Purchase Work For

Description

How to fill out Option And Acquisition Agreement In Literary Work Along With Motion Picture Rights, Television, Video And Electronic Reproduction And Distribution Rights?

It’s widely acknowledged that one cannot instantly become a legal expert, nor can one swiftly compose Purchase Work For without possessing specific expertise.

The process of creating legal documents is lengthy and requires distinct training and abilities. So why not entrust the development of the Purchase Work For to the experts.

With US Legal Forms, which boasts one of the most comprehensive libraries of legal templates, you can find everything from court paperwork to templates for internal communications.

If you require a different form, begin your search anew.

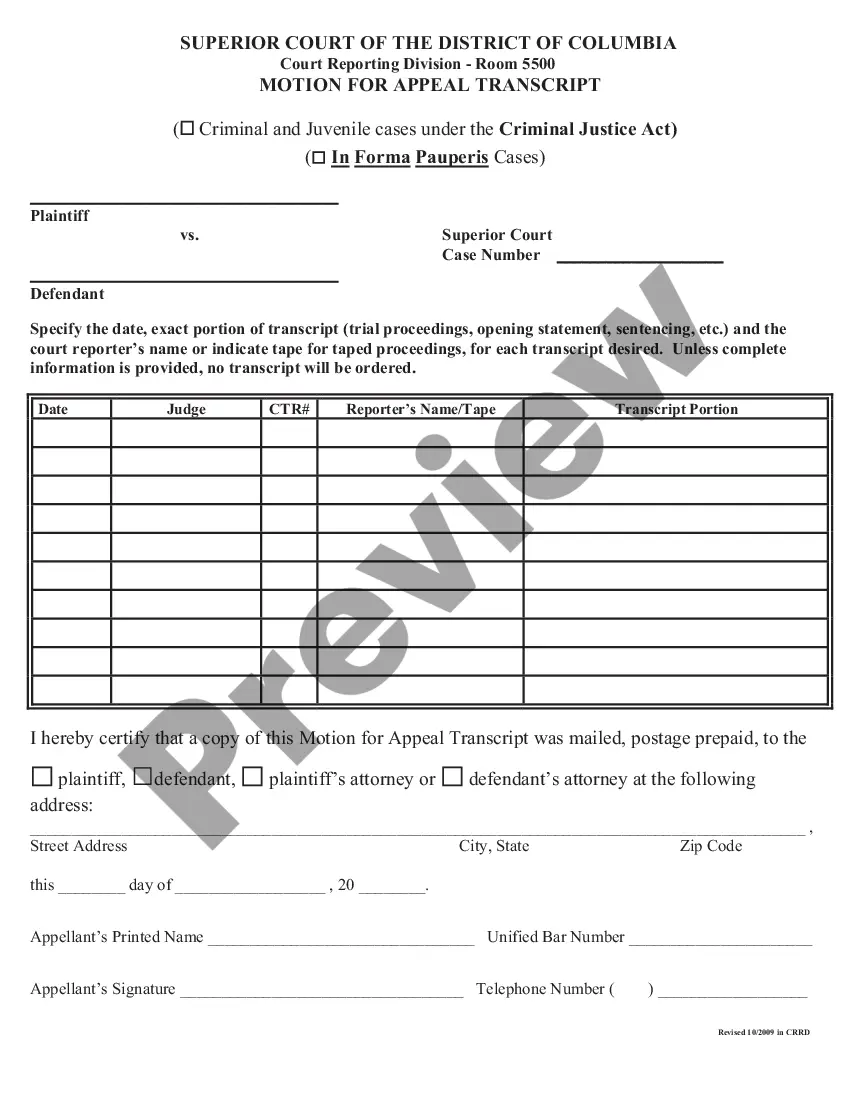

Create a free account and choose a subscription plan to purchase the form. Click Buy now. Once payment is finalized, you can download the Purchase Work For, complete it, print it, and deliver it via mail to the relevant individuals or organizations.

- We understand how crucial compliance and observance of federal and state laws and regulations are.

- That’s why, on our platform, all templates are tailored to specific locations and are current.

- Here’s how to start on our website and obtain the document you need in just a few minutes.

- Locate the form you require with the search bar at the page's top.

- View it (if this option is available) and read the accompanying description to determine if Purchase Work For is what you need.

Form popularity

FAQ

Your LLC will remain in ?Active? status if you complete the annual Franchise Tax and Public Information Report timely each year. Typically, these reports are due in May, with the option to file a 6-month extension.

An entity forfeited under the Tax Code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all franchise taxes, penalties, and interest, and (3) filing an application for reinstatement (Form 801 Word 178kb, PDF 87kb), ...

The only LLC renewal fee in Texas is the yearly taxes from your business revenues. Despite not having annual registration fees, you are obliged as an entity to submit franchise tax reports and public information reports to the Texas Comptroller.

In Texas, reinstating an LLC requires filing for either an Application for Reinstatement alongside a Set Aside Tax Forfeiture (form 801) or obtaining a Texas Certificate of Reinstatement (form 811) from the Texas Secretary of State.

This form is designed to provide a standardized amendment. form to effect a change of name for the filing entity. If the legal name of the entity is to be changed, state the new name of the entity in section 1.

How long does it take the Texas SOS to reinstate an LLC? The Texas Secretary of State's office typically processes filings in 5-7 business days. Expedited filings are usually processed in 1-2 business days.

How Much Will It Cost To Reinstate? LLC ? The filing fee for reinstating an administratively dissolved LLC in Texas is $75. Expedited service requires an additional $25. Corporation ? An administratively dissolved corporation in Texas has to pay $75 in order to be reinstated.

How Much Will It Cost To Reinstate? LLC ? The filing fee for reinstating an administratively dissolved LLC in Texas is $75. Expedited service requires an additional $25. Corporation ? An administratively dissolved corporation in Texas has to pay $75 in order to be reinstated.