Motion To Avoid Lien Chapter 7 Withdrawn

Description

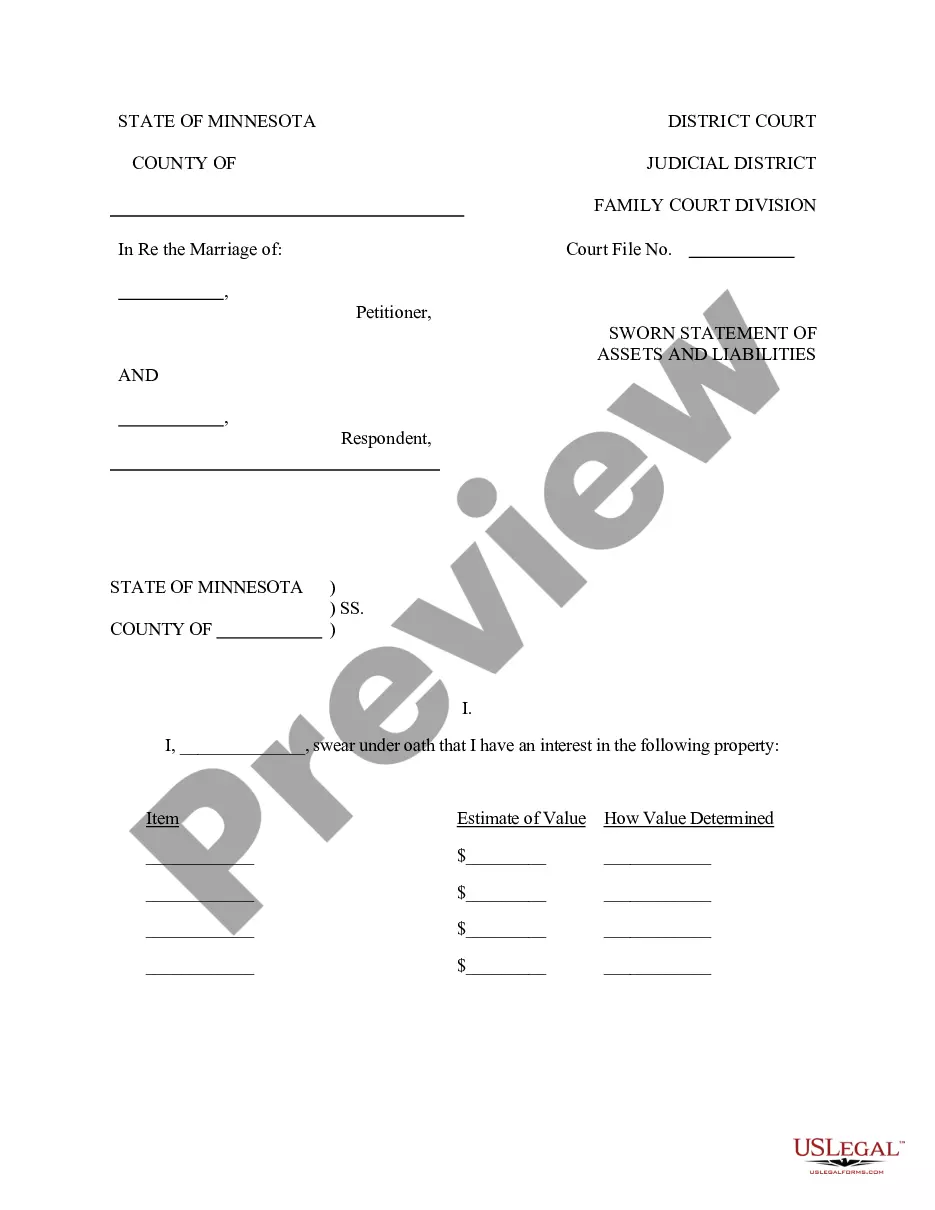

How to fill out Motion To Avoid Creditor's Lien?

Regardless of whether for commercial reasons or personal matters, everyone has to handle legal issues eventually in their lifetime. Completing legal documents requires meticulous care, starting from selecting the suitable form template.

For example, if you choose an incorrect version of a Motion To Avoid Lien Chapter 7 Withdrawn, it will be denied upon submission. Hence, it is crucial to obtain a trustworthy source of legal documents like US Legal Forms.

With a comprehensive US Legal Forms catalog available, you don’t have to waste time searching for the correct template online. Utilize the library’s user-friendly navigation to find the right template for any situation.

- Obtain the template you require using the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your circumstances, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search tool to find the Motion To Avoid Lien Chapter 7 Withdrawn template you need.

- Acquire the template if it fulfills your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the document format you prefer and download the Motion To Avoid Lien Chapter 7 Withdrawn.

- Once downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

That being said, here's what you're not allowed to do with a Chapter 7: Lie under oath about your financial or property assets. Keep property that must be used to discharge your debts. Miss payments to certain creditors in order to keep your home.

Closed Without a Discharge Cases are closed without discharge when the debtor does not complete the required debtor education required as a condition of discharge. The court may also close your case without discharge if you failed the last step for getting rid of debt. Your filing may not have been filed timely.

If you're unable to pay your filing fees, the court will usually try to work with you. For Chapter 13 bankruptcy, you may be able to roll your court fees into your repayment plan, paying the court in monthly installments.

The Minimum Percentage of Debt Repayments In A Chapter 13 Bankruptcy Is 8 To 10 Percent.

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.