This Depreciation Worksheet is a template used by companies for creating a worksheet to evaluate depreciation expenses. The Depreciation Worksheet organizes and outlines a company's depreciation expenses and can be customized for a company's specific usage.

Depreciation Worksheet Form For Rental Property

Description

How to fill out Depreciation Worksheet?

Obtaining legal document samples that meet the federal and local laws is essential, and the internet offers numerous options to pick from. But what’s the point in wasting time looking for the appropriate Depreciation Worksheet Form For Rental Property sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal case. They are easy to browse with all papers grouped by state and purpose of use. Our experts keep up with legislative updates, so you can always be confident your paperwork is up to date and compliant when getting a Depreciation Worksheet Form For Rental Property from our website.

Obtaining a Depreciation Worksheet Form For Rental Property is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, adhere to the steps below:

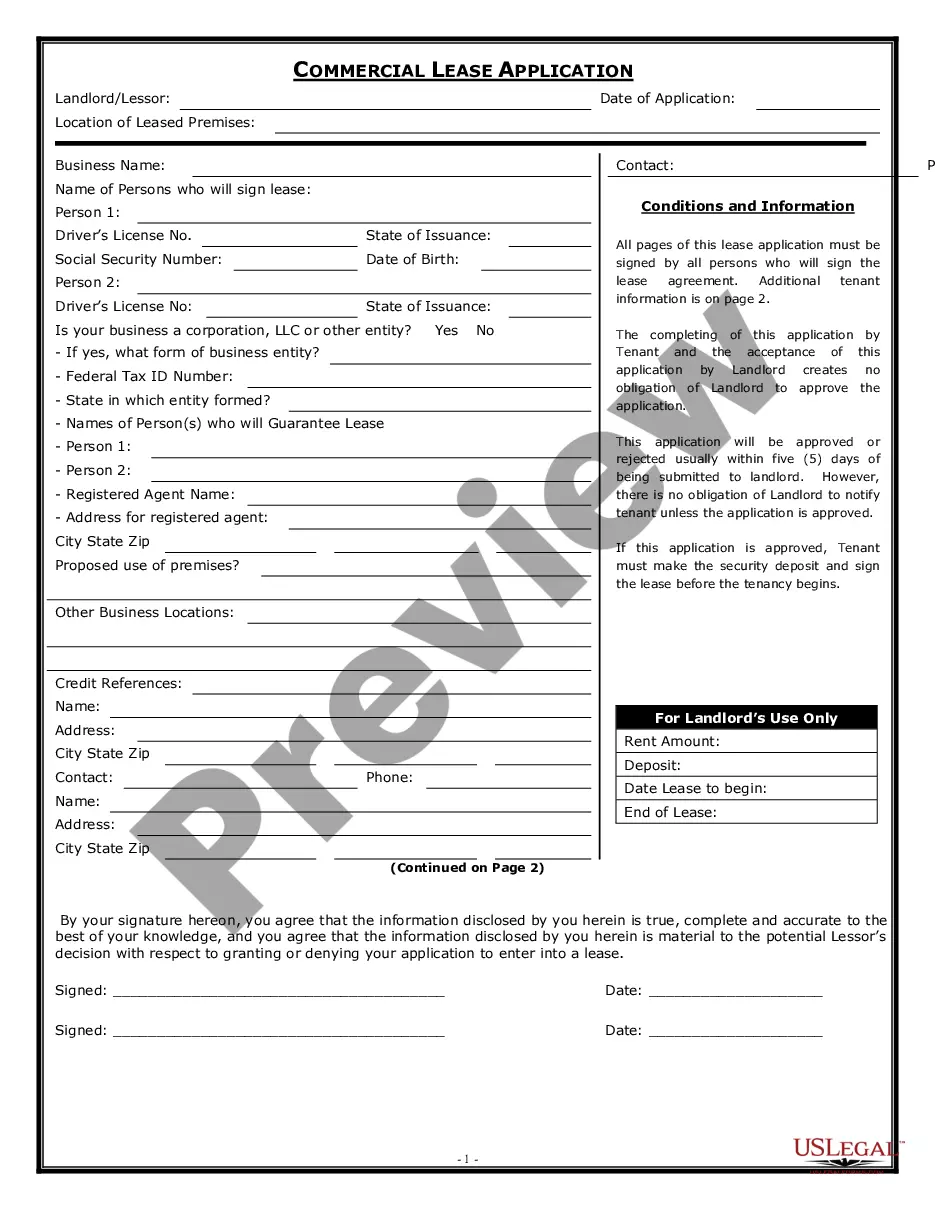

- Examine the template using the Preview option or via the text description to ensure it fits your needs.

- Locate a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and select a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Depreciation Worksheet Form For Rental Property and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and fill out previously saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

To calculate the annual amount of depreciation on a property, you'll divide the cost basis by the property's useful life. In our example, let's use our existing cost basis of $206,000 and divide by the GDS life span of 27.5 years. Your depreciation would be $7,490.91 per year, or 3.6% of the loan amount.

More In Forms and Instructions Use Form 4562 to: Claim your deduction for depreciation and amortization. Make the election under section 179 to expense certain property.

IRS Form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. Assets such as buildings, machinery, equipment (tangible), or patents (intangible) qualify. Land cannot depreciate, and so it can not be reported on the form.

Form 4562 is required for the first year that a depreciable asset is placed into service. If no new assets have been placed into service in subsequent years, Form 4562 is not required unless you filed form 1120 (corporate tax return). Form 4562 must also be filed for each asset.

In this case, the calculation would be: $400,000 (purchase price) ? $100,000 (land value) = $300,000 (building value) $300,000 (building value) / 27.5 (years) = $10,909 a year in depreciation. In other words, the client could reduce their taxable rental income by $10,909 annually.