Tenant Credit Check

Description

How to fill out Checklist For Screening Residential Tenants?

- If you're a returning user, log in to your account and locate the tenant credit check form. Click the Download button to save it to your device. Ensure your subscription is active; if not, renew it as per your payment plan.

- For first-time users, begin by browsing the available forms. Utilize the Preview mode to verify the suitability of the tenant credit check form that aligns with your jurisdiction's requirements.

- If the current form doesn’t meet your needs, use the Search tab to find alternatives that may better suit your criteria.

- Select the desired document by clicking on the Buy Now button and choose a subscription plan that fits your needs. Create an account to access the extensive library of resources.

- Complete your transaction by entering your payment details, either through credit card or PayPal.

- Once purchased, download the template directly to your device, ensuring easy access from the My Forms section of your profile.

Finalizing a tenant credit check is straightforward with US Legal Forms. By following these steps, you can secure the necessary documentation efficiently.

Don't hesitate—visit US Legal Forms today to explore our extensive legal library and ensure your tenant screening process is thorough and compliant.

Form popularity

FAQ

Rent payments typically do not count towards credit scores because they are not reported to credit bureaus by default. This lack of reporting can disadvantage responsible tenants. By utilizing tenant credit check services like those from US Legal Forms, tenants can ensure their on-time rent payments are reported, allowing them to benefit from their rental history on their credit reports.

Absolutely, reporting rent to credit bureaus can significantly benefit tenants. It provides a way to build credit history, especially for those who may not have traditional credit accounts. With services like US Legal Forms, you can easily document and report this information as part of your tenant credit check process, which can pave the way for better financial opportunities in the future.

If you believe your landlord has unfairly treated your rental payments, you can report this to the credit bureaus. You will need to collect evidence of your rental history and any agreements made. Leveraging the resources of US Legal Forms can simplify this process and guide you through the necessary steps to ensure your tenant credit check reflects your rental history accurately.

Reporting your tenant's rent to the credit bureau is a straightforward process. By utilizing services that specialize in tenant credit checks, you can submit the rental payment history directly to the relevant bureaus. US Legal Forms offers resources and tools that make this reporting seamless, ensuring that you can help your tenant build their credit effectively.

Yes, self-rent reporting is a legitimate practice that allows tenants to have their rental payments reported to credit bureaus. This can enhance their credit profile and improve their chances of securing loans in the future. By using platforms like US Legal Forms, tenants can easily report their payments, boosting their credit score while also benefiting from transparent records.

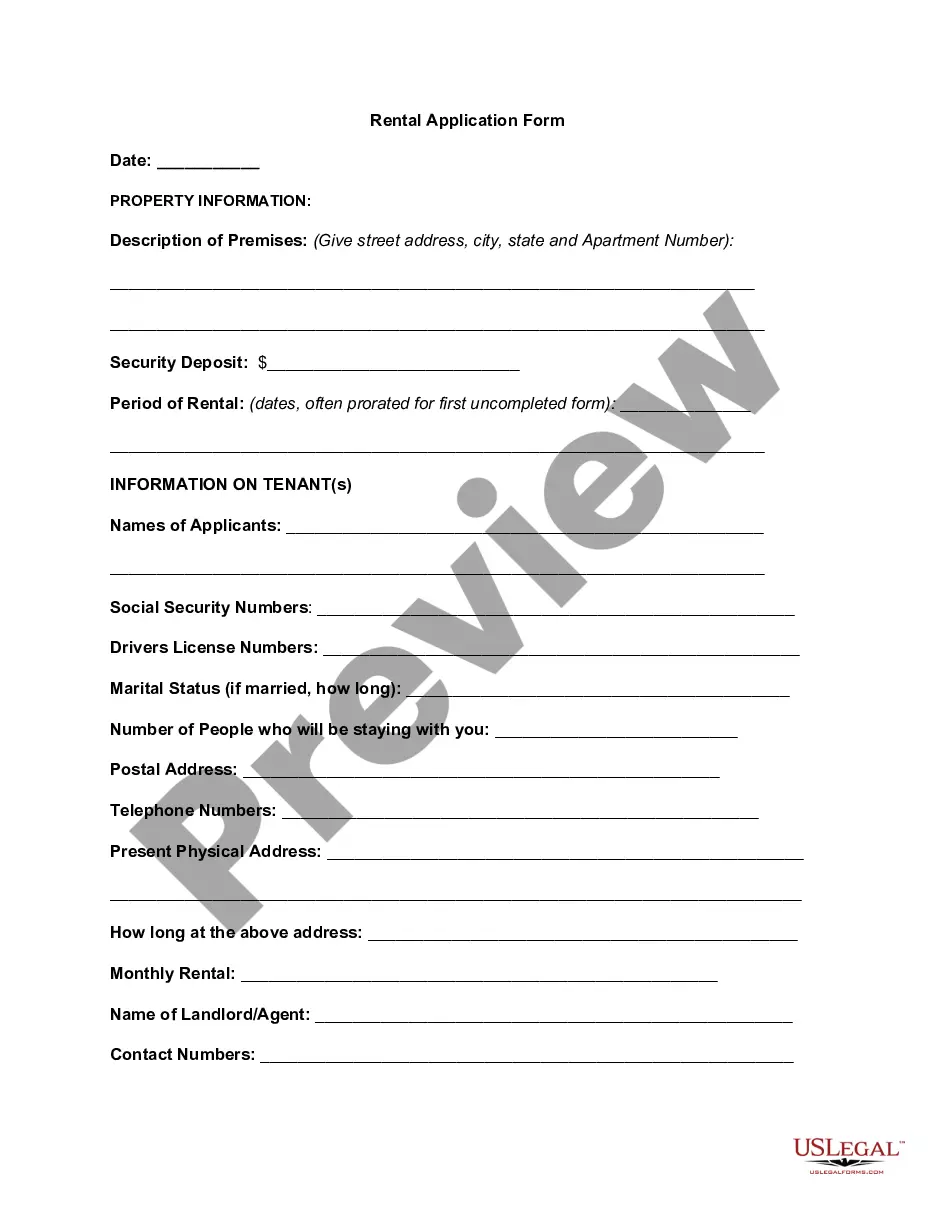

To obtain a tenant credit check, start by gathering essential information about the prospective tenant, such as their name, social security number, and date of birth. Next, choose a reliable service that specializes in tenant screening, like US Legal Forms, which offers comprehensive credit checks. Simply create an account on their platform, submit the required information, and you will receive detailed credit reports. This process helps you make informed decisions about potential renters while ensuring your rental property remains secure.

Running a credit check on someone involves using an authorized tenant credit check service that complies with legal requirements. First, obtain the individual's consent to access their credit information, which is essential for compliance with laws. Once you have their consent, input their details into the service to generate the credit report. This practice provides valuable insights into their financial history and aids in making sound decisions.

To perform a credit check for a tenant, start by gathering their full name, Social Security number, and consent to conduct the check. Next, choose a reputable tenant credit check service that meets your needs. Input the tenant's details into the service and review the generated report. This information helps you assess their financial responsibility and ensures a smoother rental process.

Most landlords use tenant credit check services that provide comprehensive reports from major credit bureaus. These services allow you to view a potential tenant's credit score, payment history, and any outstanding debts. By utilizing these check credit tools, landlords can make informed decisions when selecting tenants. Using a reliable service protects both landlords and tenants by promoting transparency.

To put a tenant on your credit report, you need to use a tenant credit check service that reports to credit bureaus. Start by obtaining their consent before you run a credit check, as this is a legal requirement. Once you have their permission, you can input their information into the service, which will then report any payment history. This process helps ensure that tenants understand the significance of their credit standing.