Section 179 Depreciation Schedule

Description

How to fill out Depreciation Worksheet?

Accessing legal document samples that comply with federal and state regulations is essential, and the internet provides numerous options to choose from.

However, what's the purpose of spending time searching for a properly drafted Section 179 Depreciation Schedule sample online when the US Legal Forms digital library already has such templates gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates created by attorneys for any business and personal situation. They are simple to navigate with all files categorized by state and intended use.

Utilize the search function at the top of the page to find another sample if needed. Hit Buy Now once you've found the appropriate form and select a subscription plan. Set up an account or Log In and finalize your payment with PayPal or a credit card. Choose the most suitable format for your Section 179 Depreciation Schedule and download it. All documents accessed through US Legal Forms are reusable. To re-download and complete forms previously acquired, navigate to the My documents section in your profile. Enjoy the most comprehensive and user-friendly legal documentation service!

- Our professionals keep up with legislative updates, so you can be confident that your documents are current and compliant when obtaining a Section 179 Depreciation Schedule from our site.

- Acquiring a Section 179 Depreciation Schedule is swift and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the sample document you require in your desired format.

- If you are new to our website, follow the instructions below.

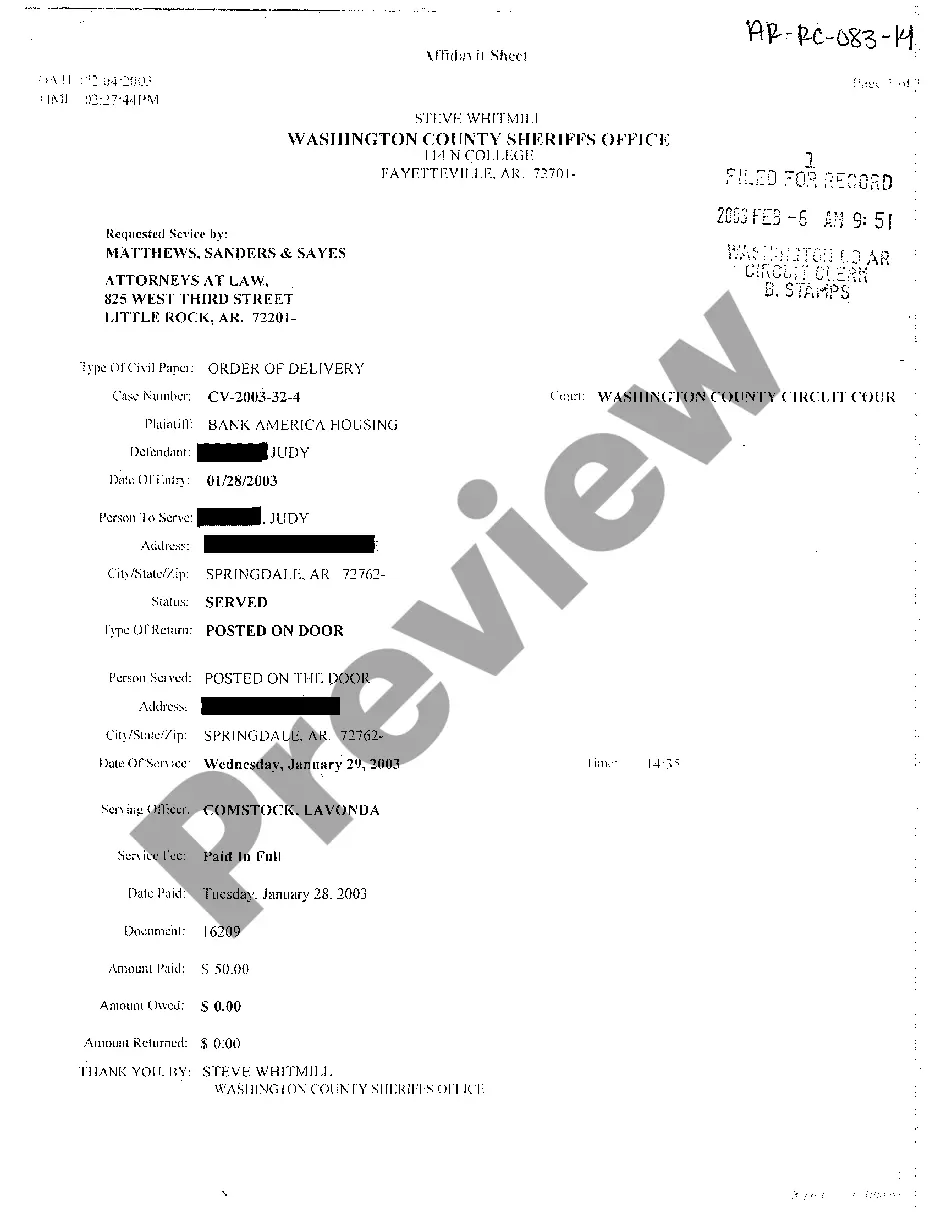

- Examine the template using the Preview feature or through the text description to ensure it suits your requirements.

Form popularity

FAQ

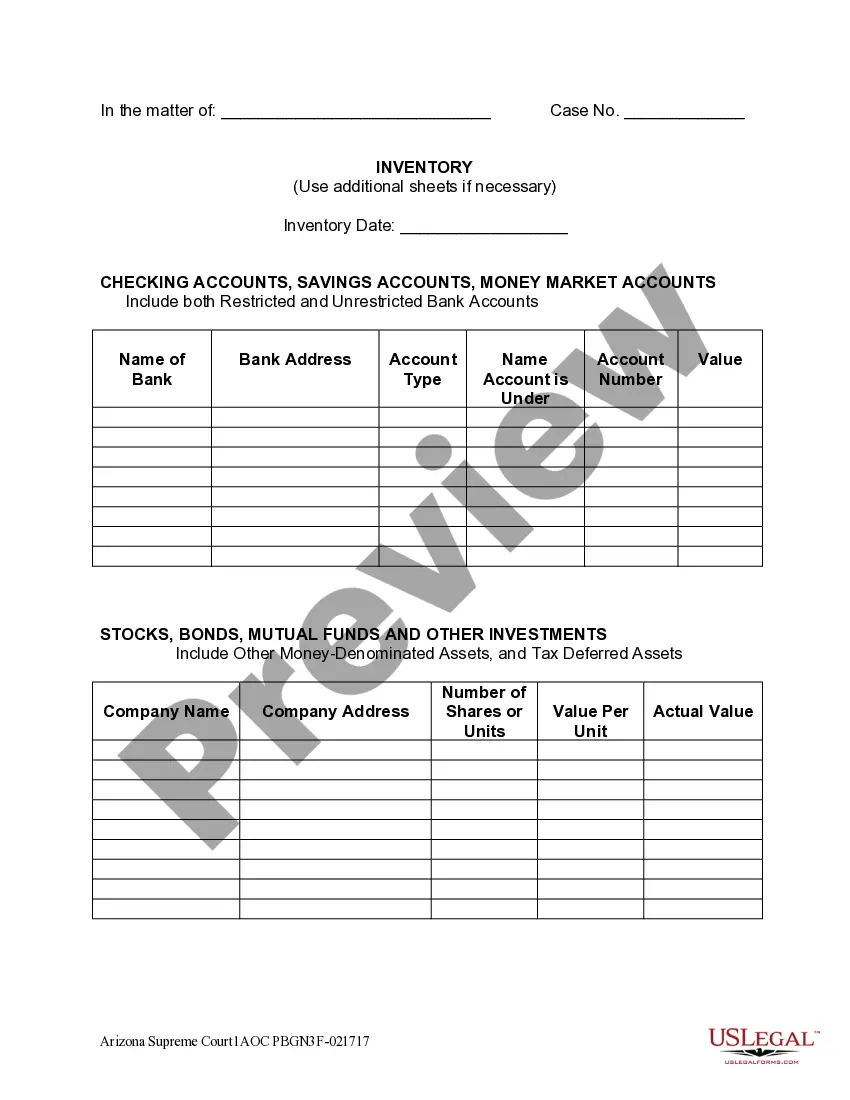

What do you need to fill out Form 4562 The price of the asset you're depreciating. A receipt for the asset you're depreciating. The date the asset was put into use (when you started using it for your business) The total income you're reporting for the year in question.

Yes, Section 179 can be used every year. It was made a permanent part of our tax code with the Protecting Americans from Tax Hikes Act of 2015 (PATH Act). How can I calculate the potential savings that the Section 179 Deduction will have on my next purchase?

The Section 179 expense limit and phase-out threshold (inflation-adjusted to $1,160,000 and $2,890,000, respectively, for 2023) are now permanent parts of the tax code.

A company can take both Section 179 and Bonus Depreciation allowances, but Section 179 must be applied first, and any amount over the $1,160,000 limit to Section 179 may then be taken in bonus depreciation. Effective 1/1/23, any property placed into service is no longer eligible for 100% bonus depreciation.

In 2023, the Section 179 deduction limit has been raised to $1,160,000 (an increase of $80,000 from 2022). This means your business can now deduct the entire cost of qualified equipment up to a total equipment purchase limit of $2.8 million.