Executor Beneficiary Form For Checking Account

Description

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

Drafting legal paperwork from scratch can often be a little overwhelming. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a a more straightforward and more cost-effective way of preparing Executor Beneficiary Form For Checking Account or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of over 85,000 up-to-date legal documents covers almost every element of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-compliant forms diligently put together for you by our legal experts.

Use our website whenever you need a trusted and reliable services through which you can easily find and download the Executor Beneficiary Form For Checking Account. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes minutes to register it and explore the library. But before jumping straight to downloading Executor Beneficiary Form For Checking Account, follow these tips:

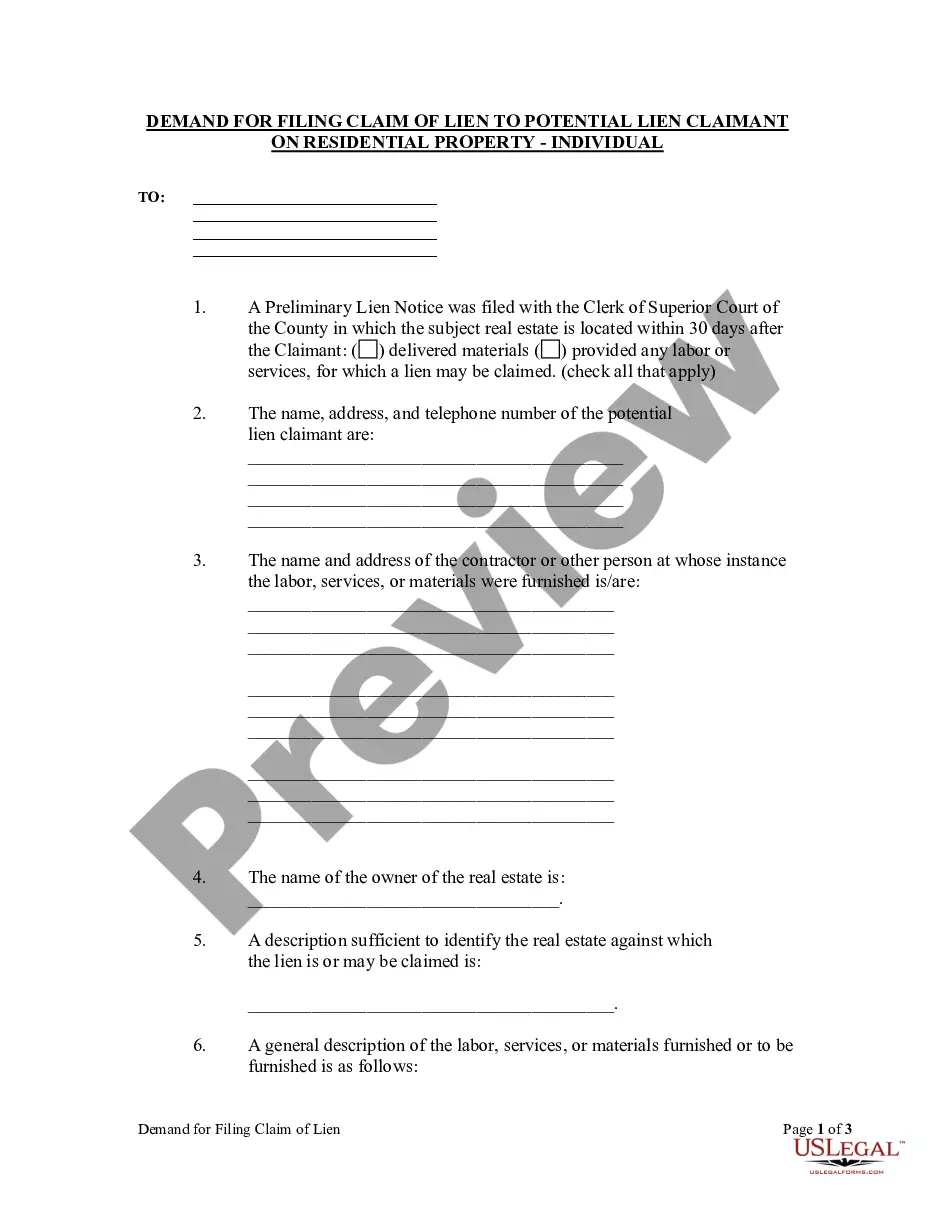

- Review the document preview and descriptions to ensure that you are on the the form you are searching for.

- Make sure the template you choose conforms with the requirements of your state and county.

- Pick the best-suited subscription option to purchase the Executor Beneficiary Form For Checking Account.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us today and transform form completion into something simple and streamlined!

Form popularity

FAQ

Most beneficiary designations will require you to provide a person's full legal name and their relationship to you (spouse, child, mother, etc.). Some beneficiary designations also include information like mailing address, email, phone number, date of birth and Social Security number.

Executors and administrators of a decedent's estate can only access their bank accounts if the decedent had not designated a beneficiary for the account. The documents an executor/administrator generally will be required to present to the bank include: A valid government-issued ID.

If you don't know the answer, you might be interested to learn that you can designate a beneficiary?or multiple beneficiaries?on most savings, checking and retirement accounts. When you name a beneficiary, your money passes directly to that person when you pass away.

Do Bank Accounts Need Beneficiaries? Unlike some other accounts, checking accounts aren't required to have named beneficiaries. But you may want to consider designating beneficiaries for checking accounts to spare your survivors from dealing with the delays and expense of probate.

There is no set format for estate accounts, however they should as a minimum detail all estate assets as they were at the date of death, all liabilities and any increases/ decreases in the value of estate assets once they have been liquidated.