Church Promissory Note Without Interest Tax Implications

Description

How to fill out Promissory Note College To Church?

When you are required to fulfill Church Promissory Note Without Interest Tax Consequences according to your regional state's statutes and guidelines, there are multiple alternatives available.

There's no necessity to scrutinize every document to ensure it meets all the legal requirements if you possess a US Legal Forms membership. It is a trustworthy resource that can assist you in acquiring a reusable and current template on any subject.

US Legal Forms is the most comprehensive online repository with a collection of over 85,000 ready-to-use papers for business and personal legal matters. All templates are authenticated to conform to each state's statutes.

Select the most suitable pricing plan, Log In to your account, or establish a new one. Pay for a subscription (PayPal and credit card options are offered). Download the template in your preferred file format (PDF or DOCX). Print the document or fill it out digitally using an online editor. Acquiring professionally crafted official documentation becomes effortless with US Legal Forms. Moreover, Premium users can also benefit from the robust integrated tools for online document modification and signing. Give it a try today!

- Consequently, when retrieving Church Promissory Note Without Interest Tax Consequences from our site, you can rest assured that you have a legitimate and updated document.

- Obtaining the essential sample from our platform is quite simple.

- If you already possess an account, just Log In to the system, ensure your subscription is valid, and save the chosen file.

- Afterward, you can access the My documents tab in your profile and retrieve the Church Promissory Note Without Interest Tax Consequences at any time.

- If this is your first time using our library, please follow the directions below.

- Review the suggested page and verify it for alignment with your standards.

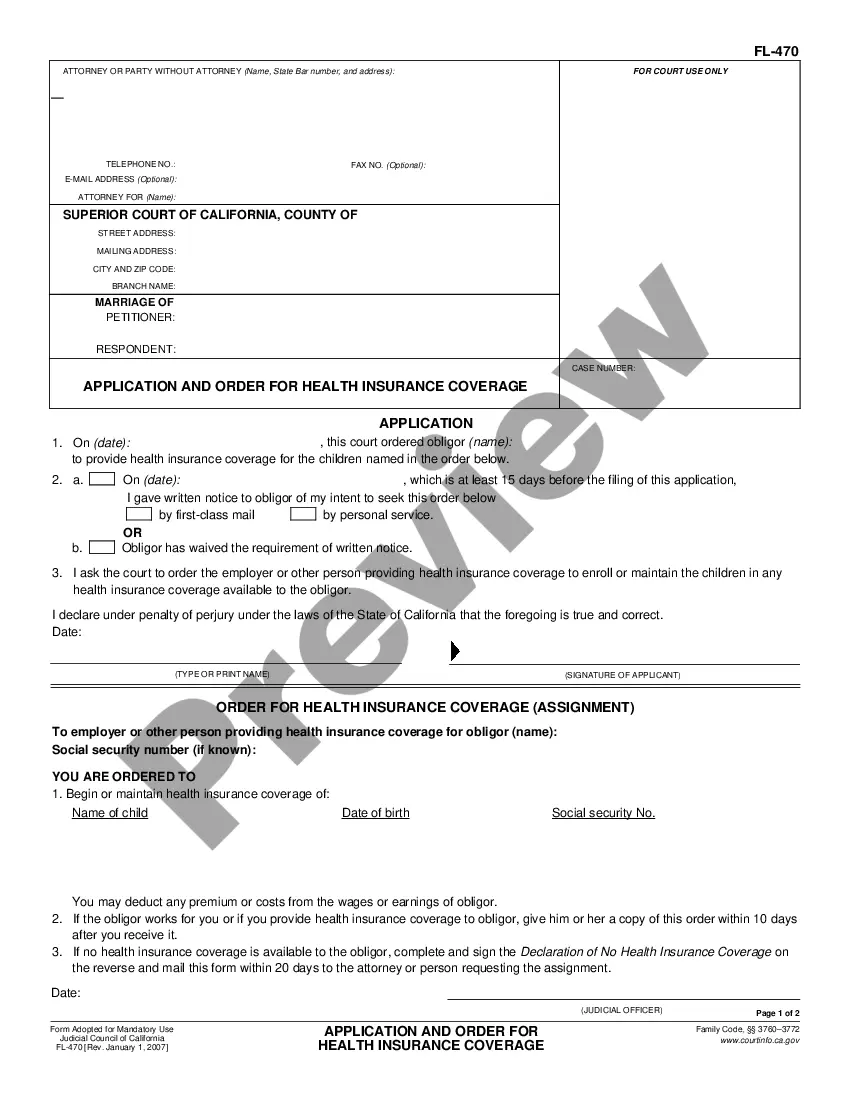

- Utilize the Preview mode and examine the form description if available.

- Search for another template via the Search field in the header if necessary.

- Click Buy Now once you identify the appropriate Church Promissory Note Without Interest Tax Consequences.

Form popularity

FAQ

A simple promissory note will state the full amount is due on the stated date; you won't need a payment schedule. You can decide whether to charge interest on the loan amount and include the interest in the document if needed.

Lenders can avoid imputed interest on below-market gift loans by keeping loans under $10,000.

Generally, any income you generate from a promissory note is taxable income and must be reported. The income generated is simply the interest you earned on the note for the tax year in question. If you lent the money personally rather than through your business, report the income on your personal income tax return.

If you are receiving the promissory interest, enter it as if you received form 1099-INT. In the Received from box, you may enter Promissory Note Interest Income and the name and any tax ID, if you have it. Only the amount is required however.

The buyer doesn't want to have to pay interest, and the seller feels funny asking for it, so they agree, no interest. Unfortunately, the IRS may impute interest received to the seller, even if the parties agreed to zero interest or a rate below the IRS' published rates.