Motion To Avoid Lien Chapter 7 Without A Lawyer

Description

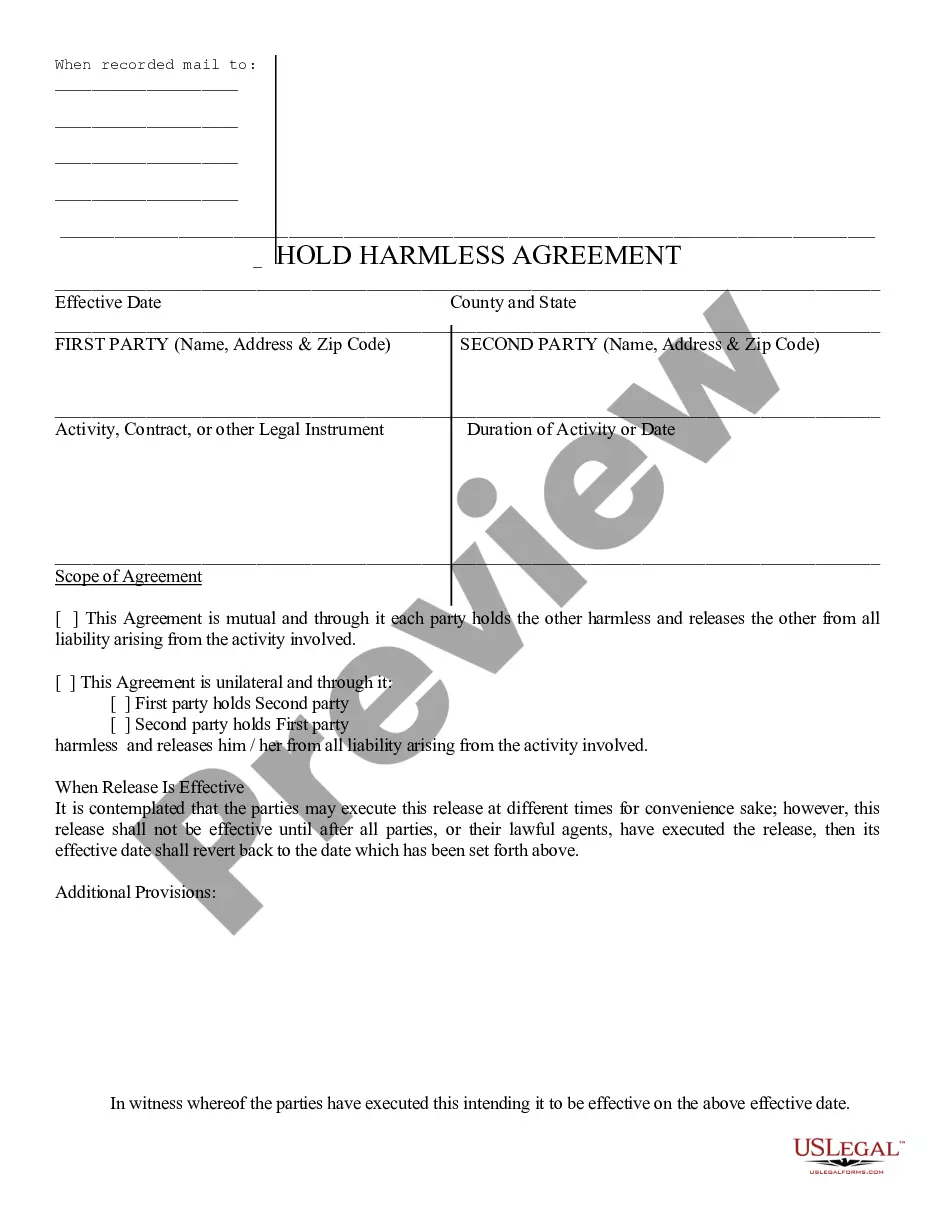

How to fill out Motion To Avoid Creditor's Lien?

Dealing with legal documents and processes can be a lengthy addition to your day.

Motion To Avoid Lien Chapter 7 Without A Lawyer and similar forms often necessitate searching for them and figuring out how to fill them out correctly.

For this reason, if you are managing financial, legal, or personal issues, utilizing a thorough and user-friendly online directory of forms at your convenience will be beneficial.

US Legal Forms is the premier online resource for legal templates, boasting over 85,000 state-specific documents and various tools to help you complete your paperwork with ease.

Is it your first time using US Legal Forms? Register and create an account in a few minutes to gain access to the form directory and Motion To Avoid Lien Chapter 7 Without A Lawyer. Then, follow the steps below to complete your form: Make sure you have the correct form using the Preview feature and reviewing the form description. Choose Buy Now when ready, and select the monthly subscription plan that meets your requirements. Click Download then fill out, sign, and print the form. US Legal Forms has 25 years of experience helping clients manage their legal documents. Obtain the form you need today and streamline any process effortlessly.

- Explore the selection of relevant documents available to you with just one click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Protect your document management procedures with exceptional support that enables you to create any form in minutes without hidden or extra charges.

- Simply Log In to your account, locate Motion To Avoid Lien Chapter 7 Without A Lawyer, and obtain it immediately from the My documents section.

- You can also access forms you have previously downloaded.

Form popularity

FAQ

What Is a Motion to Avoid a Judicial Lien in Bankruptcy? A Motion to Avoid Judicial Lien is a motion your bankruptcy attorney can file in bankruptcy court to remove an involuntary judgment lien from your house or other property after you have completed bankruptcy.

In order to avoid a lien under § 522(f), the debtor must show: (1) that he has an interest in the homestead property; (2) he is entitled to a homestead exemption; (3) the asserted lien impairs that exemption; and (4) the lien is a judicial lien.

The Formula. Section 522(f) of the Bankruptcy Code allows a debtor to ?avoid the fixing of a [judicial] lien on an interest of the debtor in property to the extent that such lien impairs an exemption to which the debtor would have been entitled[.]?

This subsection permits the bankruptcy judge to grant the debtor a discharge at any time after confirmation of a plan, if the court determines, after notice and hearing, that the failure to complete payments under the plan is due to circumstances for which the debtor should not justly be held accountable, the ...

? Lien avoidance protects an individual debtor's. right to exempt property. ? A debtor can avoid judicial liens and non- possessory, non-purchase money security. interests in household goods (?NPMSIs?) to the extent that the lien or NPMSI ?impairs? the debtor's exemption in the property.