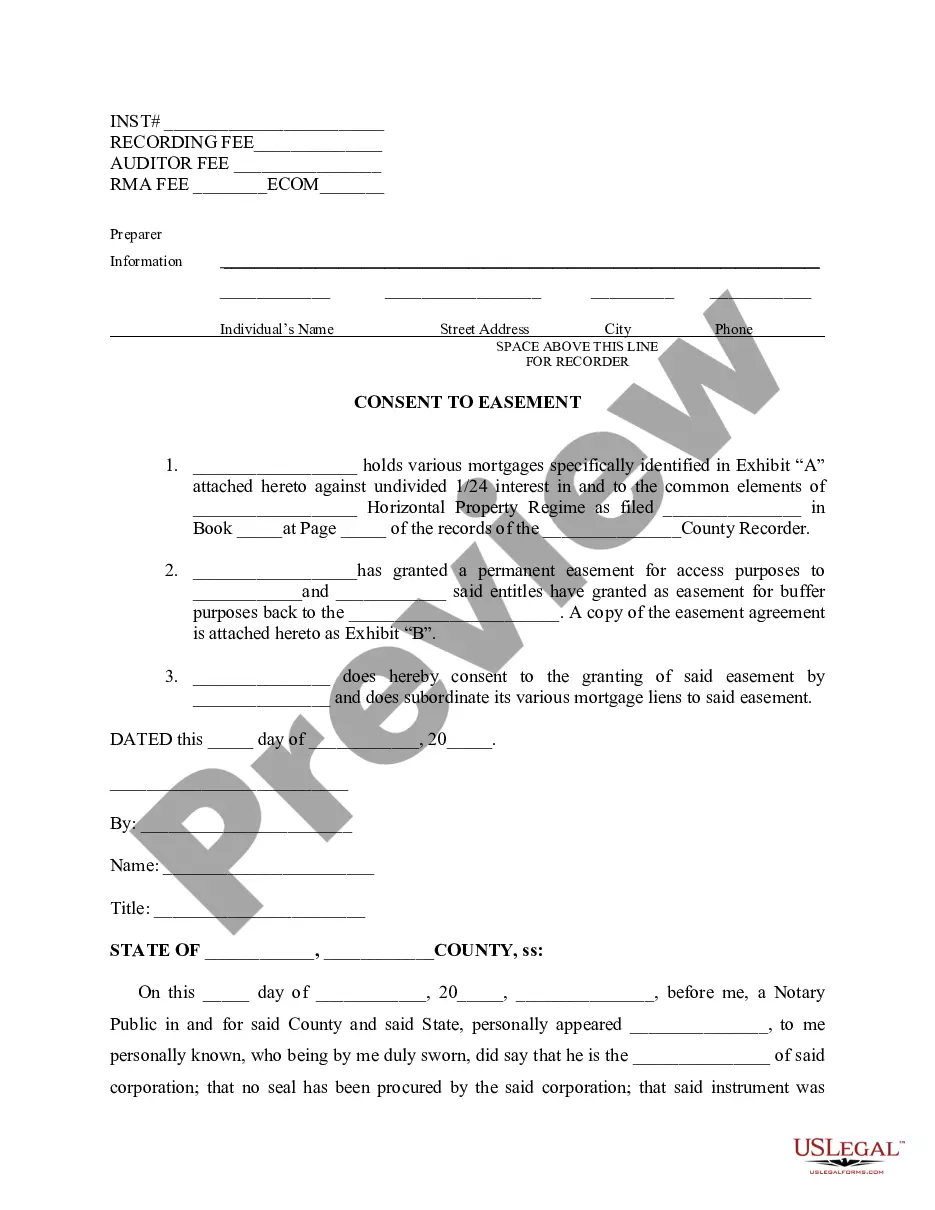

- After finding the needed form, ensure its validity by previewing it and reviewing its description.

- Confirm that the example is accepted in your state or county.

- A robust online form directory could transform the experience for anyone aiming to navigate these scenarios effectively.

- US Legal Forms stands as a frontrunner in digital legal documents, offering over 85,000 state-specific legal forms accessible to you at any moment.

- Utilize modern tools to complete and oversee your Examples Of Articles Of Incorporation For Nonprofit.

Form popularity

FAQ

While all 501(c)(3) organizations are non-profit corporations, not all non-profit corporations qualify as 501(c)(3) entities. A 501(c)(3) designation signifies that your organization is tax-exempt and meets IRS requirements for charitable purposes. To achieve this status, you must apply and provide specific documentation including your articles of incorporation. This distinction highlights the importance of understanding the legal pathways for your non-profit.

To create articles of incorporation for a nonprofit, start by gathering essential information about your organization. You'll need to include details such as your nonprofit's name, purpose, and the names of the initial board members. After drafting your articles, file them with your state's Secretary of State office. For further assistance, consider checking out US Legal Forms, where you can find examples of articles of incorporation for nonprofit organizations.

Comparing 3 Types of Partnerships in Business. There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP). A fourth, the limited liability limited partnership (LLLP), is not recognized in all states.

Types of Partnership Partnership at Will. Generally, the partnership deed has a clause regarding the expiration or dissolution of a partnership firm. ... Partnership for a Fixed Term. A partnership that is formed for a particular time period is known as a partnership for a fixed term. ... Particular Partnership.

Seven Characteristics of a Great Partnership Trust. Without trust there can be no productive conflict, commitment, or accountability. Common values. ... Chemistry. ... Defined expectations. ... Mutual respect. ... Synergy. ... Great two-way communications.

Provincial statutes in Canada recognize three types of partnerships: general partnerships; limited partnerships; and. limited liability partnerships.

Here are five types of business partnerships with useful information about each: General partnership. ... Limited partnership. ... Limited liability partnerships. ... Public private partnerships. ... Limited liability limited partnerships.

Among the most common types of partnerships are general partnerships (GP), limited partnerships (LP), and limited liability partnerships (LLP). A partnership can even start without an oral or written contract.

How to Write a Partnership Agreement Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.

How to form a Kansas General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? Name your Partnership. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.