Executor Distribution Beneficiary With Distribution

Description

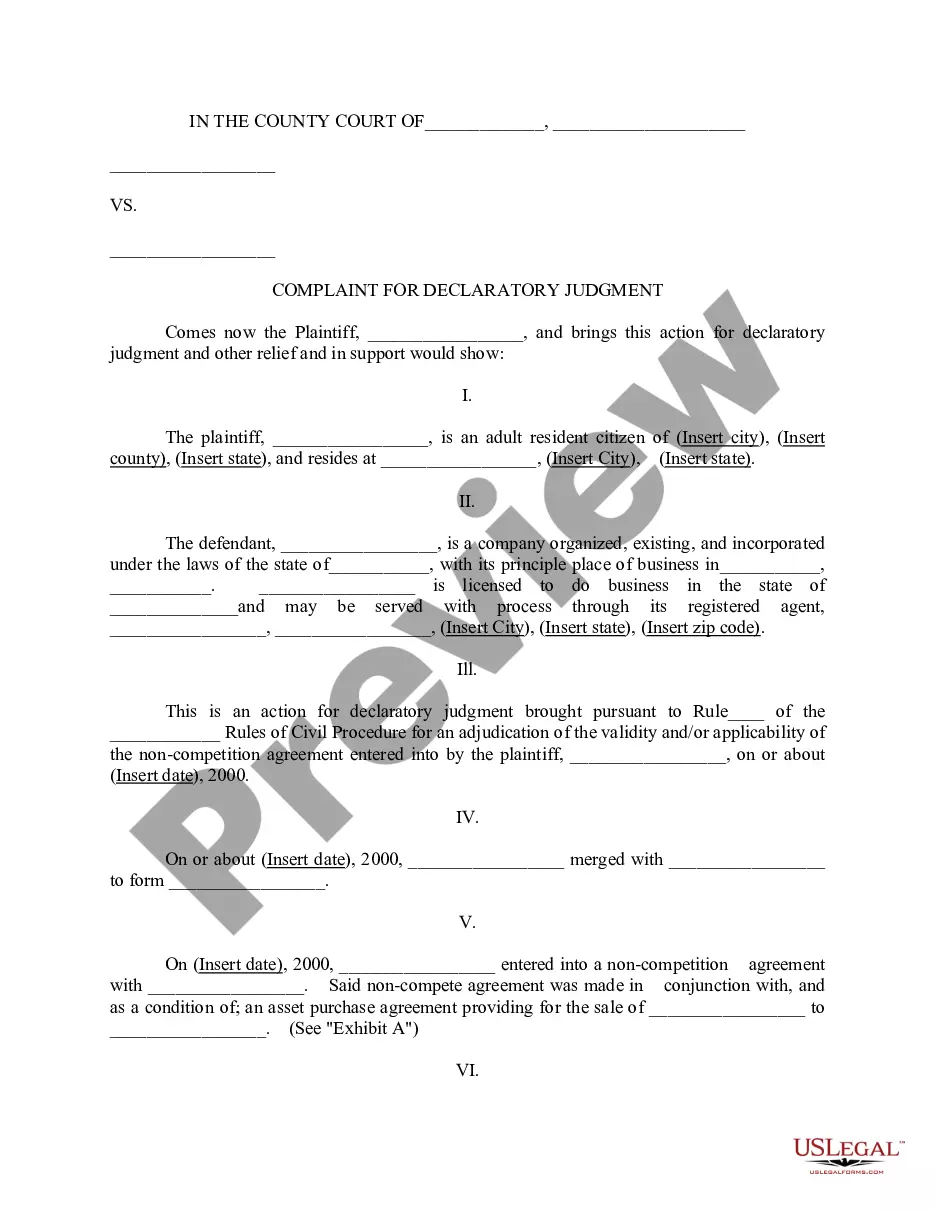

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

It’s no secret that you can’t become a law professional immediately, nor can you learn how to quickly prepare Executor Distribution Beneficiary With Distribution without having a specialized set of skills. Creating legal forms is a long process requiring a specific education and skills. So why not leave the creation of the Executor Distribution Beneficiary With Distribution to the pros?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court papers to templates for in-office communication. We know how crucial compliance and adherence to federal and local laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and get the document you need in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Executor Distribution Beneficiary With Distribution is what you’re searching for.

- Start your search again if you need any other form.

- Register for a free account and select a subscription option to purchase the template.

- Choose Buy now. As soon as the payment is through, you can get the Executor Distribution Beneficiary With Distribution, fill it out, print it, and send or mail it to the designated people or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

When writing your letter of instruction, include as much information about your estate and your assets as possible, and provide detailed instruction for how you want any assets not mentioned in your formal will to be dispersed among your heirs. Your letter of intent doesn't supersede the terms of your will.

A distribution is any money paid to the benefit or care of the beneficiary. After all of the disbursements are made, the deceased's outstanding debts are settled, and all final taxes are paid, the executor can distribute the remaining assets to the beneficiaries.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

After providing a death certificate, proof of identity, probate court order, and others, the heir can either transfer the shares into their account or sell the shares for the proceeds. Ultimately, this has the potential to save significant sums of money due to the tax loophole.