Cohabitation Remaining Unmarried Form 1040

Description

How to fill out Cohabitation Remaining Unmarried Form 1040?

There's no further justification to squander hours searching for legal documents to adhere to your local state laws.

US Legal Forms has compiled all of them in one location and streamlined their availability.

Our platform offers over 85,000 templates for various business and personal legal situations categorized by state and usage area.

Utilize the search bar above to locate another sample if the current one is unsuitable.

- All forms are accurately prepared and confirmed for legitimacy, so you can have confidence in acquiring an up-to-date Cohabitation Remaining Unmarried Form 1040.

- If you are acquainted with our service and already possess an account, you must verify that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also retrieve all saved documents anytime needed by accessing the My documents tab in your profile.

- If you haven't interacted with our service previously, the process will require a few additional steps to finalize.

- Here's how new users can find the Cohabitation Remaining Unmarried Form 1040 in our collection.

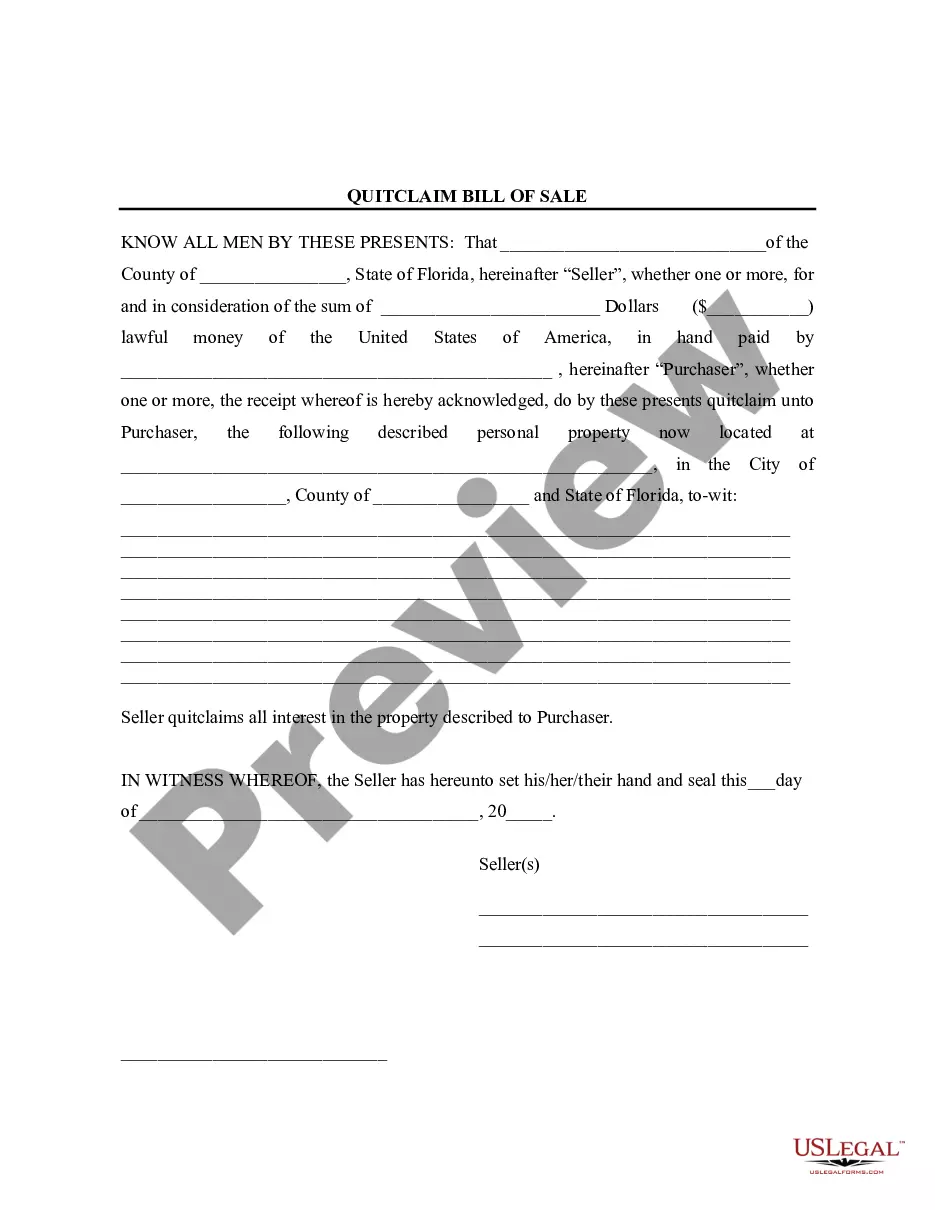

- Review the page content thoroughly to ensure it includes the sample you need.

- To assist with this, use the form description and preview options if available.

Form popularity

FAQ

The IRS considers you unmarried if you do not have a legal spouse as defined by tax law. This includes individuals who are living together as partners but have not formally married. When filing your taxes, it is crucial to understand how cohabitation remaining unmarried influences your Form 1040. By accurately understanding your status, you can take advantage of potential tax benefits and ensure compliance with IRS regulations.

To fill out line 16 on the 1040 form, enter the total amount of any other payments or credits you are claiming, such as earned income credit or additional child tax credit. It's important to verify that all numbers are accurate to avoid delays in processing your return. For individuals in cohabitation remaining unmarried situations, ensure you clearly understand how these credits apply to your unique tax situation. The uslegalforms platform can help you navigate these details effectively.

Line 6b on the 1040 form is calculated based on your total income, which includes wages, salaries, and other earnings. It's essential to accurately report all sources of income to ensure proper tax assessment. If you are in a cohabitation arrangement remaining unmarried, this income needs to reflect your true financial circumstances. You can use the uslegalforms platform to find guidance on correctly completing the Cohabitation remaining unmarried form 1040.

You generally cannot claim your girlfriend on your taxes unless she meets specific criteria, akin to those for qualifying dependents. To qualify, she would need to meet several requirements including residency and income limits. Make sure to review the IRS regulations or consult a tax professional for accurate information. The cohabitation remaining unmarried form 1040 can assist you in navigating these complexities.

Line 25 on the tax return typically varies based on the form you are using. On the Form 1040, it usually refers to nonrefundable credits. This detail is crucial in ensuring taxes owed are calculated accurately. You might find further guidance with the cohabitation remaining unmarried form 1040 to help understand how this affects your overall tax situation.

Claiming your girlfriend as a dependent is possible if she meets the IRS criteria, including living with you and not having significant income. It's crucial to evaluate her situation against these rules to confirm eligibility. This could potentially lower your tax bill. For couples in cohabitation, utilizing the cohabitation remaining unmarried form 1040 can clarify these options.

If you and your partner live together but are not married, you will typically file as single. It is essential to report your respective incomes and understand what deductions or credits you both may qualify for. Consider consulting with a tax professional who can guide you through your unique situation. The cohabitation remaining unmarried form 1040 can be a helpful resource for you.

You generally cannot claim your unmarried partner as a dependent unless they qualify under special criteria. However, you may benefit from filing taxes together if you share dependent children or specific living expenses. Always check the latest the IRS guidelines, as tax laws change. Utilizing the cohabitation remaining unmarried form 1040 might provide clarity on how to manage your tax filings.

Line 25 on 1040 Schedule 1 is for reporting additional income, such as unemployment compensation or other taxable income not reported elsewhere. It's important to accurately complete this line to reflect your total income correctly. Efficiently managing this part can help you avoid future audits. Leveraging the cohabitation remaining unmarried form 1040 can streamline this process.

You cannot claim your girlfriend as a dependent unless she meets specific criteria, such as living with you for the entire year and having limited income. Generally, the dependent exemption has been eliminated through 2025, but you may qualify for tax credits. If you meet the requirements, calculate any potential benefits carefully. Also, consider how cohabitation remaining unmarried form 1040 can work for your joint tax situation.