Motion To Avoid Judicial Lien Foreclosure

Description

How to fill out Motion To Avoid Creditor's Lien?

It’s clear that you cannot transform into a legal expert right away, nor can you comprehend how to swiftly create a Motion To Avoid Judicial Lien Foreclosure without possessing a specific set of abilities.

Assembling legal documents is a lengthy endeavor demanding specialized training and expertise.

So why not entrust the formulation of the Motion To Avoid Judicial Lien Foreclosure to the experts.

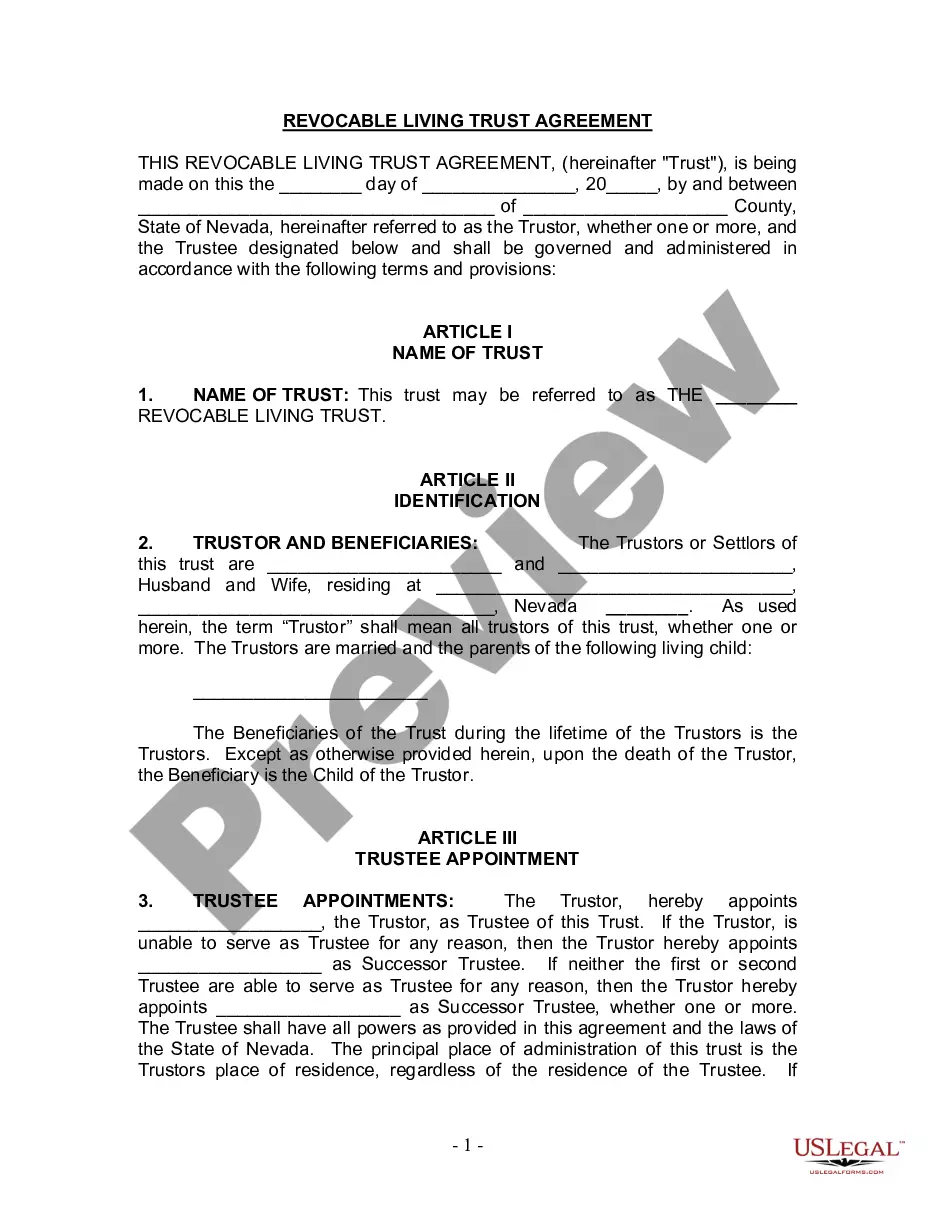

Preview it (if this option is available) and review the accompanying description to determine if the Motion To Avoid Judicial Lien Foreclosure is what you are looking for.

Initiate your search again if you require a different template. Register for a complimentary account and select a subscription plan to purchase the form. Click Buy now. Once the payment is processed, you can acquire the Motion To Avoid Judicial Lien Foreclosure, complete it, print it, and either send it or mail it to the appropriate individuals or organizations.

- With US Legal Forms, one of the most comprehensive legal template collections, you can discover anything from court documents to templates for intra-office correspondence.

- We recognize how crucial compliance and adherence to both federal and local regulations are.

- That’s why, on our platform, all templates are locale-specific and current.

- Here’s how to begin with our platform and obtain the document you need in just a few minutes.

- Locate the form you require by using the search bar at the top of the page.

Form popularity

FAQ

If you do not pay the judgment, the judgment creditor can garnish or "seize" your property. The judgment creditor can get an order that tells the Sheriff to take your personal property, like the money in your bank account or your car, to pay the judgment.

Filing for bankruptcy can eliminate your second mortgage debt. If an appraiser determines the value of your home is less than your first mortgage, or is upside down, Chapter 13 lien stripping may be possible. The bankruptcy court essentially converts your second mortgage into an unsecured debt.

Yes, a lien may be placed on property that is jointly owned. However, the effects of that lien depend on the type of ownership that the property is under. Before discussing the terms of joint ownership, it's important that you understand exactly what liens are and what they may mean for you and your investment.

What Is a Motion to Avoid a Judicial Lien in Bankruptcy? A Motion to Avoid Judicial Lien is a motion your bankruptcy attorney can file in bankruptcy court to remove an involuntary judgment lien from your house or other property after you have completed bankruptcy.

An original judgment lien is valid for 10 years. If the judgment isn't paid by the end of the first 10 years, then the judgment creditor can seek a renewal judgment on the lien that would be valid for another 10 years.