Executor Release Form Saskatchewan

Description

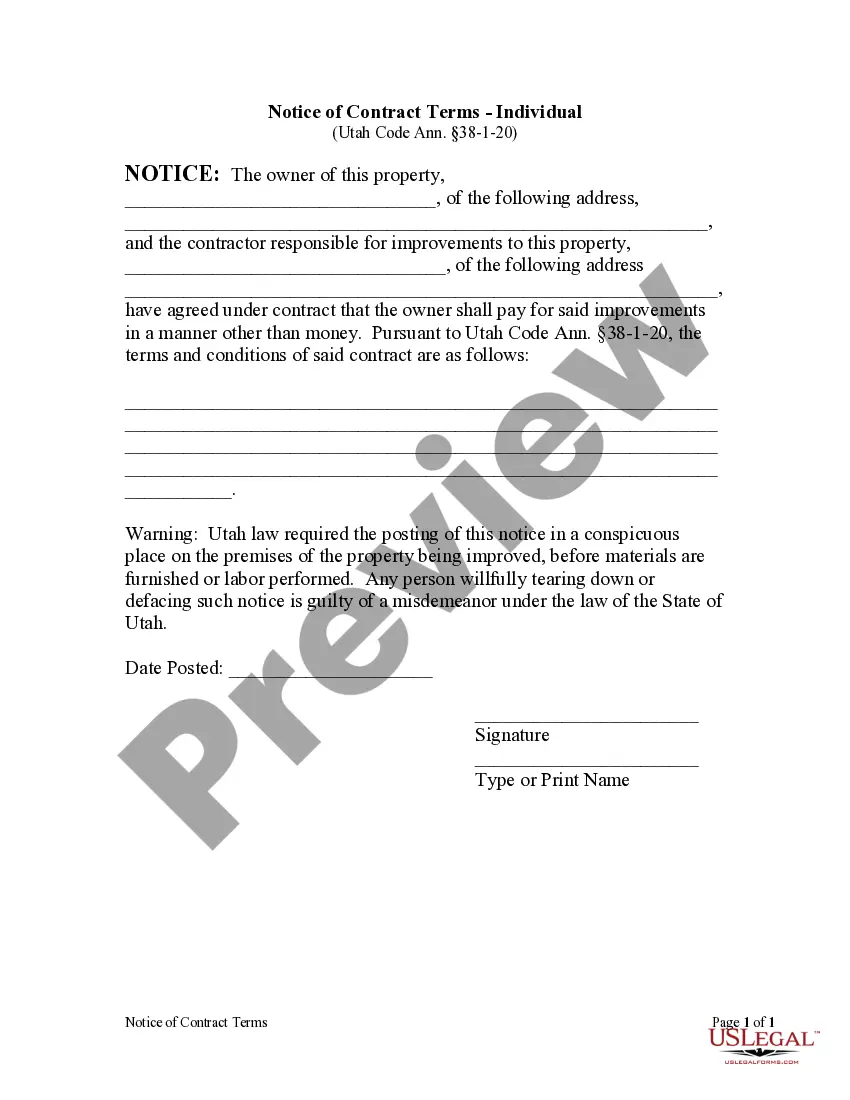

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

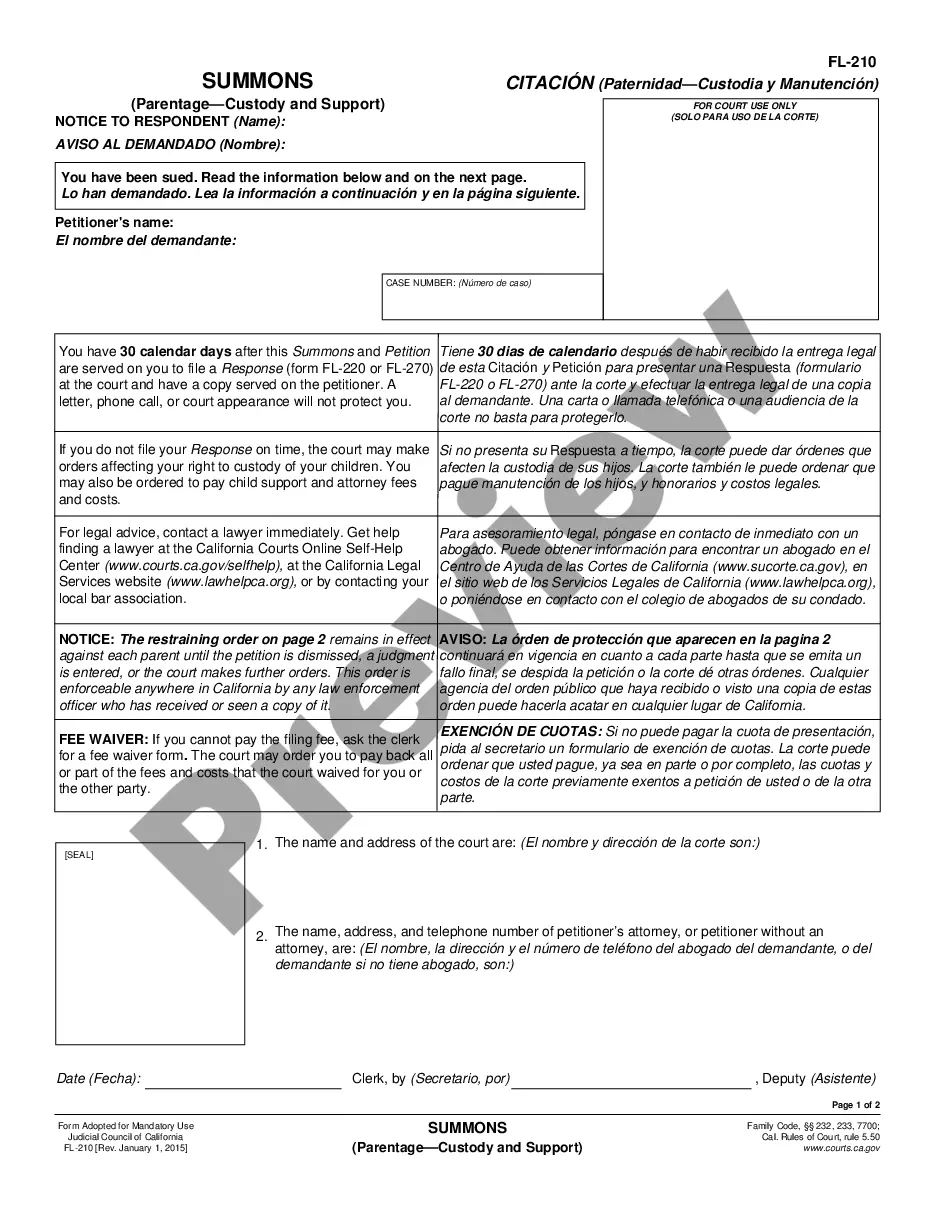

Drafting legal paperwork from scratch can sometimes be daunting. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a a simpler and more cost-effective way of preparing Executor Release Form Saskatchewan or any other paperwork without jumping through hoops, US Legal Forms is always at your disposal.

Our online collection of over 85,000 up-to-date legal documents covers virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-compliant forms diligently put together for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly find and download the Executor Release Form Saskatchewan. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes minutes to set it up and navigate the library. But before jumping directly to downloading Executor Release Form Saskatchewan, follow these tips:

- Review the form preview and descriptions to ensure that you are on the the form you are looking for.

- Check if template you select complies with the regulations and laws of your state and county.

- Choose the right subscription option to buy the Executor Release Form Saskatchewan.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us now and transform form execution into something easy and streamlined!

Form popularity

FAQ

Obtain a Copy of the Death Certificate The first responsibility of an estate executor is to obtain copies of the death certificate.

The Executor or Administrator is required by law to pass the accounts within two years of when Letters Probate or Letters of Administration were granted.

Keeping proper accounts An executor must account to the residuary beneficiaries named in the Will (and sometimes to others) for all the assets of the estate, including all receipts and disbursements occurring over the course of administration.

Some of the many tasks the executor needs to handle include: investing any significant surplus cash until the estate is finalized, helping to set up any trusts set out in the Will, cancelling CPP or QPP and other government benefits, handling the transfer of employment, health, pension and retiree benefits and ...

Fees commonly range from 2-5% of estate assets. All else being equal, the larger the estate, the smaller the percentage fee, and the more effort and results, the greater the percentage.