Executor Estate All Format

Description

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

Whether for commercial reasons or personal affairs, everyone must handle legal matters at some point in their lives.

Completing legal documents requires meticulous attention, starting with choosing the appropriate form template.

Once saved, you may fill out the form using editing software or print it and complete it by hand. With a comprehensive catalog of US Legal Forms available, you will never need to waste time searching for the correct template online. Utilize the library’s straightforward navigation to discover the right form for any situation.

- Find the template you require by utilizing the search bar or catalog browsing.

- Review the form’s details to ensure it fits your circumstances, region, and locality.

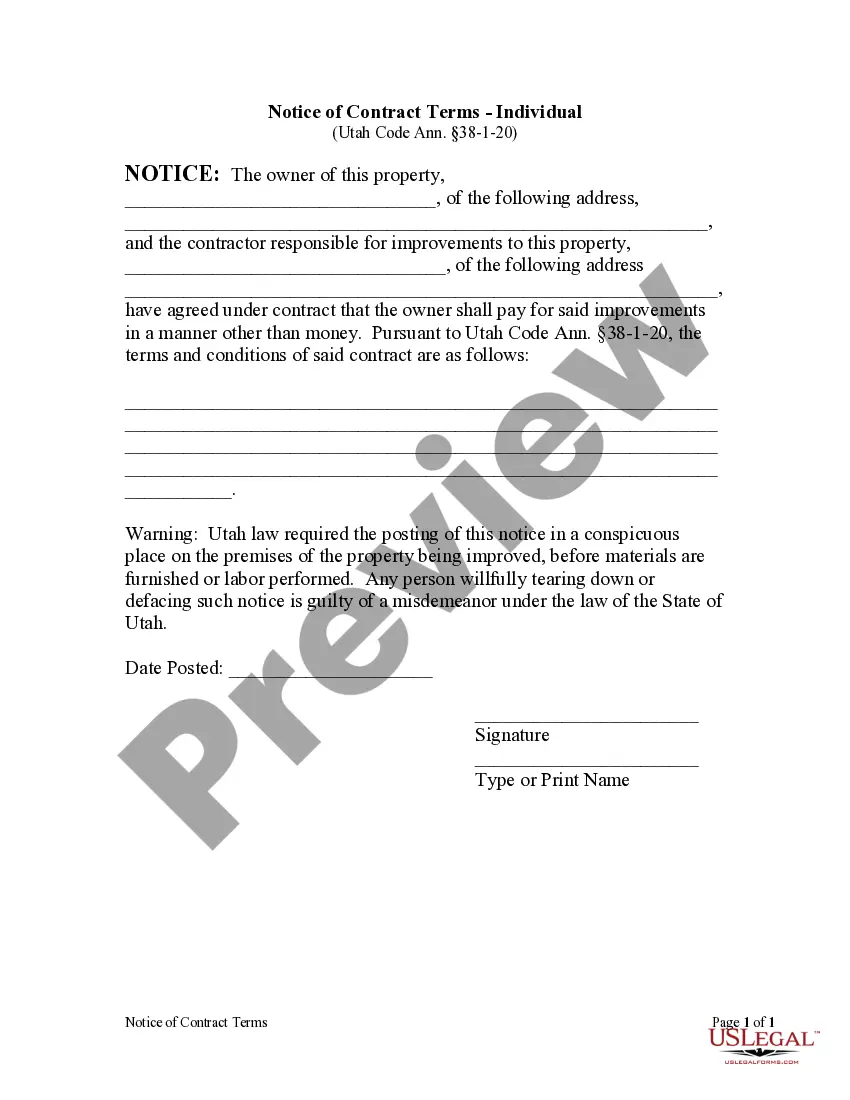

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search function to find the Executor Estate All Format template you need.

- Download the file once it satisfies your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access documents previously saved in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Select the proper pricing option.

- Complete the account sign-up form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file type you prefer and download the Executor Estate All Format.

Form popularity

FAQ

To get executor of estate paperwork, first contact the probate court where the will is filed. They can provide you with the necessary forms and guidance for completing the probate process. Additionally, using services like US Legal Forms can simplify obtaining the required forms and documents. This can save you time and ensure you have all paperwork needed to fulfill your role effectively.

You can prove you are the executor of an estate by presenting the Letters Testamentary from the probate court. This document is your official credential to act on behalf of the estate. It serves as proof when dealing with banks, creditors, and other entities. Should you need assistance in obtaining or managing estate paperwork, consider platforms like US Legal Forms for their resourceful services.

To get a copy of the executor of the estate documents, you'll need to request the Letters Testamentary from the probate court that oversees the estate. This may involve filling out a request form and providing identification. Always check if there are any associated fees. Once obtained, this document will empower you to execute your duties as an executor.

A letter stating you are the executor of the estate is often referred to as the Letters Testamentary. This letter is issued by the probate court and serves as an official confirmation of your executorship. It outlines your authority to manage the estate's assets and liabilities. You'll need this document to conduct various legal and financial activities associated with the estate.

The document that proves you are an executor is the Letters Testamentary, which you receive from the probate court. This official letter confirms your role and grants you the authority to act in accordance with the estate's will. Keep this document safe, as it is essential for managing the estate's financial and legal matters. You can easily acquire it by filing the will and completing necessary court procedures.

As an executor of a will, the first important step is to locate the original will and file it with the probate court. This step initiates the probate process, allowing you to legally manage the estate. Additionally, you should notify beneficiaries and start cataloging the estate's assets. This initial organization will pave the way for a smoother administration of the estate.

You can get proof of executorship by obtaining a copy of the Letters Testamentary from the probate court. This document serves as official proof that you have the authority to act on behalf of the estate. It's essential for handling matters related to the estate's assets and responsibilities. The process may vary by state, so be sure to check your local court's requirements.

The court document that displays the executor of the estate is typically the Letters Testamentary or Letters of Administration. This document is issued by the probate court after verifying the validity of the will. It officially appoints the executor to manage the estate's affairs. You can obtain this document through the probate court where the estate is being administered.

When filing taxes as an executor of an estate, first determine whether the estate needs to file an income tax return. You will need to gather all financial documentation, including income generated by the estate. Afterward, file either a personal tax return for the estate or as representative of the deceased. Relying on tools from uslegalforms can assist you in navigating these tax obligations.

To declare an executor of an estate, you must include the designated individual in your will. During the probate process, the executor formally accepts the role by filing necessary paperwork in probate court. This step is crucial for the executor to legally manage estate matters. Utilizing the Executor estate all format can simplify this declaration process.