Assignment On Bank Company Act 1991

Description

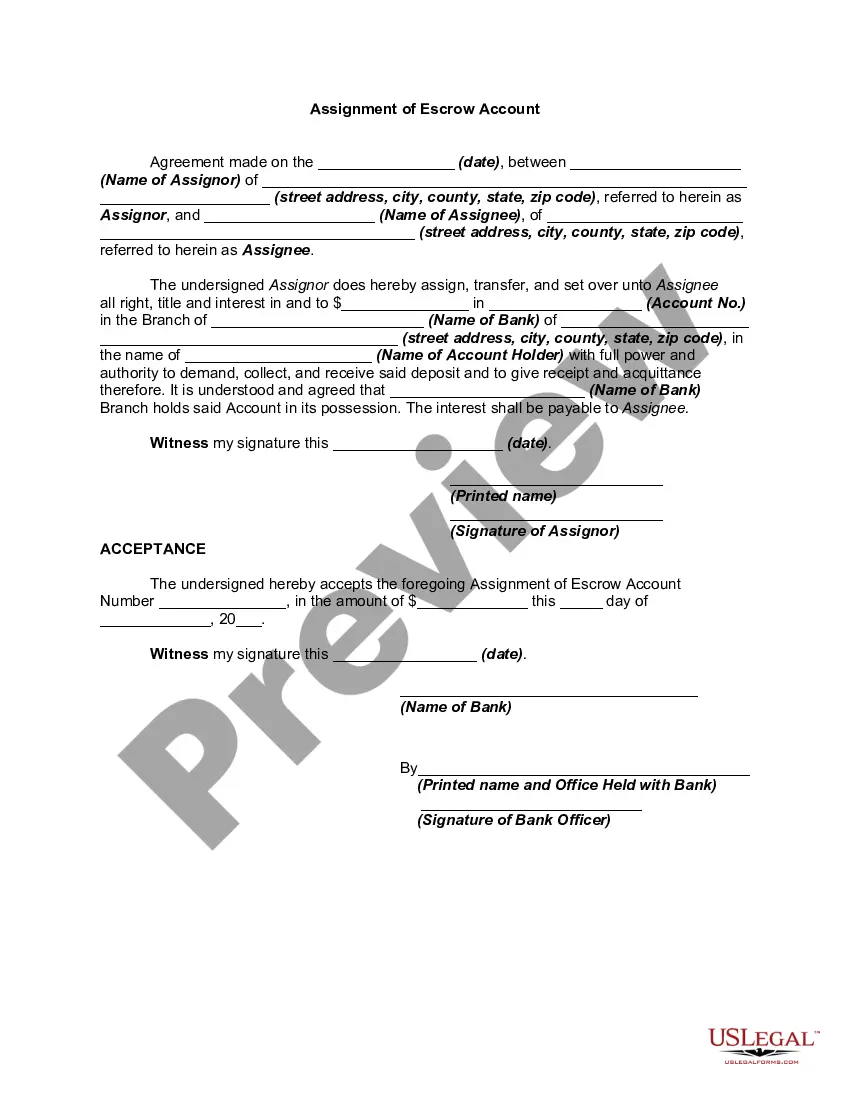

How to fill out Assignment Of Bank Account?

Engaging with legal paperwork and protocols can be a lengthy addition to your schedule.

Tasks related to the Bank Company Act 1991 and similar forms frequently necessitate searching for them and comprehending the most effective way to finalize them proficiently.

Consequently, whether you are managing financial, legal, or personal affairs, having a comprehensive and user-friendly online directory of forms readily available will be immensely beneficial.

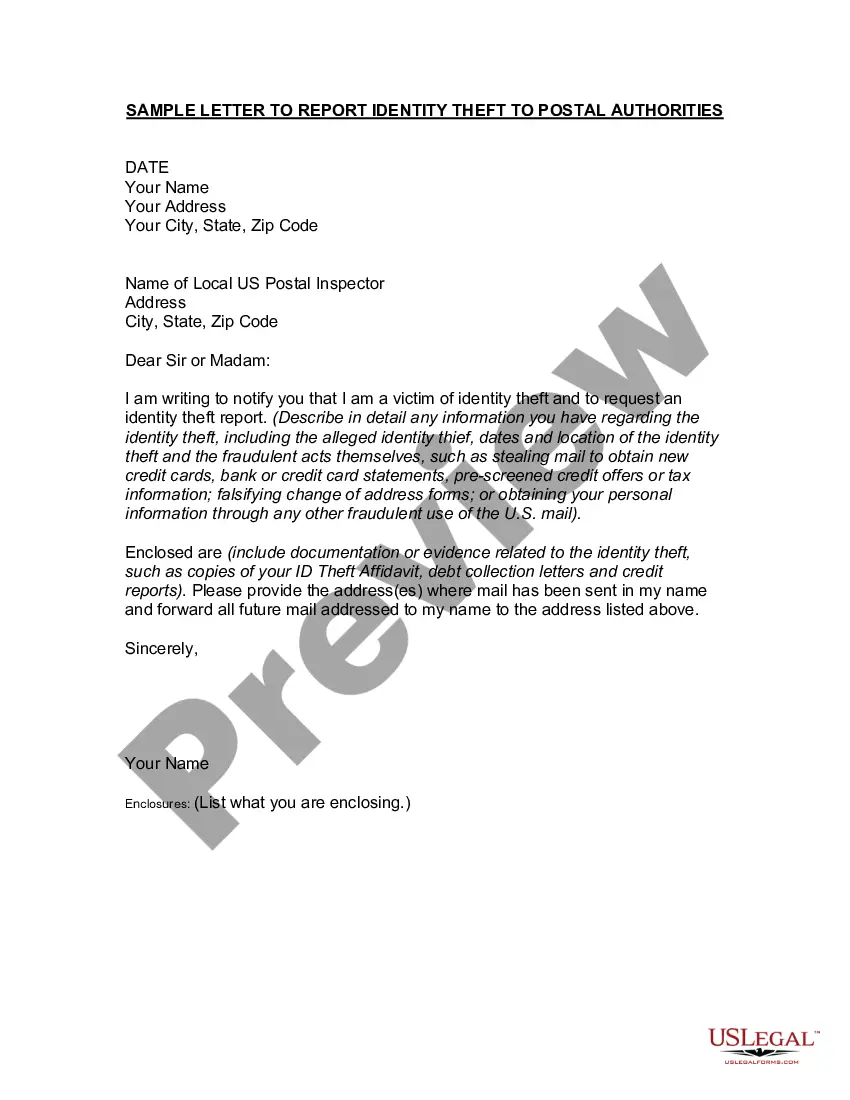

US Legal Forms is the premier online platform for legal templates, offering over 85,000 state-specific forms and various tools that will assist you in completing your documents with ease.

Simply Log In to your account, locate the Assignment On Bank Company Act 1991, and obtain it promptly from the My documents section. You can also access previously saved forms.

- Browse the collection of relevant documents accessible to you with just a single click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Protect your document management processes by utilizing a high-quality service that enables you to assemble any form within moments at no extra or concealed cost.

Form popularity

FAQ

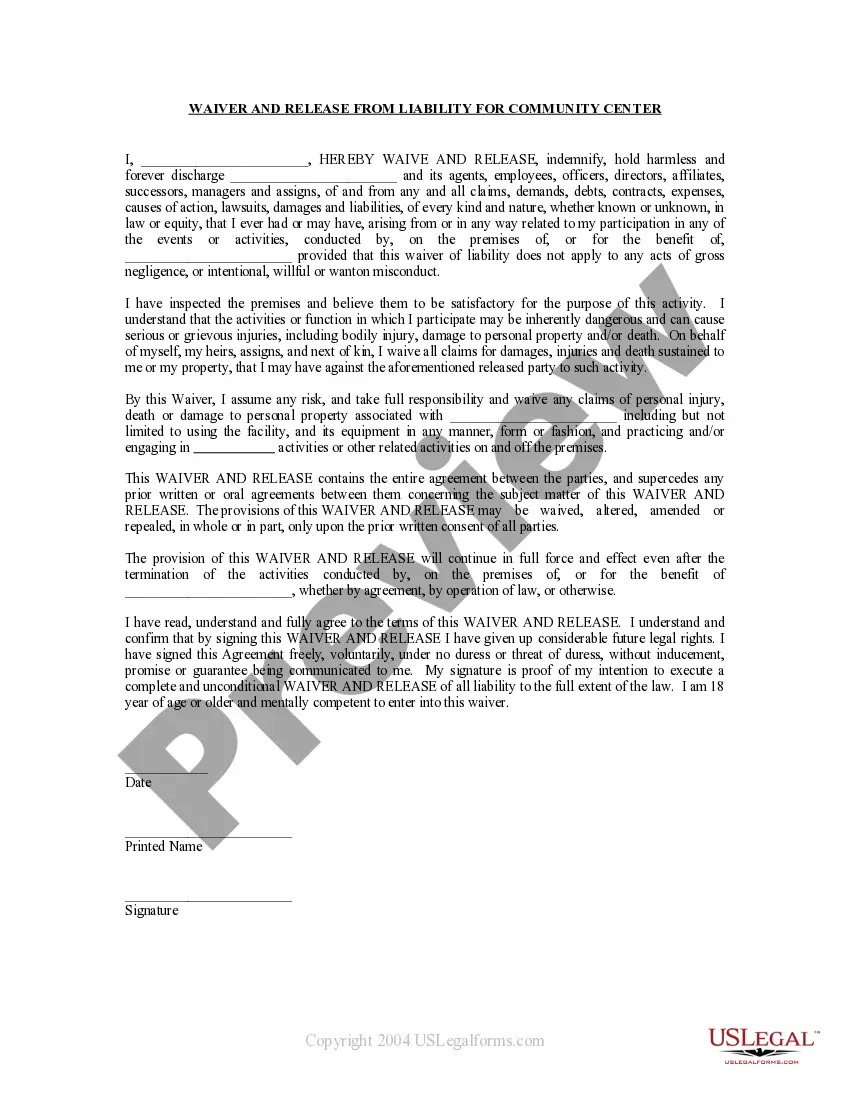

The provisions of the Banking Regulation Act encompass various rules that govern banking in India. It covers aspects such as the licensing of banks, management, and financial obligations. A thorough understanding of these provisions is crucial for anyone delving into the Assignment on bank company act 1991, as they provide the legal structure that supports banking operations.

Section 7 of the BSCA requires depository institutions to notify, in writing, their respective federal banking agency of contracts or relationships with service providers that provide certain services.

Although banks do many things, their primary role is to take in funds?called deposits?from those with money, pool them, and lend them to those who need funds. Banks are intermediaries between depositors (who lend money to the bank) and borrowers (to whom the bank lends money).

Mr. Speaker, the Banking Services Act permits a Deposit Taking Institution with the approval of the Supervisory Committee, to appoint an agent through which one or more of the banking services listed in that Act, will be offered.

In a recent circular, desh Bank has announced that new commercial banks are now required to have a minimum paid-up capital of Tk 5.0 billion. The central bank issued the circular on Thursday, June 15. Previously, the minimum paid-up capital requirement for a new bank was Tk 4.0 billion.

?Notwithstanding anything contained in section 6, no banking company shall hold any immovable property howsoever acquired, except such as is required for its own use, for any period exceeding seven years from the acquisition thereof or from the commencement of this Act, whichever is later or any extension of such ...