Motion To Avoid Judicial Lien Without Notice

Description

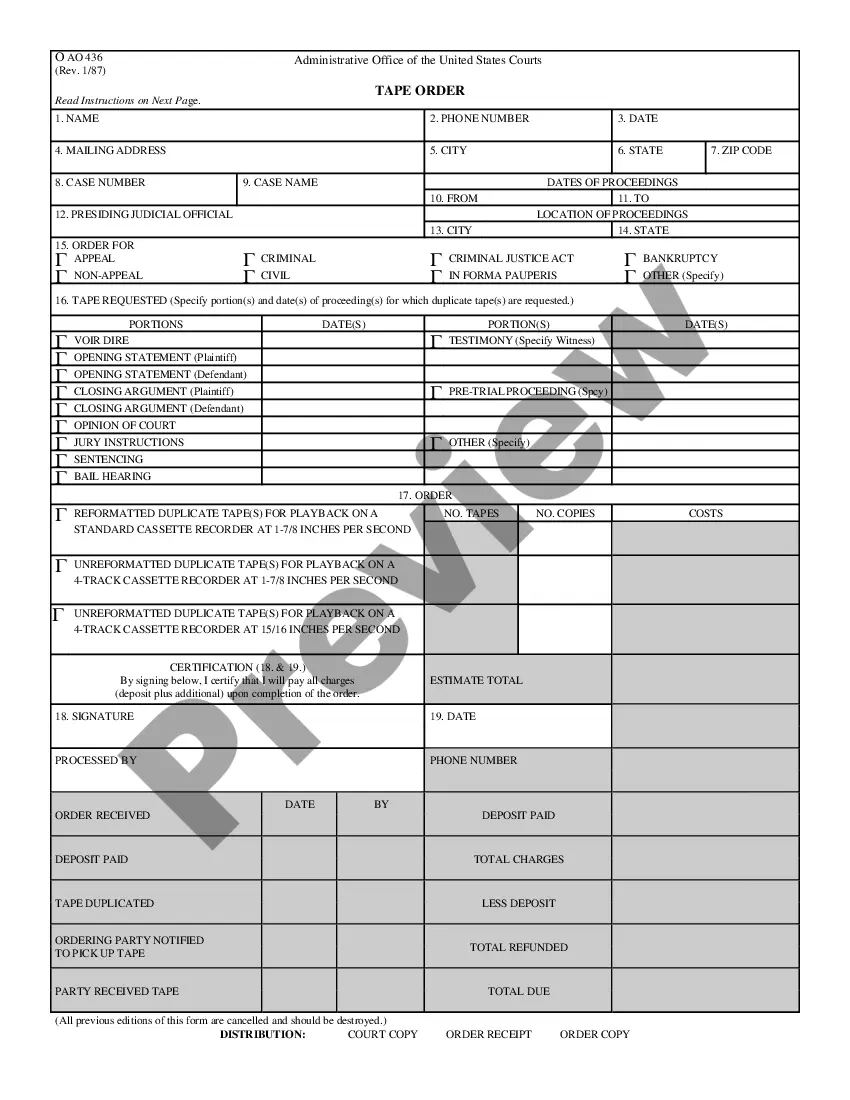

How to fill out Motion To Avoid Creditor's Lien?

The Motion To Evade Judicial Lien Without Notification that you find on this page is a versatile legal template crafted by experienced attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with over 85,000 authenticated, state-specific forms for any professional and personal need. It’s the quickest, easiest, and most reliable method to obtain the documents you require, as the service ensures bank-level data protection and anti-virus safeguards.

Choose the format you would like for your Motion To Evade Judicial Lien Without Notification (PDF, Word, RTF) and save the template on your device.

- Search for the document you require and examine it.

- Browse through the file you searched and preview it or read the form description to confirm it meets your needs. If it doesn’t, use the search bar to find the appropriate one. Click Buy Now once you’ve identified the template you desire.

- Register and Log In.

- Select the pricing plan that fits you and create an account. Utilize PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Acquire the editable template.

Form popularity

FAQ

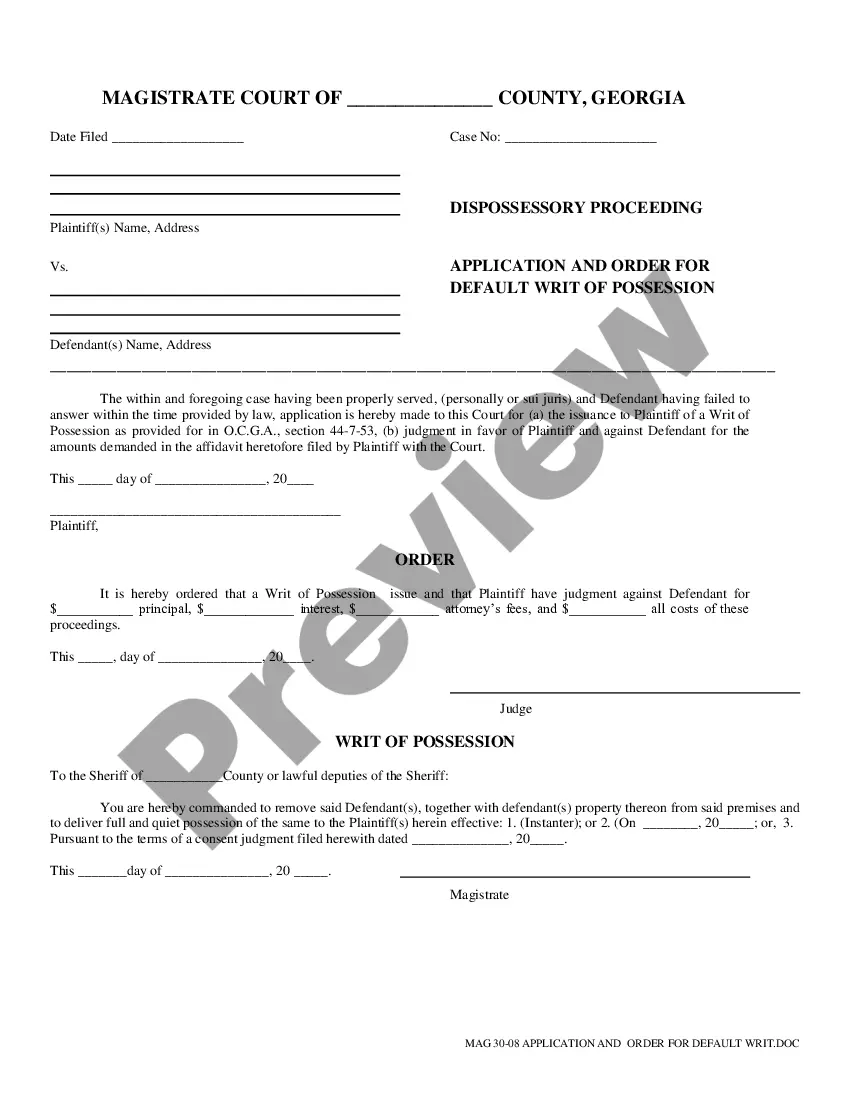

Hear this out loud PauseA lien is a right to retain possession of another's property, where that possession already lawfully exists, pending the discharge of indebtedness. An equitable lien (see paragraph 9.147), however, does not require possession to be valid. A lien sometimes arises where a service has been performed but not paid for.

Hear this out loud PauseA lien is the right of a person who has lawfully received property belonging to another to retain that property for so long as a debt owed by the owner of the property remains unpaid. Liens may be recognised by common law or may be created by contractual agreement. Common law liens: are a form of possessory security.

Hear this out loud PauseA lien is an encumbrance that makes property security for the payment of a debt or discharge of an obligation. The Registrar-Recorder/County Clerk (RR/CC) serves notification by mail to debtors when an involuntary lien is recorded against them. An involuntary lien is a lien that a property owner did not sign.

Hear this out loud PauseWhat Is a Lien? A lien is a claim or legal right against assets that are typically used as collateral to satisfy a debt. A creditor or a legal judgment could establish a lien. A lien serves to guarantee an underlying obligation, such as the repayment of a loan.

Conditions for Exercising Lien The goods for which this right is to be executed has to be possessed by the creditor who exercises it. There has to be a lawful debt due to the person in possession of the goods by the owner. There should not be any contract to the contract.