Executor Es

Description

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

- If you're a returning user, simply log in to your account and click the Download button for your desired form template. Ensure your subscription is active; otherwise, renew it as per your payment plan.

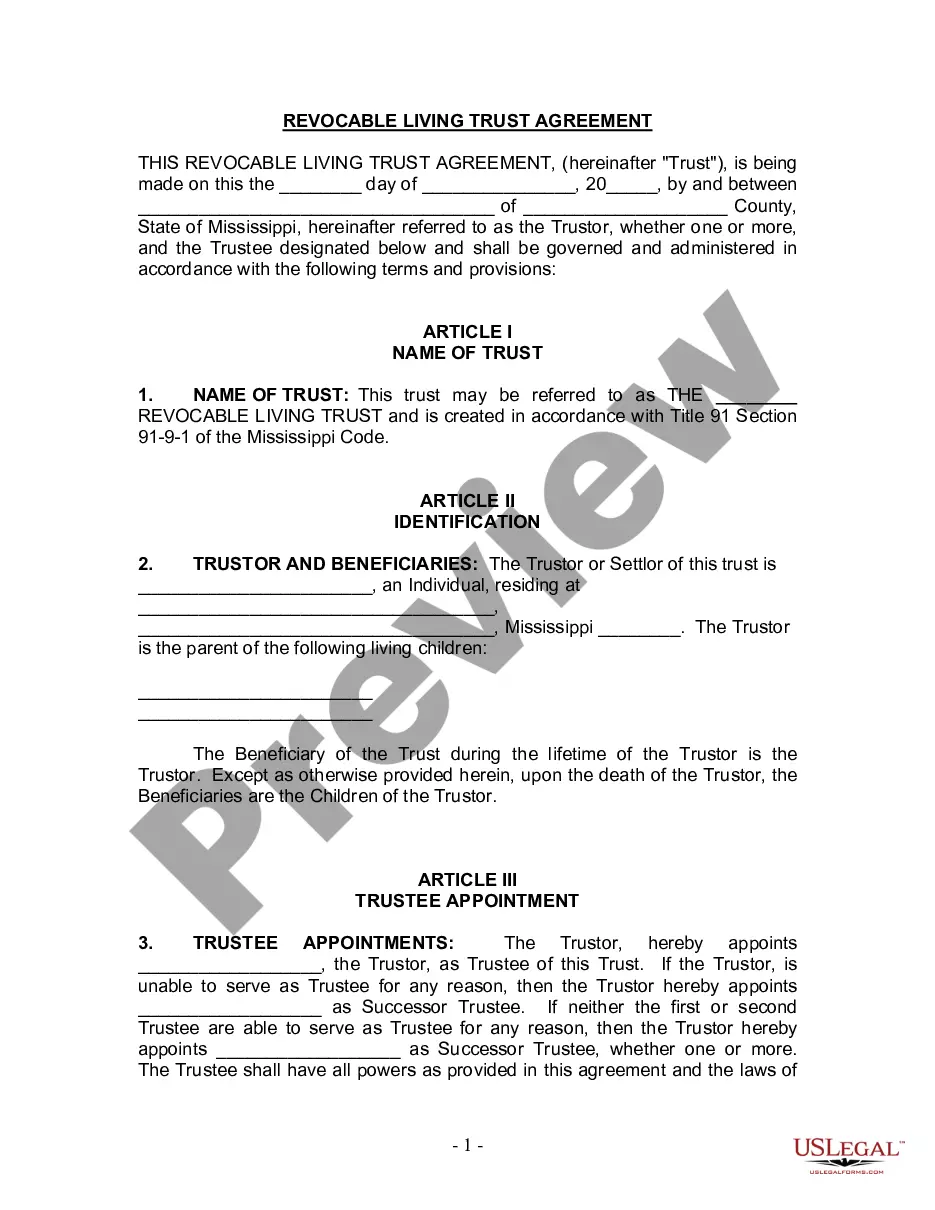

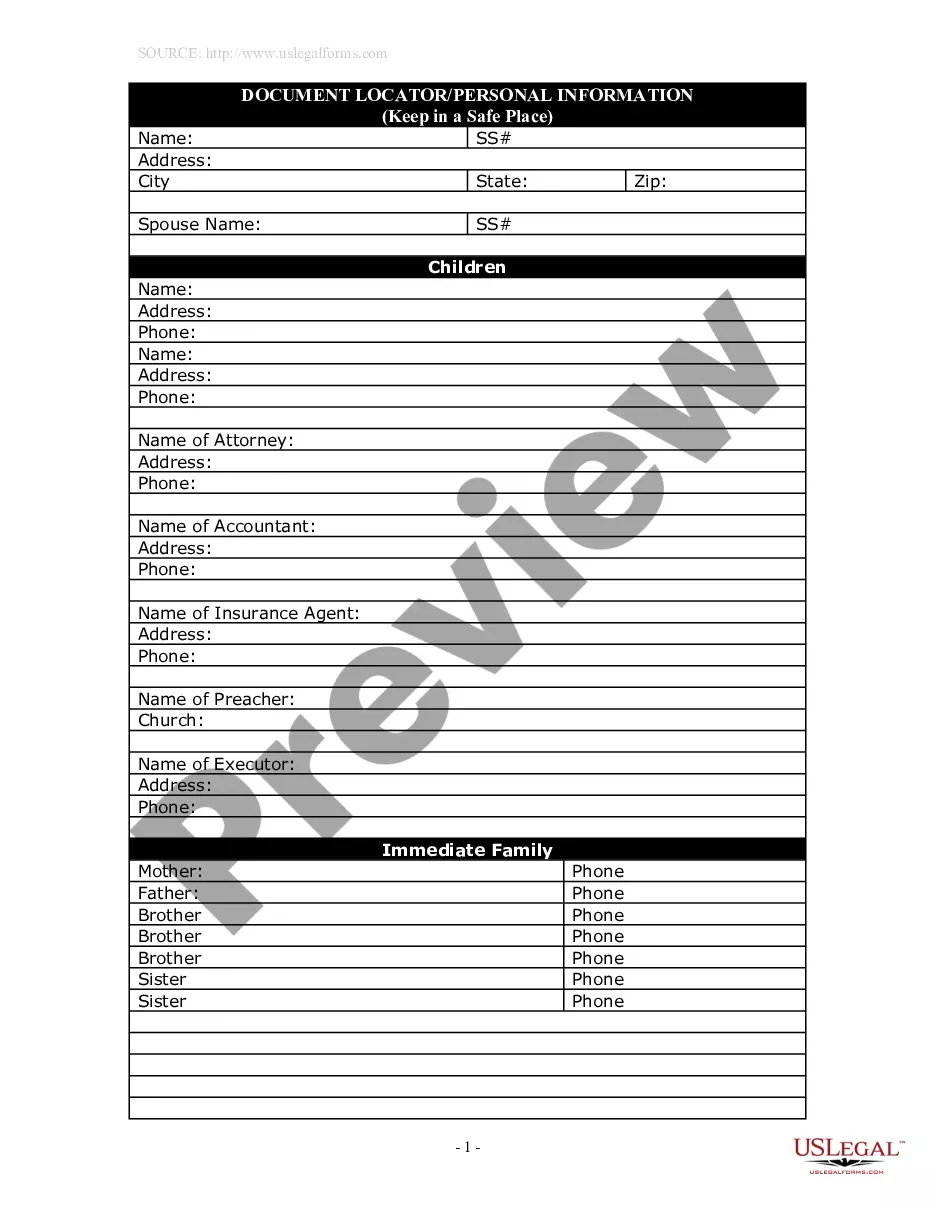

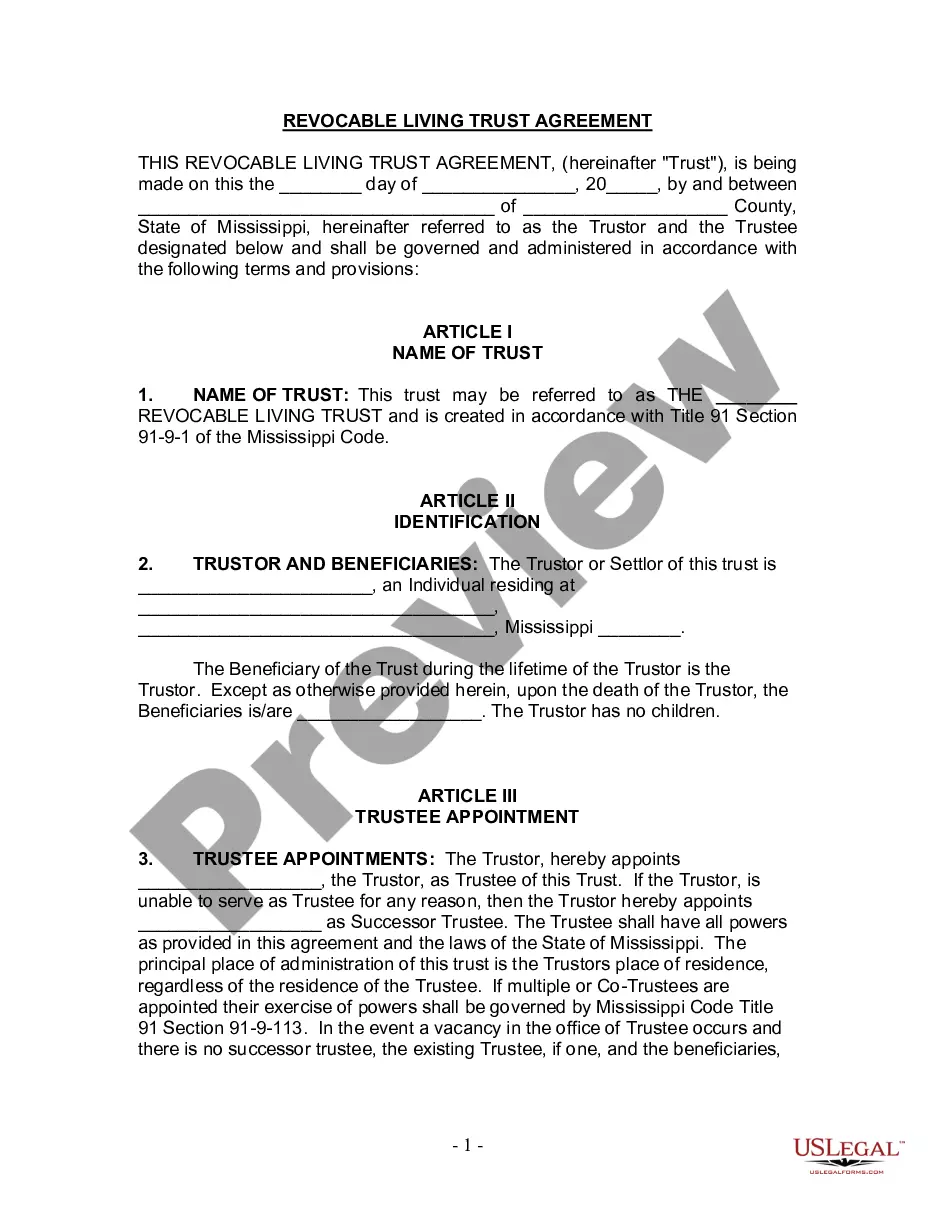

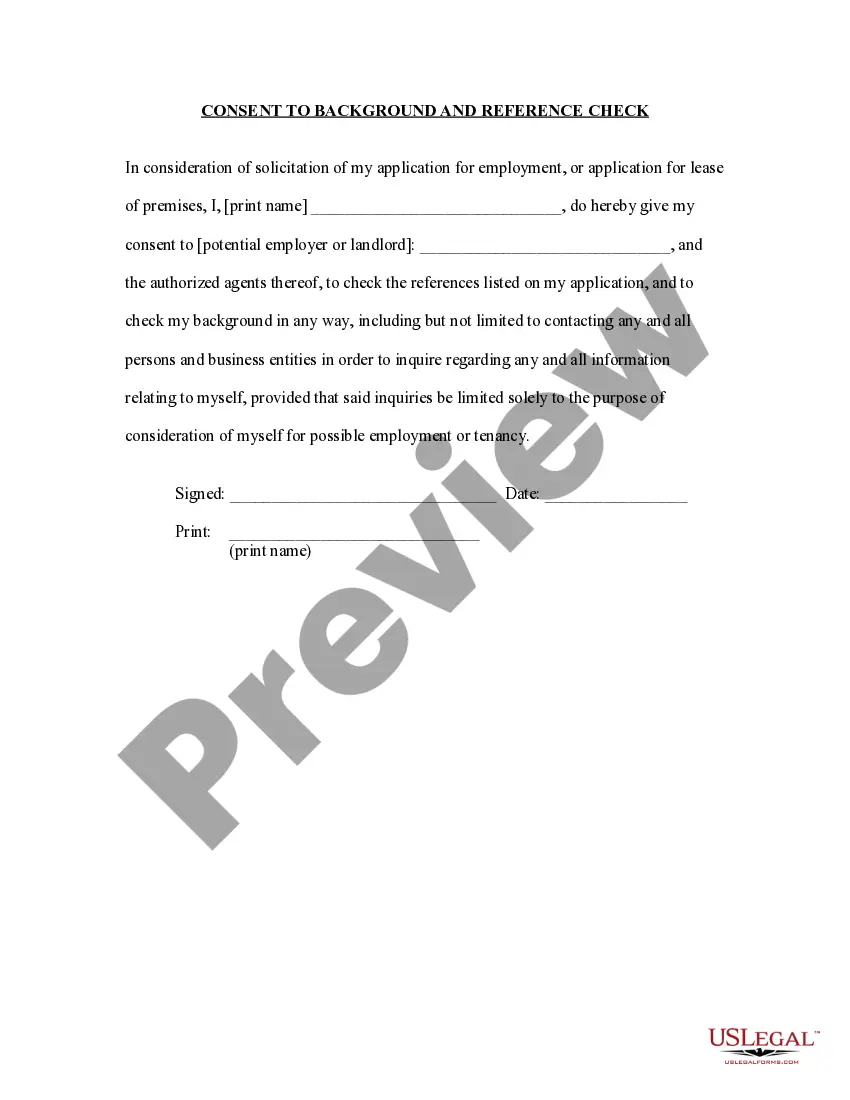

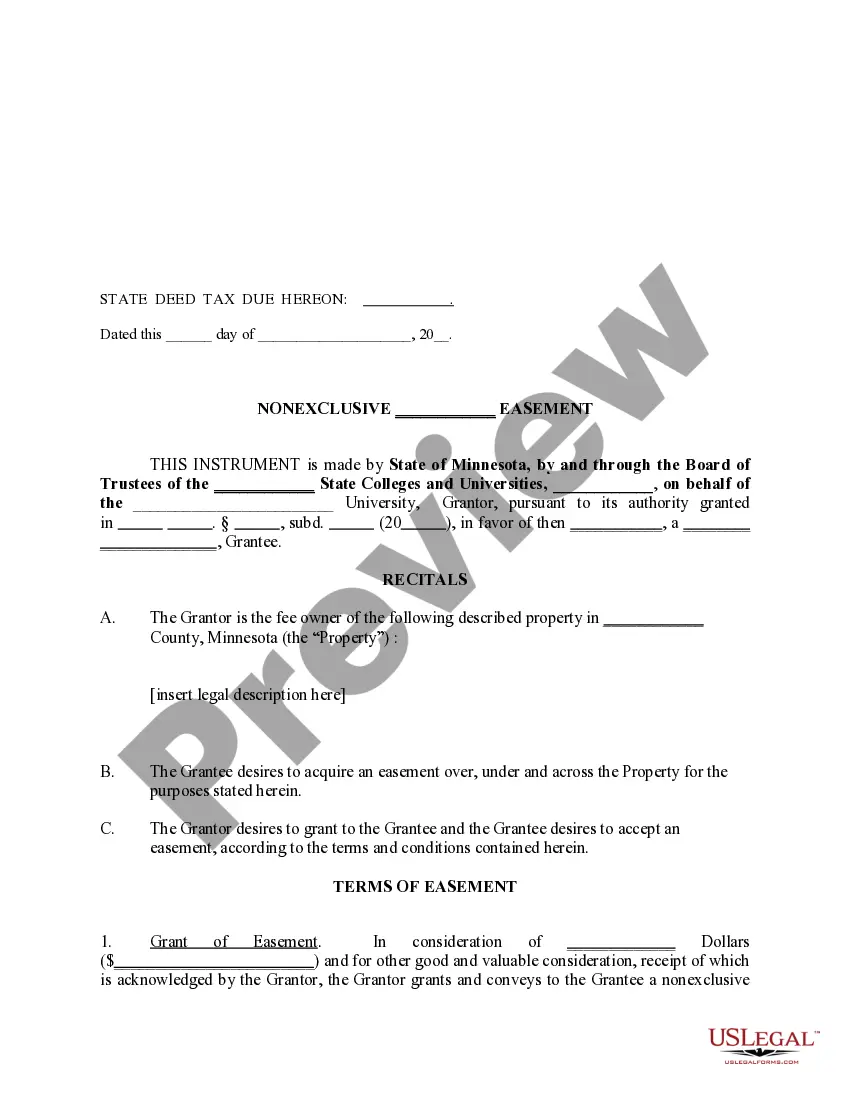

- For first-time users, begin by browsing the Preview mode and form descriptions to select the right document that meets your needs and adheres to your local jurisdiction.

- If your initial choice doesn’t fit, utilize the Search tab to find the appropriate template.

- Once satisfied, click on the Buy Now button and select a subscription plan, which will require you to create an account for accessing the form library.

- Finalize the purchase by entering your credit card or PayPal details.

- Download your selected form to complete it, and remember, you can access it later from the My Forms section in your profile.

In conclusion, US Legal Forms makes obtaining legal documents easy and efficient. By following these simple steps, you can ensure you have the forms you need, when you need them.

Start accessing thousands of legal templates now and take control of your legal documentation!

Form popularity

FAQ

To file taxes as an executor, start by gathering the necessary financial documents of the estate. Complete Form 1041 to report income generated by the estate, and ensure all income and expenses are accurately represented. Utilizing platforms like US Legal Forms can simplify this process by providing the necessary forms and guidance for executing your responsibilities effectively.

Yes, executor fees are generally considered taxable income by the IRS. If you receive compensation for serving as an executor, you must report this income when filing your personal taxes. It's crucial to keep accurate records of the fees received to ensure proper reporting and compliance with tax laws.

Being an executor comes with various challenges, including managing complex financial matters and potential familial disputes. The role can also be time-consuming, demanding significant attention to detail. Additionally, the executor may face emotional strains while handling the wishes of the deceased and supporting grieving family members.

The initial step for an executor is to take inventory of the deceased’s assets and liabilities. This action lays the foundation for effective estate management. Next, consider whether to file the will with the local probate court, as this will officially begin the probate process and allow you to perform your duties responsibly.

Choosing the right executor is crucial for the smooth administration of your estate. Look for someone who is trustworthy, organized, and willing to take on the responsibilities that come with being an executor. Additionally, it is advisable to consider individuals who understand your wishes clearly, making the process more straightforward.

As an executor, you are responsible for filing the estate's tax returns. Begin by gathering all financial records and determining the estate's income. You may need to file Form 1041 for the estate and report any distributions made to beneficiaries, ensuring that you follow the specific tax regulations related to executor es.

Yes, the estate may issue a 1099 form to the executor if they receive compensation for their services. This form reports the income earned by the executor while administering the estate. Keep in mind that if you are an executor, you must report this income on your personal tax return, ensuring compliance with IRS regulations.

In the Skywalker Saga, players typically unlock the executor by progressing through the game’s storyline or completing specific challenges. Make sure to gather sufficient resources and engage with characters that guide you to this unlockable feature. While this question doesn’t relate to estate matters, platforms like US Legal Forms can be invaluable when navigating more serious topics.

While hiring a lawyer is not mandatory to become an executor, it is highly recommended. A legal professional can provide guidance on complex probate laws and help with paperwork. They can also assist in addressing any disputes that may arise during the estate administration. US Legal Forms can offer resources that simplify understanding the legal obligations of an executor.

To obtain a copy of the executor's information, you can request documents from the probate court managing the estate. Typically, the court includes executor details in the estate filings. Alternatively, you may contact the executor directly if you’re seeking their contact information. Utilizing US Legal Forms can guide you through requesting necessary legal documents.