Small Business Inventory Forum

Description

How to fill out Checklist - Small Business Legal Compliance Inventory?

The Small Business Inventory Document you see on this site is a versatile legal template formulated by expert attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal experts more than 85,000 validated, state-specific forms for various business and personal needs. It’s the fastest, simplest, and most reliable means to acquire the documentation you require, as the service ensures bank-level data protection and anti-malware measures.

Register for US Legal Forms to have validated legal templates available for all of life's situations at your fingertips.

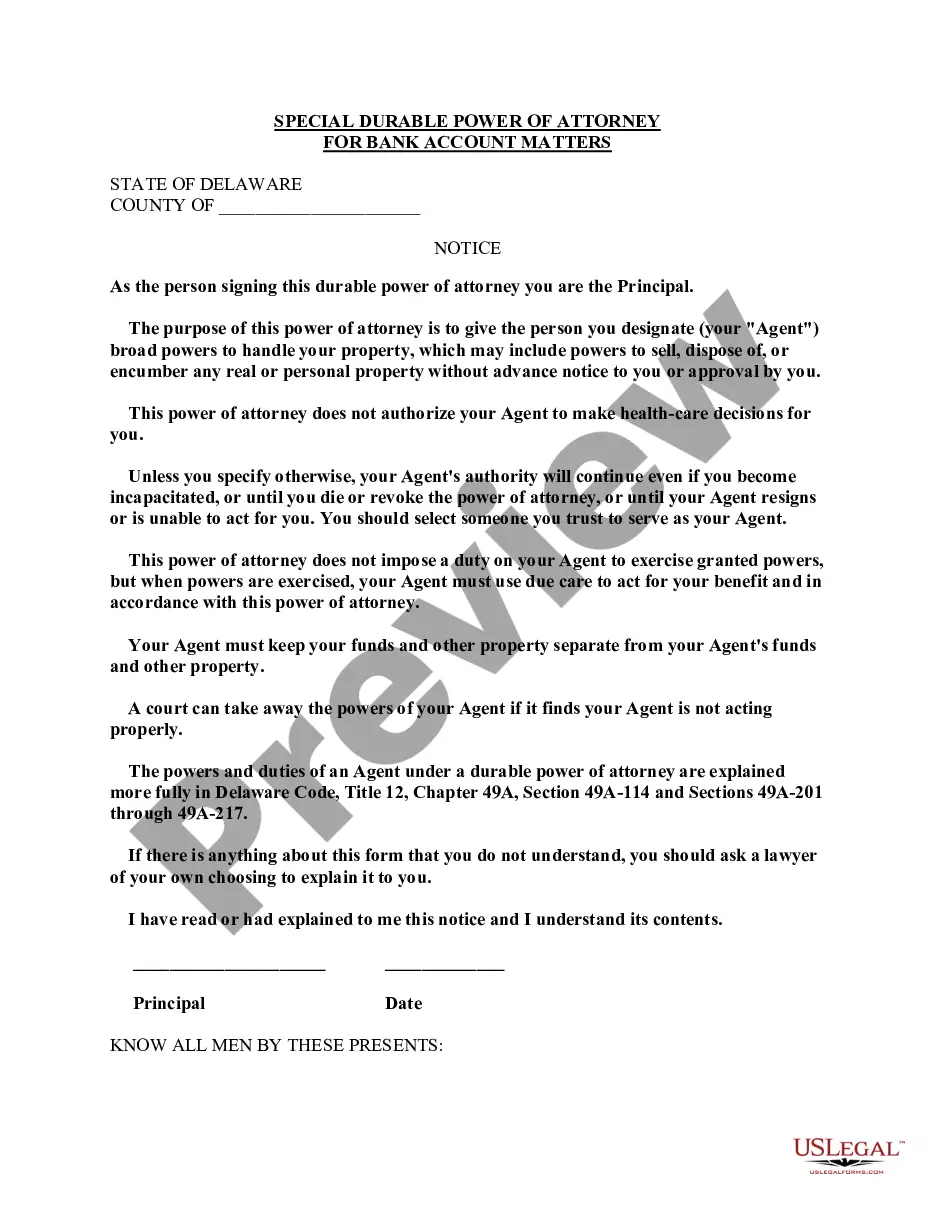

- Search for the document you need and assess it.

- Browse through the example you looked for and preview it or review the form description to confirm it meets your requirements. If it does not, utilize the search functionality to locate the correct one. Click Buy Now when you have found the template you need.

- Choose and sign in.

- Select the pricing option that fits you and create an account. Make a quick payment using PayPal or a credit card. If you already possess an account, Log In and review your subscription to continue.

- Get the editable template.

- Select the format you prefer for your Small Business Inventory Document (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the documentation.

- Print the template to fill it out by hand. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill out and sign your form with a valid signature.

- Download your documents again.

- Utilize the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously downloaded documents.

Form popularity

FAQ

You begin by calculating the cost-to-retail ratio, which is the cost of goods available for sale divided by their retail value. Multiply this ratio by the difference between the retail value of goods available for sale and total sales for the period. The result is an estimate of the cost of ending inventory.

Inventory carrying cost is the amount of money your business spends to keep products in stock over time, including expenses for warehousing, inventory control, insurance, and more. Your inventory holding cost should range from 20% to 30%, depending on your industry.

Businesses generally must use inventories for income tax purposes when necessary to clearly reflect income. To clearly reflect income, businesses must take inventories at the beginning and end of each tax year in which the production, purchase or sale of merchandise is an income-producing factor.

How to write an inventory report Create a column for inventory items. Similar to an inventory sheet template, create a list of items in your inventory using a vertical column. ... Create a column for descriptions. ... Assign a price to each item. ... Create a column for remaining stock. ... Select a time frame.

Inventory refers to all the items, goods, merchandise, and materials held by a business for selling in the market to earn a profit. Example: If a newspaper vendor uses a vehicle to deliver newspapers to the customers, only the newspaper will be considered inventory. The vehicle will be treated as an asset.